There was a time in history when you could walk into a bank, hand over US dollars, Sterling Pounds, or Yens—depending on which country you lived in— and the teller would give you an equivalent amount of gold with hardly any questions asked.

In that era, paper currency was considered a placeholder for gold (or silver), the actual money. And that is because you didn’t need as much logistics to move and use paper bills as you did for gold.

The value of a standard unit of the paper currency was then legally based on the value of a fixed amount of gold. For example, in the 19th century, the US had set the exchange rate of an ounce of gold at $20.

In most countries, the central bank, on behalf of the government and therefore the people, determined the value of paper currency units in gold terms.

This arrangement is what came to be known as the gold standard.

Before the gold standard

Even before the gold standard period, paper had been used to represent gold in trade.

This came out of a pressing need. Holding and securing gold has always been a challenge. In particular, it is a huge security risk, especially when it is in significant amounts. It is also cumbersome to move it from one point to another.

Because of this, people of the past, especially in medieval Europe, asked goldsmiths to keep it for them in the strong vaults where they kept their own gold for a fee.

Over time, this became the ideal way to secure gold and an extra source of income for the goldsmiths. As proof of gold in their vaults, the goldsmith would issue paper receipts.

Instead of withdrawing the actual gold to settle debts, people increasingly passed on these goldsmith vault receipts as a medium of exchange. This was more convenient especially considering the cost of physically moving gold and the risk involved.

The paper receipt became a currency that derived its value from the gold stored in the vaults that issued it.

That also meant if the bearer of the paper receipt, at any time, wanted to own the actual gold, they would present it to the goldsmith who issued it, and they would be given the bullion.

The paper currency issued by the goldsmith was largely ad hoc and informal. The government saw the need to regulate the system partly as a way to collect taxes and also as a way to protect the citizenry from bad actors.

The gold standard era

The gold standard era didn’t start until the early 19th century.

Goldsmiths issued receipts are not considered part of the gold standard, and that is because their issue was not anchored in the law. The government did not stipulate how many specific units of paper money should be worth what amount in gold.

The printed paper receipts were also not standardized, and each goldsmith issued their own unique receipt.

Indeed, the gold standard is the law specifically outlining how much units of paper money printed by or on behalf of the government are worth in gold (or silver).

England became the first country to adopt the gold standard in 1821. The US had some form of it in operation just before the civil war in the 1860s. Germany, Belgium, Italy, Switzerland, France, and much of Europe made it the law in the 1870s.

The USA, however, had the complete switch over in 1900. By that year, most countries around the world were already on the gold standard.

It is important to point out that some countries chose the silver standard instead of the gold standard. Those in that list include China, Hong Kong, British India, and the Philippines.

It could be argued that the UK had earlier adopted some form of the silver standard. The Sterling Pound used to be one pound weight of silver, and this unit of currency measure goes as far back as 775AD.

The gold standard has existed in two phases; the classical gold standard and the Bretton Wood gold standard.

The classical gold standard

The classical gold standard is about individual sovereign states making their paper currency convertible into gold based on a specific rate established in law.

It is the classical gold standard that began in the early 19th century, and it ended with the second world war in 1945.

During this period, many countries had paused and started it several times. They, in particular, paused the system during war periods. For example, the US paused it during the civil war and restarted it after. Later on, most global powers paused it during the first world war of 1914 to 1919.

In the 1920s, there were efforts to get back to the gold standard. However, these efforts were distracted by the great depression and the second world war a few years later.

In 1934, the US abandoned the gold standard through what is known as the Gold Reserve Act of 1934. This law made direct ownership of gold more than $100 illegal and was confiscated and taken to the government vaults.

