Through cryptocurrencies, and Bitcoin, in particular, the blockchain has transformed the process, purpose, and impact of printing money.

For thousands of years, printing or minting of money has been an exercise performed by the government. Even in the cases where private entities have done it, it has almost always been on behalf of or with the government’s express permission.

Indeed, printing money is one of the ways political power has been exercised.

With the government’s monopoly on printing money, however, society has had to accept inflation as part of the inherent nature of money. It has widely been accepted that the value of money declines and the prices of goods and services rise over time.

The printing of money

When the words printing and minting are used in regard to the generation of money, they are more likely to create the mental images of physical paper bills coming out of a printer or metal coins being forged in a furnace.

But that is not how much of the money in circulation comes into existence. According to some estimates, only 10 percent of currencies around the world exist as physical cash. The rest exists only as digits on computers or in electronic bank accounts.

Even before the internet, a significant amount of money was not in physical bills and coins. It came into circulation as well as used through checkbooks thanks to the fractional reserve banking system.

In this system, a commercial bank can issue loans up to 90% of the actual deposits. In many cases, the money loaned out is considered a new deposit as it often does not leave the bank and it is used to issue another loan. This can be repeated many times such that a small amount of money can multiply into a significant amount of money available for use by the members of the public.

Before the computers, much of this money was assigned to an account from which the holder could spend it using a checkbook.

The digital revolution that came with the adoption of computers in banking in the 1970s made printing money a lot easier. Now all that is done is enter numbers into the computer, and new units of money come into circulation. Of course, this is subject to guidelines by the regulators.

Generally, inflation occurs when more money than necessary is released into circulation through actual printing and the fractional reserve system. It could also be due to rising wages, currency devaluation, or more demand for goods and services than what the economy can produce.

There are two main types of inflation.

Hyperinflation

This is also known as Galloping inflation, and it is easily noticeable and happens in waves. It is easy to notice, in particular, because it happens rapidly, and the price changes are abrupt and significant at the same time.

In late October 2021, Twitter Co-founder Jack Dorsey indicated that we are about to witness major hyperinflation:

https://twitter.com/jack/status/1451733913961783299

When they occur, galloping inflations often cause economic and political uneasiness that must be addressed through policy.

The steps taken to control it are known as contractionary monetary policies, basically reducing the amount of money in circulation.

That is done by reducing the amount of money printed or released to the public, increasing bank interests to encourage people to save, and decreasing bond prices so that more money is locked in the government.

Creeping inflation

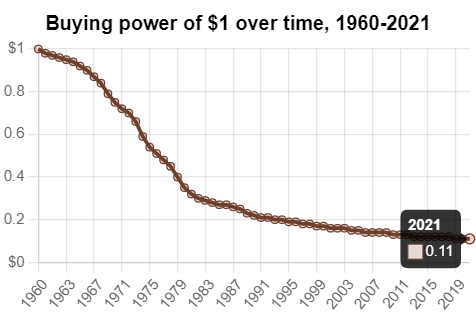

Source:https://www.in2013dollars.com/us/inflation/1960?amount=1

An even more impactive but less noticeable form of inflation is creeping inflation. This happens slowly and continuously over a long period. The changes are often only noticeable when one looks at the data from the period in question.

Join Club Swan and get… more!

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan’s flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

Creeping inflation is a common phenomenon around the world. Nearly every country is experiencing it all the time. For example, a dollar today is worth only 11% of a dollar in 1960. That translates to a cumulative price increase of 826.72%.

In other words, today’s prices are 9.27 times higher, which means a dollar today only buys 10.79% of what it could buy 60 years ago.

The most worrying aspect of the creeping inflation is that the annual rate is growing. The annual inflation rate in 1960 was 1.72%. Today it is over 5%. That means the dollar is likely to lose more than double the value it lost in the last 60 years.

The creeping inflation is the reason why cash is the worst store of value. If you keep your wealth in a bank account for an extended time, you will lose a significant amount of it to inflation even with a promise of a significantly high-interest rate.

But if you are losing value, it sure must be going somewhere.

Indeed, inflation does transfer value from one place to another. Like energy, value is hardly destroyed. And this turns out to be the biggest motivating factor for governments and the banking industry around the world to continue printing more money and fueling creeping inflation.

The main cause of inflation

While there are many causes of inflation, such as rising costs and wages, more demand for goods than the supply side can handle, and currency devaluation, the primary cause is money printing.

And that is because the central banking system and the government are incentivized to release more money into circulation.

The more loans commercial banks give out, the more profits they make. Indeed, loans are treated as assets by banks as it is what generates them the revenues primarily. Meanwhile, much of the loan is new cash given to borrowers.

On the other hand, the government is incentivized to print more money and release it into circulation.

