Who are Bitcoin whales?

If you closely follow the Bitcoin price trends and market news, you will likely encounter mentions of Bitcoin whales.

As the value of other digital assets created on the blockchain, in particular altcoins and non-fungible tokens (NFTs), has continued to grow, it has become more common for the term crypto whales to be used in place of Bitcoin whales. The former is more inclusive.

Nevertheless, the meaning is mostly the same. The phrases refer to individuals or entities holding substantial amounts of Bitcoin or other crypto assets. The phrases could also refer to individuals or entities with the financial potential, capability, and interest in buying crypto assets in significantly high volumes.

However, for one to be considered a true whale, the volumes they trade must be substantial enough to influence either supply or demand of the asset in the global market.

When whales buy, the global price is likely to go up because they create a significant market demand. On the other hand, when they sell, they flood the global market with the asset, increasing the supply and, as a result, pushing down the price.

But what does it mean to be a whale in numbers?

It is a little bit difficult to establish the exact volume of an asset that is likely to affect its global price.

For example, how many bitcoins does it take to be a whale?

Over time, notable actors in the crypto market have attempted to determine the levels of volumes that affect global market prices. While their methodology remains largely arbitrary, they have become resourceful, especially to traders keen on benefiting from the price volatility of crypto assets.

One such actor is Whale Alert, an online tool that tracks and analyzes blockchain transactions in real-time and shares the data with its followers on social media, including over two million on Twitter. As the name suggests, this tool alerts traders when a whale makes a purchase or a sale.

In Whale Alert’s terms, a transaction worth more than 1000 bitcoins can influence the global market price. For ETH, it is more than 5000 coins, and for most of the other crypto assets, it is a value of more than $10 Million.

🚨 🚨 🚨 1,985 #BTC (39,558,726 USD) transferred from unknown wallet to #Coinbasehttps://t.co/FcampGkUf2

— Whale Alert (@whale_alert) September 2, 2022

How much Bitcoin is held by whales?

It is easy to access the public ledger on which Bitcoin transactions are recorded and analyze them. Indeed, several companies have been set up to provide tools to collect data from the blockchain. The most notable of such companies is Chainalysis.

Even with the availability of tools that collect Bitcoin transaction data, it is still difficult to determine who holds what amount of bitcoins. That is because users remain pseudo-anonymous. Also, one HODLer might have several wallets that cannot be linked, but the contents can make them a whale when combined.

With that said, a few other tools are designed to track what is known as sleeping bitcoins. These are coins that have not been moved for at least several years. Most notable tools of that kind include Btcparser.com and BitInfocharts.com.

According to data from BitInfocharts.com, about 2000 wallet addresses hold between 1000 and 10,000 bitcoins, with a total of about 5 million bitcoins. Meanwhile, 93 wallet addresses hold between 10000 and 100000 bitcoins, with a total of 2.1 million. At the top are 5 wallet addresses holding between 100000 and 1 million bitcoins with a total of 783,129 bitcoins.

Source: BitInfocharts.com

Who are the top Bitcoin Whales

Most Bitcoin and crypto HODLers remain anonymous. The only information available to the public is a wallet on the blockchain with a significant amount of coins assigned to it. With that stated, there are a few whose identities are known. It is also the case that there are those known to hold significant amounts of crypto assets but the exact wallets in which they hold their assets are not linked to their real world identities.

So who owns the most bitcoins?

The following is a list of some of the individuals and entities that are known to hold a significant amount of crypto:

Satoshi Nakamoto

Since Satoshi Nakamoto was the first to mine bitcoins, their addresses are more easily identifiable. That is even though the true identity of this person has never been unveiled.

The wallets associated with Satoshi Nakamoto are estimated to hold about 1.1 million bitcoins. If that number of bitcoins or even a part of it is sold, that can significantly drive down the price of Bitcoin in the global market at least for a short while.

Changpeng Zhao

The wallets of Changpeng Zhao are not publicly known, but the founder of the Binance exchange and the Binance Chain ecosystem is estimated to be worth over $17 billion and was close to $100 billion during the bullish market of late 2021.

The Binance exchange is the largest globally in terms of the volume of transactions it processes. Meanwhile, Binance Chain supports the second largest number of utility and non-fungible tokens behind the Ethereum blockchain ecosystem.

Samuel Bankman-Fried

Samuel Bankman-Fried is a co-founder of the FTX, an exchange, a portfolio manager through Blockfolio, and an investment firm. Indeed, the FTX exchange is the second largest exchange after Binance in terms of volumes transacted.

Samuel Bankman-Fried is estimated to be worth over $20 billion.

The Winklevoss twins

Source: bostonmagazine

Cameron and Tyler Winklevoss are known to HODL a significant amount of bitcoin. They are estimated to be worth about $4 billion. They are also the founders of the crypto exchange Gemini.

