Holding or transferring extremely large amounts of crypto is hardly ever an issue.

It can be even a billion dollars worth, and you can easily keep it in an obscure wallet you have full control over. You can also instantly move the amount from that wallet to another whenever you need to, and you don’t need to seek permission from anyone.

You also don’t have to worry about limits or cross-border restrictions.

The challenge

The challenge, however, comes when you need to exchange that significant crypto stash for fiat currencies such as the US dollar.

Liquidating large amounts of crypto is particularly difficult because the platforms, off-ramps, or marketplaces you need to do have to deal with daunting obstacles such as transfer limits and cross-border restrictions imposed by payment processors and financial regulators, as well as low market liquidity.

For example, while selling $1000 worth of Bitcoin can go on smoothly and near instantly, selling 10,000 bitcoins might be difficult because no bank will readily remit $ 200 million, especially on short notice without questions asked. And that is beside the challenge of getting a buyer with that kind of money to spend.

With that stated, in this post, we are looking at the major options available for anyone intending to liquidate a significant amount of crypto. To make it a lot more resourceful, we reached out to Steven Hatzakis, Global Director of Online Broker Research at ForexBrokers.com, a Reink Media Group company. We are immensely grateful that he agreed to share some of his deep knowledge on the topic in the post.

But what amount is large?

The concept of ‘large amounts’ is relative, of course. While $10,000 might be a large amount for one trader, it might be insignificant for another. There is no generally accepted understanding of what constitutes a large amount in crypto trading.

With that stated, one way to determine whether an amount of crypto is large, especially when liquidating it on a marketplace, is to answer the question of whether its effect on the market price will be noticeable.

For example, selling 0.001 bitcoin will definitely have little effect on the supply volume on an exchange and thus will not change the price on a noticeable scale. However, an offer to sell 20,000 bitcoins will add a conspicuous amount to the market supply and push down the prices for everyone.

Steven believes that what constitutes a large amount is relative to factors such as market conditions, execution venues, and available order types, among other variables. He also asserts that a huge trade’s impact depends on which crypto asset you are trading.

But what is a large amount, according to him?

“Due to the nature of the limited supply of crypto assets,” he offers, “a huge trade, in my opinion, is anything that can cause a market impact of 1.5-5%, which could vary from an 8-figure trade to a trade in the high six or low 7 figure.”

Meanwhile, the crypto market tracking tool, Whale Alert, considers a transaction worth more than 1000 bitcoins, 5000 ETH, or $10 Million for other coins to be large enough to influence market prices. When such amounts are traded, the tool issues a whale alert to over 2 million followers on Twitter.

The other way to tell whether an amount of crypto is large is to determine whether the fiat equivalent in the liquidation transaction is above the daily, monthly, or per-transaction limits set by payment processors and financial regulators.

Generally, most banks have a $10,000 daily limit. Where there are no limits, a transaction above that amount is likely to trigger red flags and have the regulator notified.

Some of the limits are imposed by the regulator, such as the Federal Reserve Regulation D in the US, as one of the ways through which it manages monetary policy. Others are by the banks themselves so they can meet all their customers’ withdrawal needs.

The common difficulties when liquidating large amounts of crypto

The common issues you might have when trying to liquidate significant amounts of crypto include the following:

Lack of an appropriate off-ramp

While crypto is accessible and can be used by anyone anywhere in the world as long as there is internet access, on-ramp and off-ramps such as exchanges are not available everywhere. Generally, they need to be registered as money businesses by local authorities to operate.

In some countries, exchanges find it hard to operate either because crypto is banned or because the regulatory requirements are difficult to meet.

Low limits allowed by the banks for fiat

Most banks can not easily transact amounts that exceed $10,000. That means you need to seek an audience with the bank administration to acquire approval to move amounts above the set limits, or you might have to liquidate your crypto in batches, which might take days, weeks, or even months.

Scams and fraud

Crypto, once stolen, can easily be moved around with little success in the owner or the law enforcement tracking it. That is because, unlike other forms of digital payments, value in crypto is delinked from real-life identity. This makes it attractive to scammers and remote thieves.

At the point of liquidation, you are particularly exposed because you often have to have the crypto in a hot wallet whose keys can be stolen. And two, you might be tricked into sending the crypto to the wrong address or releasing it before receiving payment in fiat.