In his book, The Creature from Jekyll Island, author, and filmmaker G. Edward Griffin explains that contrary to what many of us might think, the significant amount of the money the government spends does not come from taxation. It comes from inflation.

Whenever the government needs to fund a major project, it can easily print the money for it. In the US, that is done through the Federal Reserve. Once the amount is paid to the contractors, it finds its way into the general circulation.

The net impact of the money released as payment to contractors is that it dilutes the value or purchasing power of the money already in people’s pockets and bank accounts.

How cryptocurrency has changed the game

Of course, some have always thought it is not a good idea that money should be inflationary. That it should not be acceptable that holders of money lose their value to taxation through inflation.

For the longest time, however, there was nothing that could be done about it. The financial system in place, though with major shortcomings, and in particular, inflation, was the best that could be realized. The arrival of Bitcoin and its underlying technology in 2009 changed all that.

Bitcoin is the first currency built to function strictly using mathematical and cryptographic rules. While traditional financial systems have been claimed to be based on scientific (or economic) principles, humans have a lot of leverage to manipulate them to meet short-term and often selfish interests.

Bitcoin uses what could be described as pure science that cannot be manipulated to meet the short-term and selfish needs of a few. It is decentralized and therefore exists with no one individual, entity, or organization having enough control to change the rules that guide how it works.

The rules that guide how Bitcoin works make it a truly deflationary currency. That means its value is likely to grow over time or, in the least, generally remain stable.

Unlike with the fiat currencies like the US dollar, we know for sure how many bitcoins will ever be in circulation. Anyone can also independently verify this aspect of the currency.

When it comes to deflationary nature, what comes close to cryptocurrencies are precious metals like gold and silver. These are rare, and therefore the supply is significantly low. In fact, their rarity is what made them currencies for thousands of years.

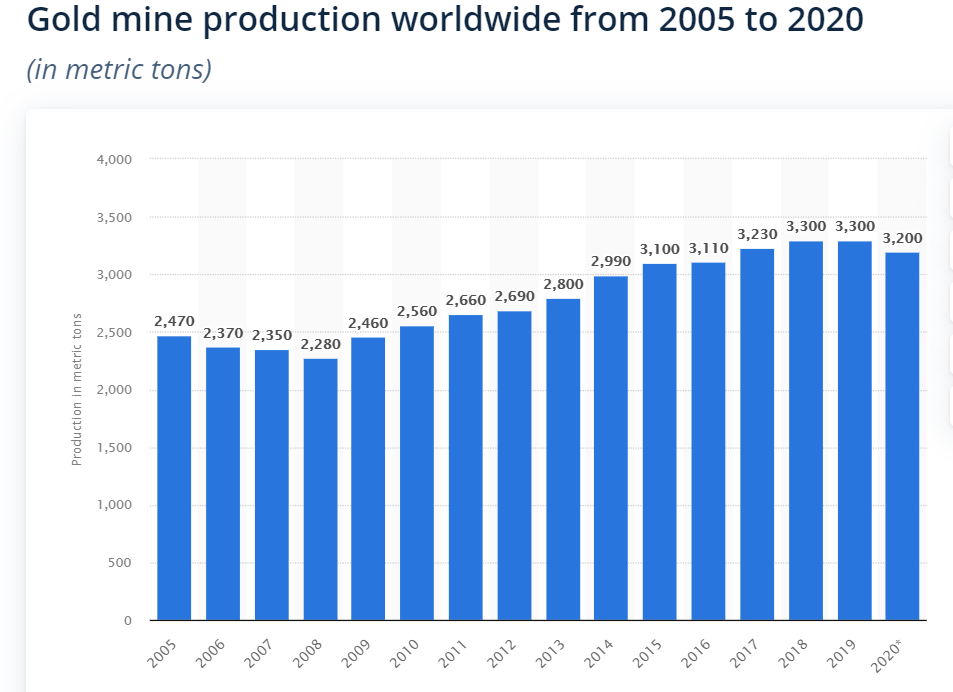

However, precious metals don’t have a definite upper cap. For example, every year, between 2500 and 3000 tonnes of gold are mined, and this is likely to go on forever.

https://www.statista.com/statistics/238414/global-gold-production-since-2005/

And if humans acquire the capacity to explore other nearby rocks, moons, and planets, we might land a significant amount of these precious metals, and that could significantly devalue what we already have.

Therefore, even when we compare it to precious metals, Bitcoin still offers the best solution to the inflation problem.

Instead of having new coins generated infinitely, Satoshi Nakamoto decided Bitcoin was going to be a deflationary currency.

How was this achieved?

Satoshi Nakamoto wrote the code so that the number of coins that will ever be mined is finite. The rules that guide how the cryptocurrency works stipulate that only 21 million coins will ever exist.

The emission is gradual, though. At the launch of Bitcoin, 50 coins were mined every ten minutes and earned by those who support the network. After four years, that halved into 25 bitcoins. It again halved to 12.5 in 2016. In 2020 that amount came down to 6.25 bitcoins.