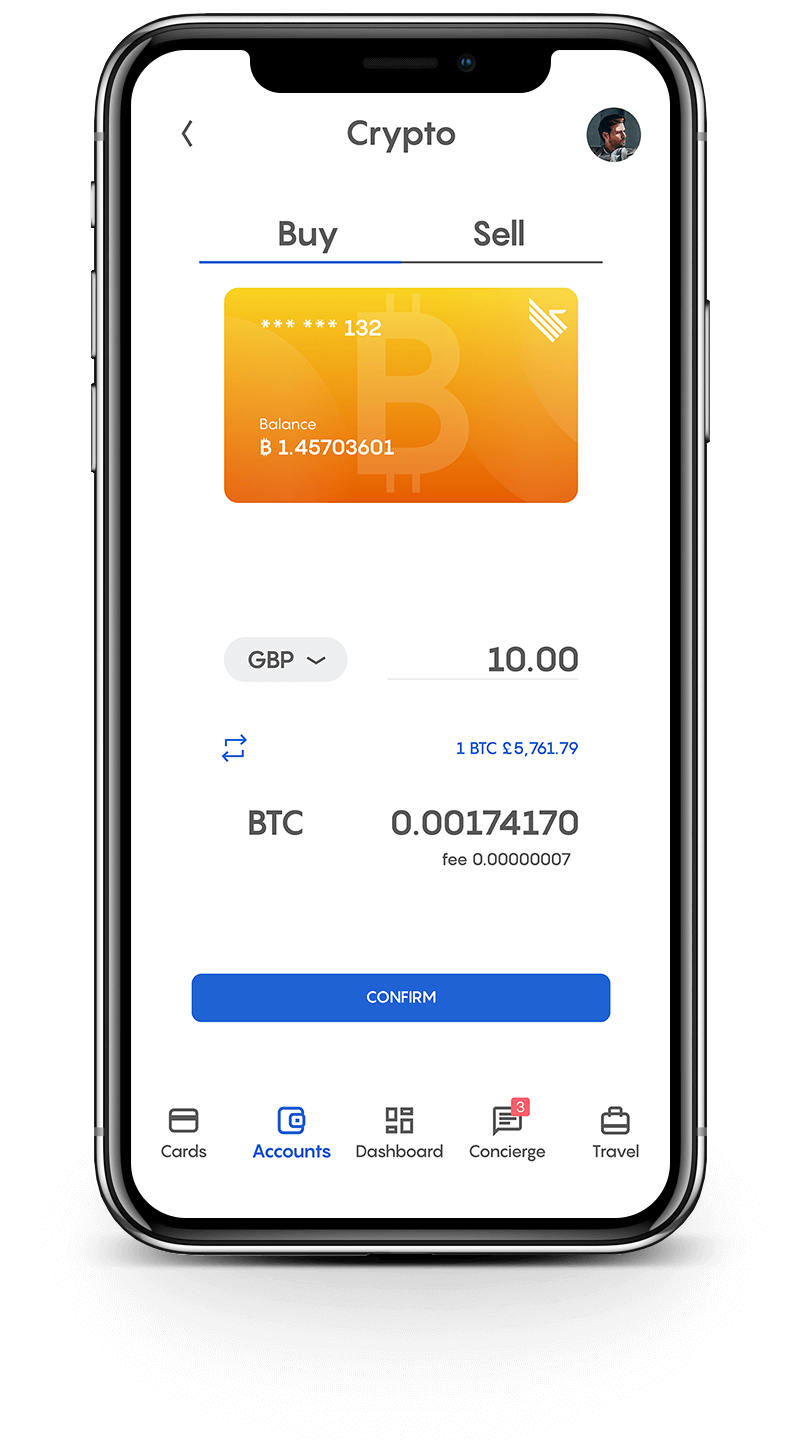

Join Club Swan and get… more!

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan’s flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

Bretton wood gold standard

In 1944, the global community met in Bretton Woods, New Hampshire, to chart the way forward for international relations and lay the foundation for the reconstruction. This also happened to be the birth of the new form of a global gold standard.

The treaties signed made the US dollar the global reserve currency and, therefore, used to settle debts among nations and in international trade instead of gold. However, nations holding US dollars could present the currency to the US treasury and redeem gold at the rate of $35 an ounce. The US citizens could, however, not redeem gold with the dollar. Only those of other countries could.

This arrangement seemed to have exposed the US to the risk of depleting its gold reserves. In 1971, with nations like France actively exchanging the dollars they had in their reserves for gold, president Richard Nixon signed an executive order officially ending the Bretton Wood gold standard.

Lessons from the gold standard era

Today, there are many pushing for the return of the gold standard. They offer several reasons why they prefer the system revived. At the top of the list is the need to control inflation.

With currency pegged on gold, there is a limit to how many units of paper money can be issued.

