The global financial ecosystem is undergoing a major shift. In particular, the use of physical cash has declined significantly. And it is all thanks to digital innovations.

Many countries today can boast of being cashless. Only 20% of payments in the UK are made using physical cash. In Sweden, it is less than 2%. China is close to being a totally cashless society.

All this has happened even before we experience the full impact of crypto, stablecoins, and Central Bank Digital Currencies (CBDCs).

However, one component of the old financial system seems to be agile enough to adapt to the changing environment. That component is payment cards (credit, debit, and prepaid).

Before digital payment solutions came along, payment cards allowed people to travel and shop without carrying physical bills and coins. Nevertheless, they might be seen in the same light as physical cash, and therefore there might be an expectation that they will face a similar fate.

The future of payment cards

Even with the digitization of the global financial system, payment cards seem to have a great future. According to data from the market research website Statista, the number of payment cards in circulation around the world has continued to increase with time.

In 2017, there were about 20 billion payment cards in circulation. The number had grown to 25 billion in 2021. The research projects that there will be over 30 billion payment cards in circulation by 2026.

But what exactly makes payment cards adaptable to the growing use of digital payment solutions?

The reasons are in three broad categories:

- They have unique consumer benefits that are appealing

- They are evolving and acquiring new features

- They are acquiring new uses

Attractive benefits

The following are old benefits that will continue to make payment cards relevant, at least in the foreseeable future:

- An avenue to quick credit.

- Most widely accepted means of payment globally, making traveling a lot more convenient.

- Attractive to many consumers because of the rewards they give.

- Means to improve credit score, which can help one to apply for larger loans such as mortgages.

Acquiring new features

Besides having unique consumer benefits, payment cards are evolving to blend in with the emerging ecosystem.

For example, it is now a common phenomenon to have digital versions of payment cards. These can be as functional as physical ones, especially when shopping online.

Indeed, the digital version of payment cards has flexibility that is difficult to achieve with physical cards. It is possible to create one card for a specific transaction or merchant, which protects the consumer from possible theft as the card can only work on the transaction or merchant it is created for.

For example, you can create a unique payment card for your web hosting service provider. If someone steals the card details, they cannot process payments with other merchants.

Also, being virtual, one can have numerous cards without worrying about physical storage.

Club Swan is one of the brands that have thought outside the box in continuously adding new features to payment cards, including a virtual card. We have turned the space on the physical prepaid card into real estate that can be used for branding and also self-expression for the consumer. The payment card becomes unique to you and your experience.

Join Club Swan and get… more!