The halving will continue until the 21 million mark is hit. That is going to happen around the year 2140.

When you combine this with the fact that the demand for cryptocurrency will grow as more people learn about it, its value is more likely than not to grow over time. The phenomenon is the opposite of what we see with fiat currencies.

Indeed, in 2009, bitcoin was worth pennies of a dollar. In ten years, the value of Bitcoin has grown up to over $60,000. Indeed, when you consider that the dollar has lost some value to inflation in a decade, Bitcoin is likely to have acquired more value than what we can determine by comparing it to the dollar.

Can Bitcoin Change?

The question you might have is, what if Satoshi Nakamoto comes back and decides to change the number of coins to be in circulation to more than 21 million? Or what if someone else with the necessary technical capacity decides to make this change?

That would make it inflationary.

The good news, though, is Bitcoin is a decentralized currency, it is not controlled by any entity. Everything, including making changes to its core rules, happens through consensus in the larger community of users.

You need to run the core software to be part of its peer-to-peer network. If you run a core software that is even slightly different from what the rest of the network runs, you can easily be excluded from the network’s activities.

For any change to be effective on the network, the proposer has to persuade everyone and the entire community to run the core version with it.

Even if Satoshi Nakamoto came back today, they will have no control over the project. They can only change the core software they run on their own computer. Everyone else will ignore them unless they can provide a persuasive reason the rules need to change.

In other words, removing the 21 million cap is an almost impossible undertaking. Given that most people buy Bitcoin partly because of its inflationary nature, it is impossible to get the majority to accept changing its monetary policy.

Of course for one reason or another, a few people will attempt to make those changes. However, their efforts will mostly be ignored. And if they have a significant influence, the original Bitcoin will fork and continue existing.

Bitcoin has already forked a few times due to the disagreement on other aspects of the protocol, in particular, the size of the block of transactions confirmed every ten minutes. The biggest hard fork happened in August 2017, and it led to the emergence of Bitcoin Cash as a separate cryptocurrency.

Bitcoin as a store of value

Bitcoin was designed to function as money. That means being a medium of exchange, a unit of account, and a store of value.

As a medium of exchange, Bitcoin is still a work in progress. While the list of merchants who accept it as payment for goods and services is growing, you can’t walk to any store, and expect them to accept it. At least not yet.

It is true, though, that crypto debit cards like the one issued by ClubSwan make it possible to spend the cryptocurrencies in millions of stores around the world. The service provider helps convert the cryptocurrency into a currency that merchants accept.

As a unit of account, the cryptocurrency has had the least success. It might be a while before it is used as a tool for measuring value. Even in places where cryptocurrency is used as a medium of exchange, the pricing is still indicated in fiat currencies like the US dollar, Euro, and the Sterling Pound.

The most successful use of Bitcoin as money is as a store of value. More people and companies are choosing to accumulate and HODL it because they are confident that its value will go up over time.

Already the Bitcoin price has grown from under a dollar in 2009 to over $60,000 in 2021. When you factor in the dollar’s inflation, Bitcoin has grown in value even more than what is apparent.

According to Bitcoin Treasuries, a site that tracks the accumulation of bitcoin by corporate entities, the technology company MicroStrategy has bought about 115,000 bitcoins worth about $7 billion.

Meanwhile, the electric car manufacturer Tesla has accumulated over 43,000 bitcoins worth over $2.6 billion.

Other entities with significant holdings of bitcoin include Square inc. (part of Twitter) 8000 bitcoins, Marathon Digital Holdings 6665 bitcoins, and Coinbase Global 4487 bitcoins.

It is important to point out that given the anonymity that is possible to achieve with bitcoin, other entities and individuals could be holding significant stashes of bitcoin with little information about it available to the public.

What is the source of Bitcoin’s value?

The common weakness of bitcoin that its critics point out is that it does not have intrinsic value. On the other hand, those who support the cryptocurrency have pointed out that the amount of energy spent mining bitcoin can be considered its intrinsic value.

However, the same question can be asked about the other forms of money we have had, including paper money, precious metals, and digital currencies used through internet banking and mobile.

Like any of these other currencies, Bitcoin is just a technology that allows us to exchange value, measure value, and store value. The value itself is the wealth we create through our human capital.

Therefore, bitcoin might not have any intrinsic value. However, it is turning out to be the most effective tool for managing the value we generate with our time, effort, and intelligence.

Conclusion

The dream of Bitcoin becoming a medium of exchange and unit of account might never be realized. However, its use as a store of value is almost guaranteed.

Meanwhile, other coins are being designed to be better at being media of exchange and units of account. They include stablecoins like Tether and USD Coin and privacy coins like Monero and ZCash. There are also those equipped with high transaction throughputs, such as Cardano.