For example, P2P marketplaces can be the easiest to access and use, especially in countries with no locally licensed exchanges. However, in such platforms, someone can easily trick you into releasing your assets before they pay you.

Complex taxation

Before you even start liquidating your crypto assets, it is important to figure out if you need to pay any taxes and what amount you will owe the tax collector.

That depends on where you are located and how the regulators see crypto. For example, in countries where the regulator and tax collector do not recognize crypto, you might not be expected to pay any taxes. Still, you might be expected to explain the huge fiat transactions in your bank account.

In those where crypto is considered a property, such as the US, you might be expected to pay capital gain taxes when liquidating it. This means you pay taxes on the difference between the price you paid to acquire the assets and the price you are liquidating. This can be challenging, especially regarding understanding what taxes are required to pay and keeping records of your transactions for that purpose.

Market liquidity issues

The question of liquidity is more complex than just the available funds or assets in the marketplace.

“I just took a quick look at the BTC/USD order book on a popular crypto exchange,” Steven illustrates, “and while the spot rate was $20,597.00, there was $10m available at $20,278, representing a roughly 1.5% premium that would need to be paid to execute that order right away. Depending on the available liquidity, larger trades can cause a more significant price impact or slippage.”

In essence, plenty of liquidity can be available on a large exchange’s order books, yet very little is available at the current price at the top of the order book, as Steven explains. For example, 20 bitcoins might be available at the current price, while hundreds more are available at lower prices away from the spot market rate.

“Once you trade past the available amount at the top of the book price, the market price will necessarily change to find the next price with enough liquidity available to fill your order, thus causing market impact when the supply available at the spot rate isn’t enough to fill your whole order.”

“A huge trade submitted as a market order can experience significant slippage across various prices, getting filled along the way and causing an impact on the market while averaging a much worse rate, assuming all else is equal (i.e., prices are constant). Of course, the time of day and market conditions play a huge factor, especially whether a trading desk is tasked with a working order to minimize market impact and maximize the best execution,” Steven further explains.

Common ways to liquidate a large amount of crypto

The following are the options for liquidating large amounts of crypto available today. Each has strengths and limitations.

Centralized Exchanges

These are money businesses with online marketplaces where they buy and sell crypto. Over time the list of exchanges has kept growing. The list of the most popular exchanges includes Kraken, Coinbase, Gemini, Binance, and BitStamp.

Some exchanges operate within single countries, such as Coinbase in the US, while others are available in multiple countries. For example, Binance is available in close to 140 countries around the world.

Steven avers that most large centralized exchanges can accommodate the needs of most retail users. He explains, “Most large centralized exchanges will be able to accommodate the needs of most retail users for amounts up to hundreds of thousands of dollars and even several million if they are willing to pay a premium due to the structure of order books and available liquidity at different prices, and in major crypto assets that are more liquid, like bitcoin and ethereum. Institutional traders will often be connected to many exchanges via API along with OTC desks and can spread their trade size across a large number of venues to minimize market impact.”

The advantages of liquidating on an exchange

It is fast to trade through an exchange. Your order is nearly instantly fulfilled because you don’t have to wait for an offer from another trader. Instead, the exchange itself buys from you directly.

The prices are straightforward, and you don’t have to search or negotiate offers on the platform.

Most exchanges are designed to accept common payment options for fiat currencies. That includes bank transfers, debit cards, and digital payment methods.

Limitations of exchanges

Exchanges are not available or accessible everywhere due to geo limitations. That means you might want to sell on a particular exchange, but you can’t because it does not support traders in your country of residence. If you are in a country that has banned crypto, such as China, you might not find a local exchange.

It is also the case that most exchanges support only a few coins and digital assets created on the blockchain. If you have a crypto asset besides Bitcoin and Ethereum, it is possible not every exchange supports it.

The capacity to fulfill borders is often limited. For example, according to data from CoinMarketCap, most exchanges transact volumes under 100000 bitcoins daily. That means if they receive an order that exceeds this amount, they might need help to fulfill it.

Some of these exchanges may not support the payment methods that you prefer. And often, the completion of fiat payment might take days.

The privacy of the seller and the buyer is not guaranteed, especially given that you must verify your identity through strict KYC requirements before transacting. It is common for exchanges to experience hacks, during which it is not only stolen assets but also user data.

