Disclosure: Aurae and Club Swan are not exchanges. Aurae and Club Swan are lifestyle clubs for cryptocurrency enthusiasts that facilitate the usage of cryptocurrency in all forms.

Converting large amounts of crypto to fiat and vice-versa may be a complicated task, especially for those who are not accustomed to dealing with exchanges1, Bitcoin wallets, and decentralized apps on a daily basis. What’s more, you may have never known that these obstacles existed until you had to face them first-hand.

A fintech expert Steven Hatzakis, who is the Global Director of Online Broker Research, ForexBrokers.com & StockBrokers.com, has disclosed the following problems that cryptocurrency users face:

“In the past, if someone wanted to off-ramp crypto to fiat or vice versa, the only possible option to do it was via online exchanges. As the industry was pretty young, there were many flaws such as the lack of stable coins or inability to integrate with a banking account.

In the following years, new solutions emerged, but none of them was perfect. Prepaid debit cards have withdrawal limits while local regulators impose their own rules that are not always executable. For example, if you sell bitcoin for more than $10k in the US, you are obliged to file a declaration to the tax authorities which is not always possible as not all providers have a full history of operations.”

In this article, we are going to describe popular methods of on-ramping and off-ramping large amounts of crypto, obstacles one may come across and existing solutions to overcome them.

Centralized exchanges

Binance, Huobi, Kraken, and other popular centralized exchanges may seem to be the most obvious solution for exchanging cryptocurrencies. They have been around for a long while already and have established themselves as a secure and reliable solution for traders and investors. They usually support a large variety of digital assets and the fees one has to pay for transactions within the platform stay within the norm.

However, the target audience of these platforms mainly consists of small and mid-size investors and traders. The sums they operate with rarely exceed $100k. If you try to convert a larger amounts, you may face the following issues:

- Not all exchanges support fiat. Typically, they may offer alternatives in the form of stable coins such as USDT or USDC. However, this option is good only if you don’t plan to cash out in the near future.

- Strict KYC requirements. Those exchanges that deal with fiat are usually subject to tighter control from the local authorities, therefore they set up strict verification rules for their users. To set up an account, you will have to provide them with a big variety of personal documents while the onboarding procedure may take up to a few months.

- Hacker attacks. Typically, centralized exchanges store the majority of funds on cold wallets, but still, you may hear news pieces from time to time of that exchange or the other being hacked.Also, there are a big lot of technical security bugs that tricky hackers may exploit. For example, the Bitcoin malleability issue enables hackers to change the ID of the transaction before it is confirmed by the network. This problem is eliminated by another technical solution SegWit, but at the time of writing, it is only supported by ~70% of all transactions.

Transactionfee.info: SegWit is supported by ⅔ of all transactions leaving the rest in danger

Transactionfee.info: SegWit is supported by ⅔ of all transactions leaving the rest in danger - Your personal data is at risk. Not only can funds be stolen from an exchange. You may not hear about personal data leakages in the world of crypto very often because the news about hacks that result in the loss of funds obtain greater media attention. However, the problem exists just the same.

- Withdrawal limitations. Typically, exchanges set up their own withdrawal limits, especially for wire and SEPA transfers. For example, one of the most popular exchanges, Binance allows a maximum withdrawal of EUR 50k per day. Also, you may have to wait three to five days before you see the funds credited to your bank account.

- Geo limitations. There is practically no exchange that accepts users from all over the world, there are always some geographical restrictions. Finding an exchange that would support fiat withdrawals and deposits in a given region may be a challenge.

- Complicated interface. Centralized exchanges typically develop their functions to fit the requirements of sophisticated traders. The abundance of options may be confusing for a person who doesn’t devote 100% of the time to studying candlestick graphs and placing orders.

- Your order won’t be processed. If you place a single big order, most likely, it just won’t be processed due to the lack of liquidity. The platforms are filled with automated trading bots that will push your order down the waiting line and thus it will never be fulfilled.

- A large transaction can swing the market. To avoid the previous issue, you may buy all the offers from the order book one by one, but that will result in a very inefficient exchange rate. Other participants of the market will see that someone executes all the orders that appear in the book and will increase their prices.