Inflation is further controlled by the fact that the amount of gold that comes into circulation every year is marginal. According to the World Gold Council, an advocacy group, about 3000 tonnes of gold is mined annually, about 0.0015% of the about 200 million tonnes already in circulation.

With inconvertible paper money issued by government decree (fiat), excessive inflation has eroded the purchasing power of money.

While an ounce of gold can still buy you what it could buy you in 1960, a dollar has lost close to 90% of the value in the same period. An ounce of gold in 1960 was priced at about $36. In 2021, the price of an ounce stands at about $1740.

During the gold standard era, there was certainty in international trade because exchange rates were relatively stable. It also provided a self-correcting mechanism in settling international trade deficits.

A country with a high trade deficit would experience an outflow of gold. In return, this would lead to a decline in domestic prices, which would lead to increased competitiveness and, ultimately, the correction of the deficit.

It is important, however, to also interrogate why the gold standard failed.

The weaknesses of the gold standard

Today not even a single country uses the gold standard. This system was only around for about a century, and the reasons it failed are varied.

One of these is the fact that it was easy for those in power to pause it whenever they needed to. With the right motivation, such as the need to fund a war, it did not take much effort.

However, it is also important to acknowledge that, throughout recent history, there have been many who are persuaded that the world is better off not being on the gold standard. And their reasons are not necessarily malevolent.

For example, they point to its rigidity as an inhibition to economic growth. They believe that it makes it difficult for the government to effectively respond to emerging needs such as the shrinking of the economy.

Without the gold standard, the central bank can easily expand or shrink the economy by simply adding or reducing money in circulation—meaning printing more bills or increasing interest rates. It does not have to worry about how much gold it has in its vaults. It only needs to consider the production output of the economy.

The opponents of the gold standard also believe that it makes it difficult for a country to protect itself from the negative impacts of the economic activities of its trading partners. That is because, under the gold standard, gold always flows from the country with low production output to one with high production output.

Also important, the gold standard makes it difficult for a country to effectively engage in wars. This could be a negative or positive point, depending on how one feels about wars.

As already mentioned, during times of war, the gold standard was often abandoned. That happened during the American civil war of 1861-1865, during the first world war, and during the second world war.

During these periods, the central banks could not let citizens redeem gold as the government needed it to pay for war supplies. With the gold standard in place, much of the gold could not be available to the government as it could quickly flow into private vaults.

Understandably, the citizenry wants to hold gold more than paper currency in war. That is because gold is a store of value that can withstand most kinds of political instability.

At the basic level though, the gold standard was an attempt to make gold easier to use. If gold was easier to split, secure, and transfer there wouldn’t have been a need for inventing a system where printed bills stood in for it in commerce.

So the gold standard failed because of the inherent limitations of gold as a form of money.

An option to the gold standard

We might never see the return of the old gold standard. However, we have an even better system in crypto. One that, besides controlling inflation, also fixes most of the weaknesses that have made gold fail to function as efficient money.

Satoshi Nakamoto, the founder of Bitcoin, seems to have been among those who believe that money or currency need to have marginal inflation or be deflationary.

Bitcoin does more than mimic gold. While gold has marginal inflation, Bitcoin is deflationary. Its supply is permanently capped at 21 million coins. Indeed, some of these coins will be lost as some users forget keys to their wallets.

Nevertheless, each coin can be divided into eight decimal points. Meaning, each bitcoin has 100 million smaller units known as satoshis. With that amount of units, the global market can never run out of money to support commerce.

Also, while moving and using gold requires costly logistics, cryptocurrencies are easier to hold and transport. In some cases, all one needs is to remember a passphrase. Besides, bitcoin can move across the globe near-instantly.

It is also a lot harder for the government to confiscate cryptocurrency. That is because it is not easy to even know who owns what amount. Also, people don’t need vaults, which are easy to detect.

Also, since it is based on mathematical protocols and smart contracts, counterparties don’t need to trust one another. The global community trusted the US in 1944, but it ended up not keeping its side of the bargain.

The US unilaterally took itself out of the Bretton Wood gold standard in 1971, leaving other countries with dollars they could not convert to gold as earlier promised.

Indeed, it is also not a standard that can be paused for convenience. There is no central point where the system can be switched off for short-term interests. Everyone has to act around the existing inherent rules.

The gold standard does not need to come back for the globe to experience a deflationary monetary system. Crypto offers an even better solution.