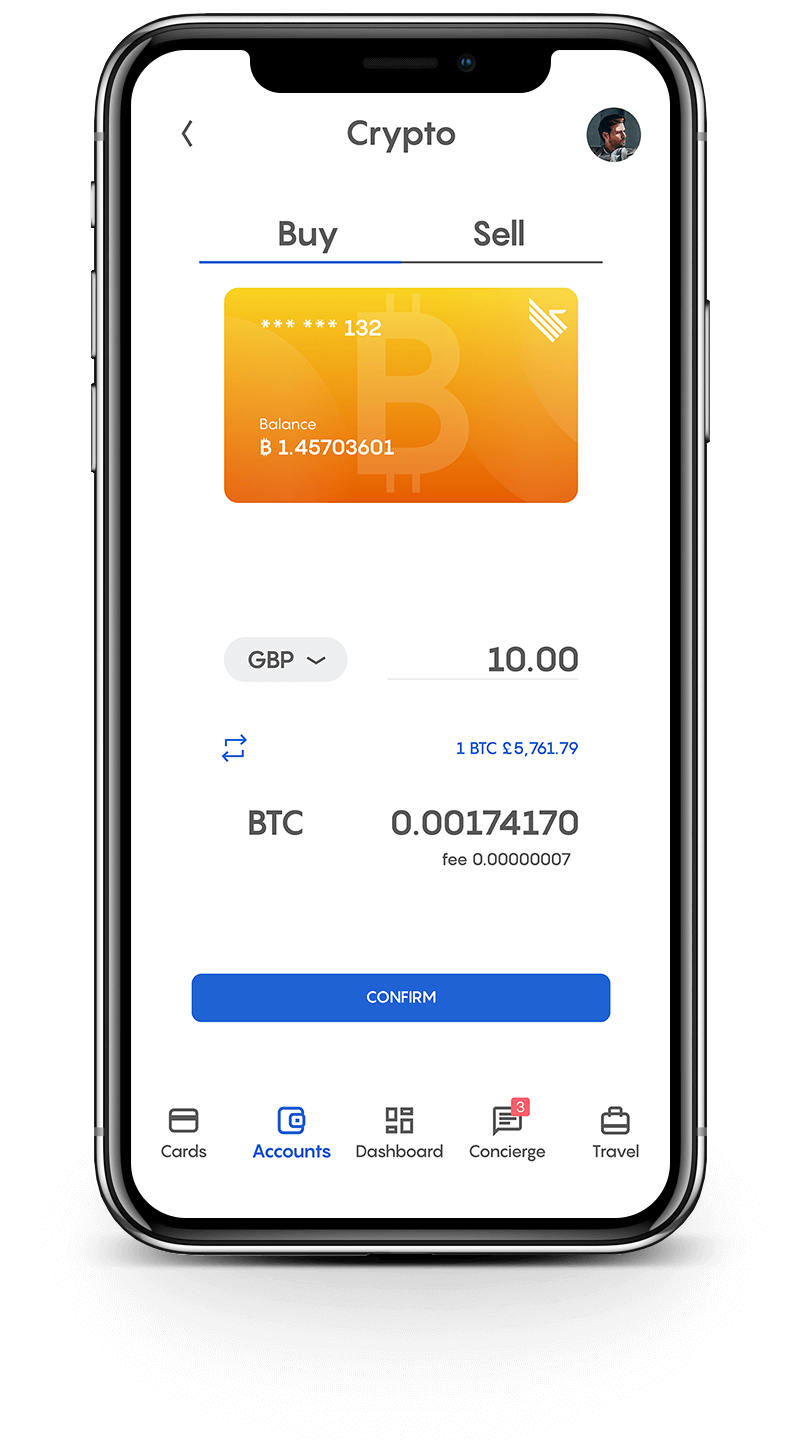

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan’s flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

Acquiring new uses

This is likely where much of the relevance for payment cards will come from going into the future. In the blockchain space, in particular, payment cards are becoming a solution to challenges that the adoption of cryptocurrencies and the metaverse face.

Crypto debit cards

Payment cards have been co-opted to enable crypto enthusiasts to easily spend their blockchain asset holdings in brick and mortar stores around the world and online. That is a solution to the problem of the acceptability of crypto assets as mediums of exchange.

The industry has seen the rise of crypto enabled debit card brands and those that are able to liquidate crypto and issue fiat currency to load to cards almost real-time, such as Club Swan. These brands issue cards supported by mainstream payment processors such as Visa, Mastercard, and Union Pay, making it possible for holders to ultimately spend crypto in millions of stores.

The entities behind crypto debit cards are either exchanges or have an exchange component that facilitates the conversion between the crypto assets and the fiat currencies that stores easily accept.

Besides, in the emerging financial ecosystem flooded by thousands of different types of crypto, stablecoins, and Central Bank Digital Currencies, payment cards offer a single platform through which a consumer can manage the different currencies they have.

The payment cards come with an accompanying portal to help users achieve this. Already a few crypto debit cards support up to hundreds of coins.

Use in the metaverse

Blockchain technology is now more than platforms that support and facilitate payment methods. The Blockchain is turning into a backend of completely new cyberspace, called the metaverse.

As the new cyberspace grows, payment cards might be useful, especially as part of the mechanism for users to cash out from the virtual world and spend in the real world.

But what exactly are metaverses?

A metaverse is a virtual world augmented by the physical world. It could be a gaming environment or a virtual working environment where unique ideas are turned into meaningful assets.

At this point, there is no standard definition of a metaverse. However, it is agreed upon as a place in cyberspace with an economy that inherently allows people to create and own assets such as non-fungible tokens or NFTs which are digitally stored on the blockchain and held in the ownership of the user.

Besides assets and enterprising, digital payment systems are critical components of the metaverse. Each ecosystem has one or several native coins or currencies that serve as the medium of exchange, store of value, and units of accounts.