- Taxation problems. Not all exchanges provide financial watchdogs with full access to your trading history. It will be near to impossible to prove the source of your income which may result in fines and penalties.

As you see, there are many challenges. There are methods to overcome them all, but unless you want to devote most of your time to investigating each method in the cryptocurrency market, this is not an efficient use of your time.

The OTC Market Alternative

Platforms that allow exchanging cryptocurrencies “over-the-counter” or, shortly, OTC markets are an alternative solution for those who want to bypass all the obstacles of centralized exchanges. On such platforms, users can convert and send cryptocurrencies directly between their own wallets without having to create an account.

Initially represented on traditional stock markets, this approach has found its way into the emerging cryptocurrency industry and has been well received by its participants. While in the early years, the list of OTC exchanges was relatively small and was represented by standalone players such as Changelly and ShapeShift, now such a service is an absolute ‘must’ for every centralized exchange as well.

OTCs serve institutional investors in a better way than centralized exchanges due to the lack of transactional limits. One can buy and sell big amounts of crypto via a user-friendly and simple interface, however, there is a flip side to this approach as well. The list of challenges include:

- Worse rate and higher fees

While on a traditional exchange you set up the price yourself and clearly see the fees, OTCs are not that transparent. Your order will be executed regardless of the sum you specify, but the rate will be much worse and the hidden fees will be much higher. - Long processing times

Typically, OTCs operate through centralized exchanges just the same so they face the same issues that standalone users do. If you want to exchange a really big amount of money, OTC will search across all the platforms that it operates with in order to get the required sum. Therefore, the time of the operation will be increased. - Some OTCs have arcane KYC processes

If the service is represented by a centralized exchange, in most cases, only verified users can make use of it. ShapeShift implemented obligatory KYC in 2018 under the pressure of local authorities. Other OTCs still roam wild and free, but it’s the question of time when governments will turn their attention towards them. - SWIFT transfers may be blocked

If you withdraw fiat to certain bank accounts using SWIFT, the transaction may be blocked. Authorities automatically flag large sums of money transferred by unverified users and have to take necessary precautions. - Geo limitations

Some OTCs don’t cover a large range of regions either. It is especially difficult for US residents to find a platform that would let them exchange funds as the regulations are more strictly defined in this country than anywhere else.

Join Club Swan and get… more!