MicroStrategy, Tesla, and others

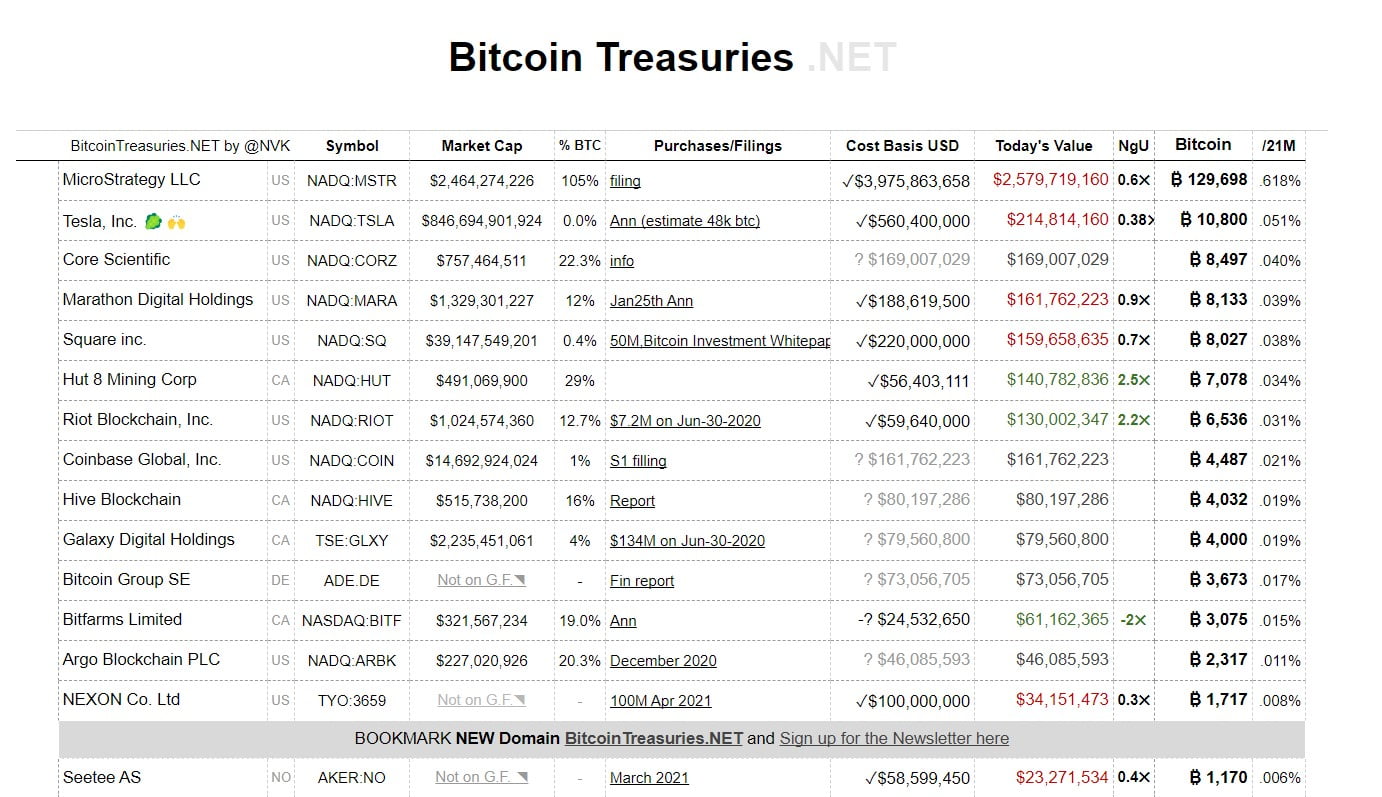

MicroStrategy is a business technology company founded and led by Bitcoin enthusiast Michael Saylor. According to Bitcoin Treasuries, a website that tracks investment in Bitcoin, the company is HODLing close to 130 000 bitcoins.

Meanwhile, the electric car manufacturer Tesla has 10800 bitcoins in its portfolio. Other entities owning over 1000 bitcoins include:

Core Scientific (8497 bitcoins)

Marathon Digital Holdings (8133 bitcoins)

Square Inc (8027 bitcoins)

Hut 8 Mining Corp (7078 bitcoins)

Riot Blockchain Inc (6536 bitcoins)

Coinbase Global Inc (4487 bitcoins)

Hive Blockchain (4032 bitcoins)

Galaxy Digital Holdings (4000 bitcoins)

Bitcoin Group SE (3673 bitcoins)

Bitfarms Limited (3075 bitcoins)

Argo Blockchain PLC (2317 bitcoins)

Nexon Co Ltd (1717 bitcoins)

Seetee AS (1170 bitcoins)

Source : Bitcoin Treasuries

How do crypto whales make money?

The earliest crypto whales made their money through mining and staking. That is participating in maintaining the transaction ledger and earning the reward provided as the incentive. In the least, that is how Satoshi Nakamoto accumulated over a million bitcoins.

The other way whales make their money is by trading crypto assets. And that is buying at a low price, HODLing, and selling at a high price. The whales are known for using their ability to sway market prices to give themselves advantages. For example, they can easily flood the market, drive the prices down, and then buy the assets back at a lower price and therefore creating the potential to increase their capital gain.

When and how do whales sell their bitcoins?

Whales often need to buy and sell assets in volumes that exceed what exchanges can support. They are also often careful not to influence prices and hurt themselves, especially when they are forced to buy in batches.

Because of these reasons, whales often use Over-The-Counter (OTC) trading desks. These are brokers with networks that enable them to fulfill orders without signaling to the markets that there is a huge supply or demand on the way, affecting the prices. Several mainstream exchanges and trading companies offer this service to whales.

Most whales sell their assets when they have a high capital gain. What that means exactly is different for different whales. Some whales sell after a few months, and others have been holding on to their assets for nearly a decade.