Some of these currencies are also used in the governance structure for staking and voting.

In metaverses, people can engage in economic activities that might have an impact even in the real world.

At least in the medium term, the challenge is that the value language in the metaverse has to be translated for the real world to engage with it.

An example is a play-to-earn phenomenon emerging in the gaming world. Players can invest time and strategy to earn assets in online gaming environments. They can then sell these assets to those who might not have the time to invest in acquiring them but would like to get the benefits that owners of the assets get.

Those earning through gaming are technically providing a service that improves the experience of other players, who often are willing to pay for it.

Play-to-Earn games

Most of the metaverses that are up and running are play-to-earn games. These are designed so that players engage in activities that earn native coins that they can then go ahead and convert into other coins or spend in the physical world.

The two most popular play-to-earn games are Axie Infinity and Pagaxy.

Axie Infinity

The initial release of this game was in March 2018. It is built on Ronin, a sidechain on the Ethereum blockchain, and it is a product of the Vietnamese studio Sky Mavis.

The Axie Infinity game is inspired by the Pokémon Go series, and in its virtual world, players acquire, breed, rent, and sell beings known as Axies. Each of the Axies and the other assets in the game, such as the real estate and equipment, are NFTs on the blockchain.

The primary activity in the game is players forming teams of Axies and going against one another in highly strategic and competitive wars. A player can buy, breed, or rent the Axies in their team.

Indeed some players may choose to only breed, sell or rent Axies and not participate in the battles. Others might decide to only participate in the battles using rented Axies.

The players in the game can earn through various ways. At the end of each battle, the winning team is awarded native tokens known as Smooth Love Portion (SLP).

The game has a second token known as the Axis Infinity Shard (AXS). The second token is used for governance of the ecosystem. Those who hold it can vote to decide how the game functions.

The AXS tokens are also used for the purchase or renting of Axies. The token is also used to pay for transaction fees on the Ronin chain when breeding, selling, or renting Axies.

Players can exchange the SLP tokens for AXS tokens. They can also exchange both tokens for other blockchain assets on major exchanges.

Besides winning battles, players can also earn by breeding the axies and selling them to other players. Indeed, this is a lucrative endeavor as some Axies (the rarest ones) have been sold for as much as 300 ETH.

Instead of selling, the players can rent Axies to other players and split with them whatever reward they win in the battles.

Pagaxy

This is a play-to-earn game whose initial release date was in late 2021 on the Polygon blockchain. It is similar to the Axie infinity in the foundational design. Like in the Axie Infinity, players acquire, breed, sell or rent virtual animals that they, or other players, use in strategic competition.

However, in Pagaxy, the virtual animal is a horse known as Pegas. Also, in Pagaxy, the competition is not a battle but PVP-style racing.

The protocol of the Pagaxy play-to-earn game randomizes variables such as wind, fire, and water to influence the speed and therefore determine the outcome of the competition. Also, players can strategically increase the power of their horses through food and skill.

How do players earn?

The competition in the Pagaxy competitions happens in groups of fourteen horses. The first, second, and third horses in each race earn the native Vigorus (VIS) tokens.

Besides winning in the races, players can also earn the tokens by breeding, renting, and selling the Pega horses.

Players can use the coins to transact in the game, such as by buying and renting horses and paying transaction fees. They can also exchange the coins on exchanges.

The use of payment cards in the metaverse

Some of the play-to-earn games have turned into full-time jobs. For example, Axie Infinity has become the only thing some players in countries like the Philippines engage in to support themselves. This trend might grow with time.

Once the players earn their payments from either winning, selling their digital assets in the games, or being enterprising in other ways, they need to cash out. They can use exchanges where they exchange the coins for other coins or sell coins for fiat currency. However, that might require them to go through several hoops.

The growth of crypto enabled payment cards might come in handy and may make the entire process easier. Instead of going to several exchanges, they can simply load a crypto payment card with their earnings and leave the conversion and settlement process to the card-issuing entity working directly with card schemes such as Mastercard, Visa and Union Pay.

It would ultimately mean that gamers could walk to any physical or online store and do shopping with little worry that the clerk will tell them they don’t accept Vigorus (VIS) or Axis Infinity Shard (AXS) tokens.

Image courtesy of Pixabay.