Trading huge amounts through exchanges can easily influence market prices. Indeed, if you sell in huge batches, you are likely to get different prices for each, with the previous affecting the price for the next.

The user interfaces of the exchanges can be overwhelming for someone who is not tech-savvy.

Tips on how to use exchanges

- Use only established exchanges with a trackable past.

- Keep your assets off the exchanges. Transfer them there only when ready to trade.

- Create strong passwords to your exchange account and secure it using 2-factor authentication.

- Confirm the fiat payment methods acceptable to the exchange and their limits before you start to trade.

P2P exchanges

These are marketplaces that connect buyers and sellers and facilitate the transaction they enter into. Typically a buyer or a seller puts up an ad on the site, and anyone who can fulfill the order reaches out, and negotiation happens.

After the buyer and the seller agree on the price and other terms of sale, they launch a contract. At that point, the crypto assets are automatically moved to an escrow wallet, locked until the buyer makes payment through a payment channel outside the platform.

Once they make the payment, the seller confirms and releases the assets in the escrow to the buyer. While the seller can release the assets, they cannot return them to a wallet they fully control. In the event there is a dispute, a moderator on the platform listens to both parties and decides who deserves the assets. The moderator has a private key to the escrow wallet and can release funds to the party they deem deserves it.

The most popular peer-to-peer (P2P) exchanges include Localbitcoins and Paxful.

Advantages of liquidating on P2P exchanges

The P2P exchanges are accessible in most parts of the world. Since they do not hold funds, such marketplaces do not necessarily need to register as money businesses, especially to access payment APIs by major financial institutions. The fiat payment happens outside the platform through channels agreed upon by the counterparties. That also offers a wider variety of payment options that can be used.

Limitations of P2P marketplaces

Transacting on the platform can be a hustle, especially as you need to find a trader online willing to accept your offer. Often you might have to initiate transactions with several traders before you find one who will go ahead and buy from you.

You can easily become a victim of scams and fraud on the platform. That is especially the case if you must be more conversant with the system’s workings.

The traders have to overcome challenges around limitations to move significant amounts of fiat currencies. That becomes an even bigger issue if the buyer and seller are in a country where crypto is banned. Therefore, disclosing the crypto transaction to the bank as the reason for a money transfer might lead to your bank account being shut down.

The user interfaces of the exchanges can be overwhelming for someone who is not tech-savvy.

Finding a trader willing to buy significantly large amounts of crypto is difficult. The platforms are ideal for trading smaller amounts.

Tips on how to use P2P exchanges

- Always first message the buyer and negotiate before you initiate a transaction.

- Confirm the payment method the buyer is using and whether it will process the fiat price of your transaction.

- Only release the funds in escrow once you are 100% sure the payment has been made.

- Keep all the conversation on the platform, and don’t click on links the buyer might send you through other channels, such as messaging apps.

Decentralized exchanges (DEX)

These are trading marketplaces built as decentralized applications (dApps) on the blockchain. They operate on open-source, decentralized protocols and use the blockchain as the primary backend. They are managed as community projects through consensus mechanisms based on smart contracts.

The liquidity is sourced from investors who get paid interest, and the fees users pay. A smart contract also manages this liquidity.

Advantages of liquidating through a DEX

As this marketplace is decentralized, it is accessible from any part of the globe and cannot be easily censored.

Also, since the operations are not managed through a company, the cost is minimal.

There are also no limits on the amount of crypto one can buy or sell. Examples of the most used DEXs include Uniswap and Pancakeswap.

Limitations of DEXs

The platforms still need to be designed to facilitate transactions that involve fiat currencies. The best one can get liquidating through a decentralized exchange is stablecoins such as the Tether (USDT), USD coin (USDC), and Binance USD (BUSD). Stablecoins are tokens on the Ethereum, Binance Chain, and other similar blockchains backed by the US dollar at a ratio of 1:1.

The DEX also does not support all types of crypto. For example, most DEX supports only assets on the blockchain they are built. For example, Uniswap facilitates trading only assets created and hosted on the Ethereum blockchain. That means you cannot liquidate Bitcoin directly on Uniswap.

There are also issues when the smart contract code is poorly written and reviewed. The smart contract can fail, and funds can either be lost or stolen.