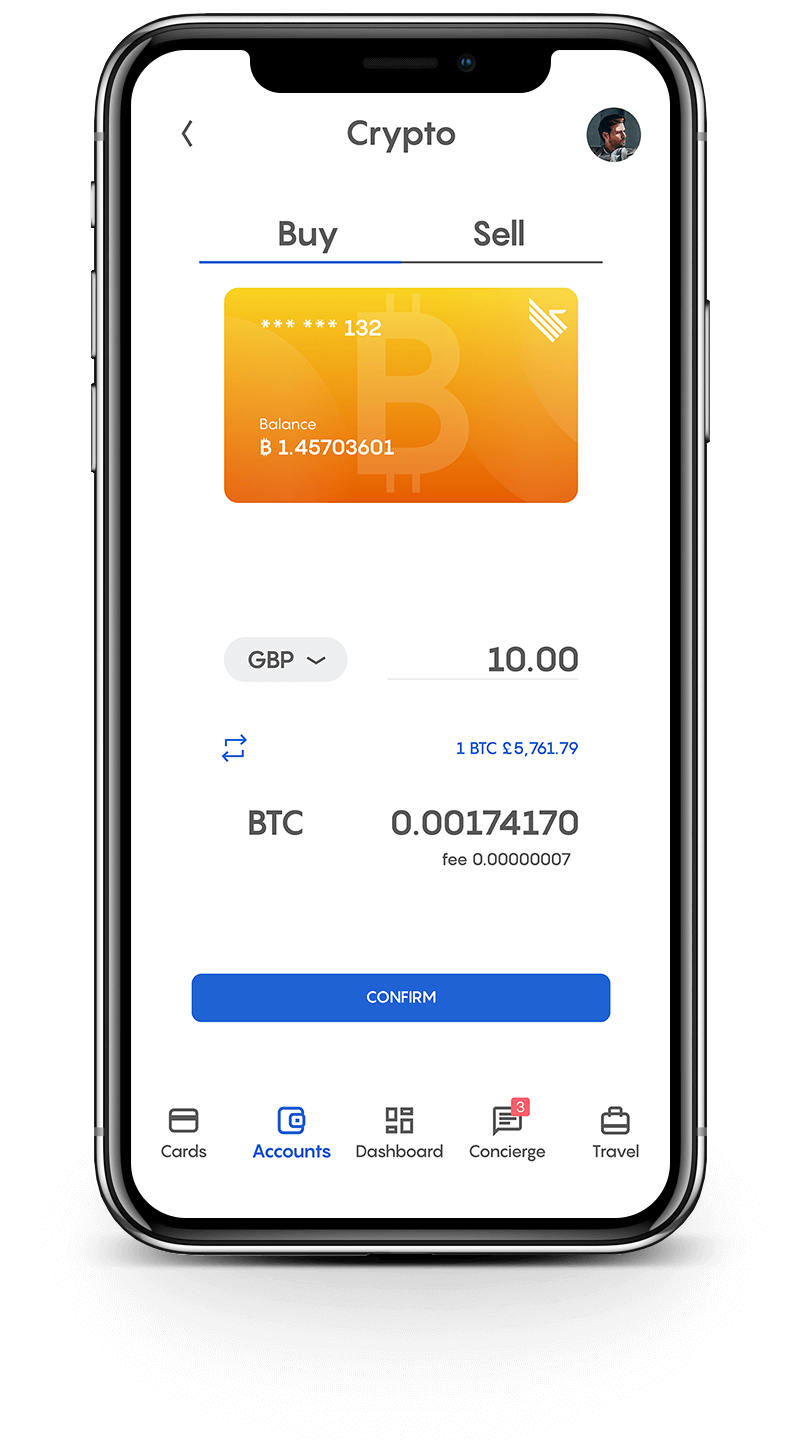

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan’s flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

Alternative Solutions

Don’t despair, though. There is a solution for almost any kind of issue, and liquidating large amounts of crypto is not an exclusion. Here are some alternative methods that you should examine.

Trading bots for liquidating large sums

Sophisticated traders have resolved the problem of profitable transactions long ago by introducing a big variety of trading bots. Most of the offers that you may find in the market refer to day-trading, however, there are some that focus specifically on institutional investors helping them convert big sums at the best rate.

Typically, such bots rely on a number of algorithms such as Smart Order Routing in order to find the best rate for the selected pair. However, they require technical knowledge and vigilance and are designed for sophisticated investors.

Brokerages

The cryptocurrency market is full of brokers ready to help investors carry their burden and take all the pains on themselves. Platforms such as Bitvavo, Etoro, and Litebit act as brokers and offer their users the simplest way of investing in cryptocurrencies. The fees they charge for their services are surely higher, but if you are a total newbie in cryptocurrency investing and don’t want to spend a significant part of your life reading candlestick graphs, this is probably not the best solution for you.

However, the services offered by such platforms are limited as all you can do there is exchange crypto.

Cryptocurrency Lifestyle Clubs

Lifestyle clubs such as Aurae Lifestyle can resolve not only all the pains associated with storing and liquidating large amounts of crypto, but also provide their members with various concierge services. Here’s what Steven Hatzakis said in his interview:

“The services provided by Aurae Lifestyle have really simplified many aspects of cryptocurrency payments for me. The prefunded debit card that they provide is the best card among the similar options represented in the market. The high limits that they offer to their VIP clients are incomparable with other options while the tailored services make managing big amounts of crypto proceeds much easier.”

Club Swan is a lifestyle club designed for moderately affluent crypto enthusiasts with lifestyle needs ranging from travel, attending specialized events and ancillary buy and sell services for cryptocurrencies. Similar to Aurae Lifestyle, Club Swan members can counterparty sell large sums of crypto depending upon their membership tier. Proceeds from liquidation go directly to the Club Swan prepaid debit card and transfers occur relatively quickly. This solution mitigates timing and spend limit problems with liquidation while providing an environment of like minded individuals.

1 Aurae, Coinx and Club Swan are not exchanges. Aurae, CoinX and Club Swan are lifestyle clubs for cryptocurrency enthusiasts that facilitate crypto usage in all forms for its members.