“Smart contracts are still susceptible to a potential zero-day bug or other attack vectors, such as faulty code exploits that hackers can use to steal funds and manipulate transactions,” Steven explains, “And even without code exploits, there can be front-running on DEXs and other methods – such as gas price auctions – that put traders at a disadvantage compared to traditional exchanges where best execution is standard.”

Steven also points out that while many DEXs have the benefit of showing you what the potential slippage will be for a given trade size before you place a trade, those values can still be significant, making it very expensive to trade on a DEX for anything other than a retail size trade.

Tips on how to use DEX

- Use only DEXs whose smart contract code is public and has been thoroughly peer-reviewed.

- Use a widely approved wallet to perform the trade.

Over-the-counter (OTC)

These are transactions facilitated through third parties or trading desks who act as go-betweens or brokers. Most transactions that involve large amounts of crypto are carried out through this channel.

The OTC brokers often form networks, which enables them to fulfill huge transactions. That means if one trading desk gets an order request they cannot fulfill, they can talk to others on the network so that they collaborate.

The list of major crypto OTC trading desks is Circle, Genesis Trading, itBit, and Galaxy Digital Holding. Some exchanges do also offer OTC trading services. Exchanges with OTC component include Coinbase, Bitfinex, Kraken, and Bittrex.

Advantages of liquidating through OTC

Given the networks they can build, OTC can facilitate amounts that exchanges and P2P marketplaces can’t handle.

The brokers are also positioned to form the necessary relationship with the financial institutions so that a huge amount of fiat currency can be without major challenges.

For example, in March 2022, Digital Galaxy Holdings, a crypto investment solutions company, partnered with Goldman Sachs to process an OTC transaction.

It is also possible to negotiate a price and lock it in through a formal contract even if the market prices change within the execution period.

Indeed, because OTC trades happen behind the scenes and not on exchanges, the transactions tend not to influence market prices. That also means there is more privacy for the seller and buyer.

This is the ideal channel a trader who is not tech-savvy can use. The OTC trading desk provides all the necessary technical support for the transaction.

“Institutional traders will often be connected to many exchanges via API along with OTC desks and can spread their trade size across a large number of venues to minimize market impact,” Steven states.

Limitations of OTC

Finding a reliable broker with the right network to facilitate an OTC transaction might take time and effort. Often the brokers don’t actively advertise their services, and it might take knowing someone to be referred to a reliable broker. Meanwhile, asking around might alert the market players, influencing the price before you even make an order.

You must pay a significant commission fee to the broker as a facilitation fee.

It may take a relatively long time before your order is fulfilled. That is especially the case if the order is too large for a single broker to fill and has to talk to a network for help.

Tips on how to use OTC

Don’t shop for a broker just before you start trading. If you shop for a broker too close to your trading day, that will affect market prices and give the brokers an upper hand.

When asking for the price rate, be unpredictable. For example, ask for both buying and selling and inquire about different volumes. This way, the broker does not know beforehand what you are up to.

Steven recommends investors only use trusted financial services providers that are properly regulated and licensed to minimize their chance of falling victim to fraud.

“In the US, crypto brokers need to be FinCEN regulated and registered as a Money Service Business (MSB), and should carry insurance and employ trusted crypto custodians,” he explains.

He also advises those seeking to liquidate large amounts of crypto to make small test transactions to prove ownership/control of the cryptocurrency wallets used to transfer and receive funds, as they must be 100% sure that the address they are sending money to belongs to the cryptocurrency exchange or broker and not that of a hacker or scammer impersonating the exchange vis-a-vis a meet-in-the-middle attack during the transaction.

“There are many other risks and attack vectors unique to cryptocurrency transactions, and the above is not meant to be exhaustive,” he adds, “Anyone that self-custodies crypto assets must be familiar with the many risks involved, especially when dealing with huge trade sizes, where an error or hack can cause massive potentially irreversible financial damage.”

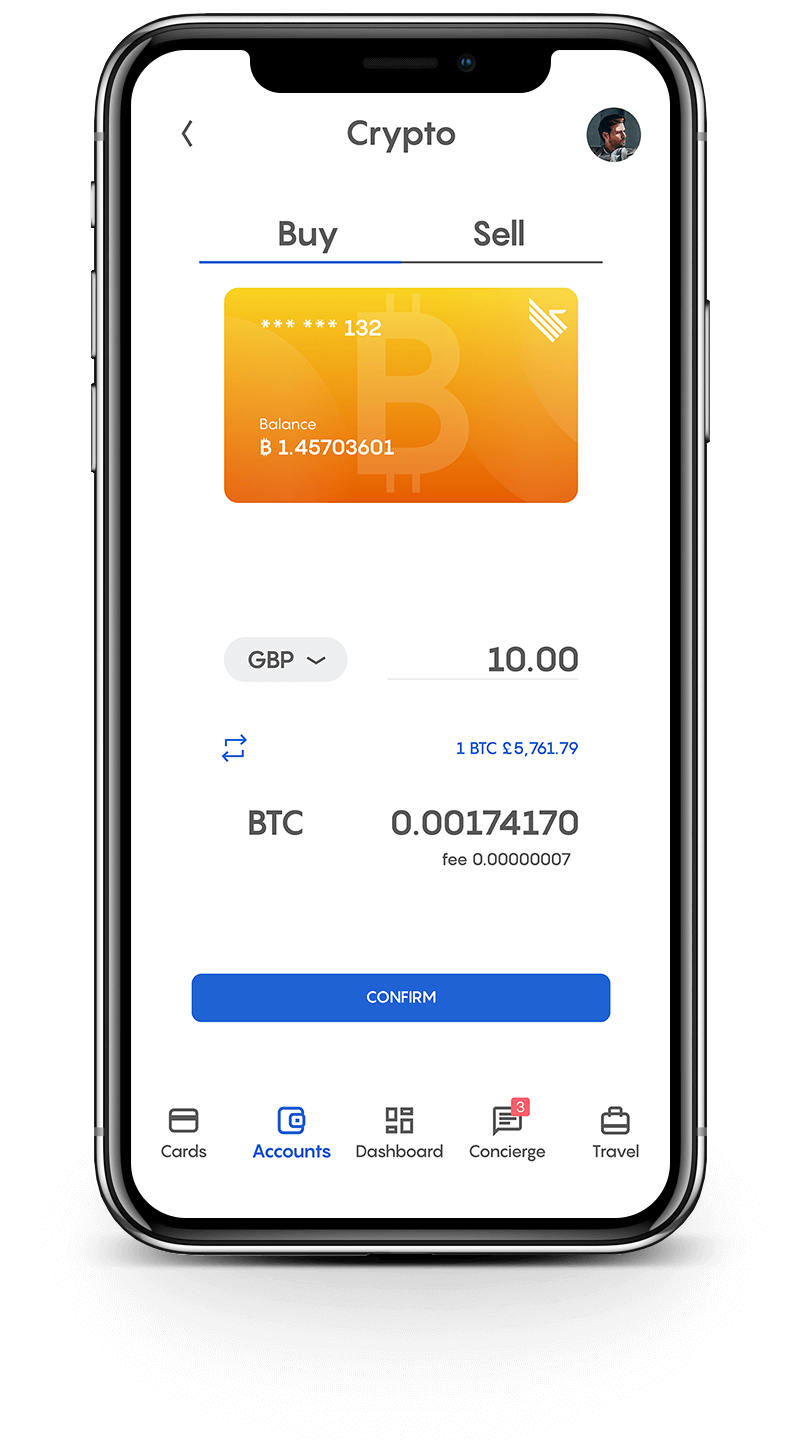

Crypto Lifestyle clubs

These are member organizations designed to provide particular benefits to their members. These include better-price deals from various merchants and personalized travel concierge support.

Some of these clubs do also support members in liquidating crypto assets. An example of such a club is ClubSwan. Besides a mechanism to convert, the club also gives members debit cards through which they can transact using crypto.

Strengths

Fast conversion of crypto into fiat. That is because the club provides members with bank accounts and crypto wallets. An internal exchange also facilitates the conversion.

They have relatively high limits and, therefore, can facilitate liquidating large amounts of crypto. That is often because the Club is registered as a regulated financial service provider.

You also get highly personalized concierge service.

Limitations

The service comes at a membership fee, which can be stiff for some people. Only some people can qualify to become a member.

Tips on how to use clubs

Join a lifestyle club that has the necessary capacity to process both crypto and fiat transactions.

As more people and institutions embrace crypto, it is becoming necessary to find ways to liquidate huge amounts. Fortunately, that area has a growing capacity, both from crypto on-ramps and off-ramps and the mainstream financial system.

Advertisement

Join Club Swan and get... more!

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan's flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.