Today many wonder whether cryptocurrencies like Bitcoin will ever replace fiat. Interestingly, this is not a new question.

Economists have been debating the replacement of fiat by privately issued currencies for centuries now. The debate became even more intense after the British economist John Maynard Keynes established the Keynesian school of economics in the 1930s to challenge Carl Menger’s Austrian economic theories.

While the Keynesian economists have since seemed to have had the upper hand and succeeded in propping up fiat-powered economic systems around the world, the Austrian economists have maintained a coherent argument that the government should have less say in matters of finance, including the creation, issuance, and management of currency.

One of the most outstanding Austrian economists of the 20th century is Friedrich August Hayek. He won the 1974 Nobel Memorial Prize in Economic Sciences alongside Gunnar Myrdal. In the same year, he published his book Denationalisation of Money.

In the book, he explains in detail why society would be better with currency created and issued by private entities and not agencies of the state.

Not settled economic science

“Good money can come only from self-interest, not from benevolence,” he states. This is in reference to having private entities compete to offer the market the best currency to be at the top to make the highest amounts of profit. It is the game theory we recognize today as critical to an effective cryptocurrency.

Cryptocurrencies are not quite the privately issued currencies Friedrich August Hayek envisioned in his book. For example, he thought the only way private currency could be issued was through centralized entities like banks, and it would mostly be in the form of paper. However, the central question about the government’s monopoly to create and issue currency is relevant to the cryptocurrency situation.

Friedrich August Hayek brings to our attention that the idea that only the government can create and issue money is not settled economic science.

Indeed, the concept of the government having a monopoly over the creation and issuance of money is relatively very new in the history of human civilization. For the most part, what has served as money has proven itself after competition with many other options at the marketplace.

For example, compressed tea bricks used in Siberia, Mongolia, China, and the rest of the Far East as currency for thousands of years was not designed and sanctioned by the government. It only emerged as a convenient form of money because of its practical usability.

It is the same story with gold, silver, and copper. It is easy to conclude that because governments throughout the ages minted coins, they were responsible for creating and issuing currency. However, a closer interrogation disapproves of the notion. For the most part, all the government did was certify already valued commodities (metals) and then purported to protect the citizenry from being conned through counterfeits and low-quality metal.

The government did not create nor decide through a decree that gold and silver could be used as money. If anything, the government has always been the main culprit when it comes to debasing the value of metal money by reducing the size of the coinage and its purity.

The concept of government creating money became the norm with the widespread adoption of paper money in the 19th century. In many states of the US, the paper money was issued by private banks until the establishment of the Federal Reserve in 1913.

However, the Federal Reserve is technically a private entity, a topic that G. Edward Griffin covers comprehensively in his book The Creature from Jekyll Island. According to G. Edward Griffin, what actually happened in the US is that, through the law, a monopoly to create and issue currency was set up. This model has been copied throughout the globe.

But how has monopoly on money by the government been a bad thing?

The inflation problem

Friedrich August Hayek and G. Edward Griffin agree that the most extensive harm from the government having a monopoly over currency is inflation. The world over, governments are motivated to issue more currency than is necessary. In part because that is the easiest way to tax the citizens without them noticing.

Putting a percentage on what the citizens earn or spend as tax is always so obvious. However, printing more money to spend on the public budget is an invisible tax on the population. It is paid through the loss of the purchasing power of the money saved.

Meanwhile, inflation causes the economy to swing between expansion when more currency is issued and contraction when a correction is attempted. This has resulted in booms that benefit only the very rich at the top and extreme crashes that hurt the poor at the bottom.

Advertisement

Join Club Swan and get... more!

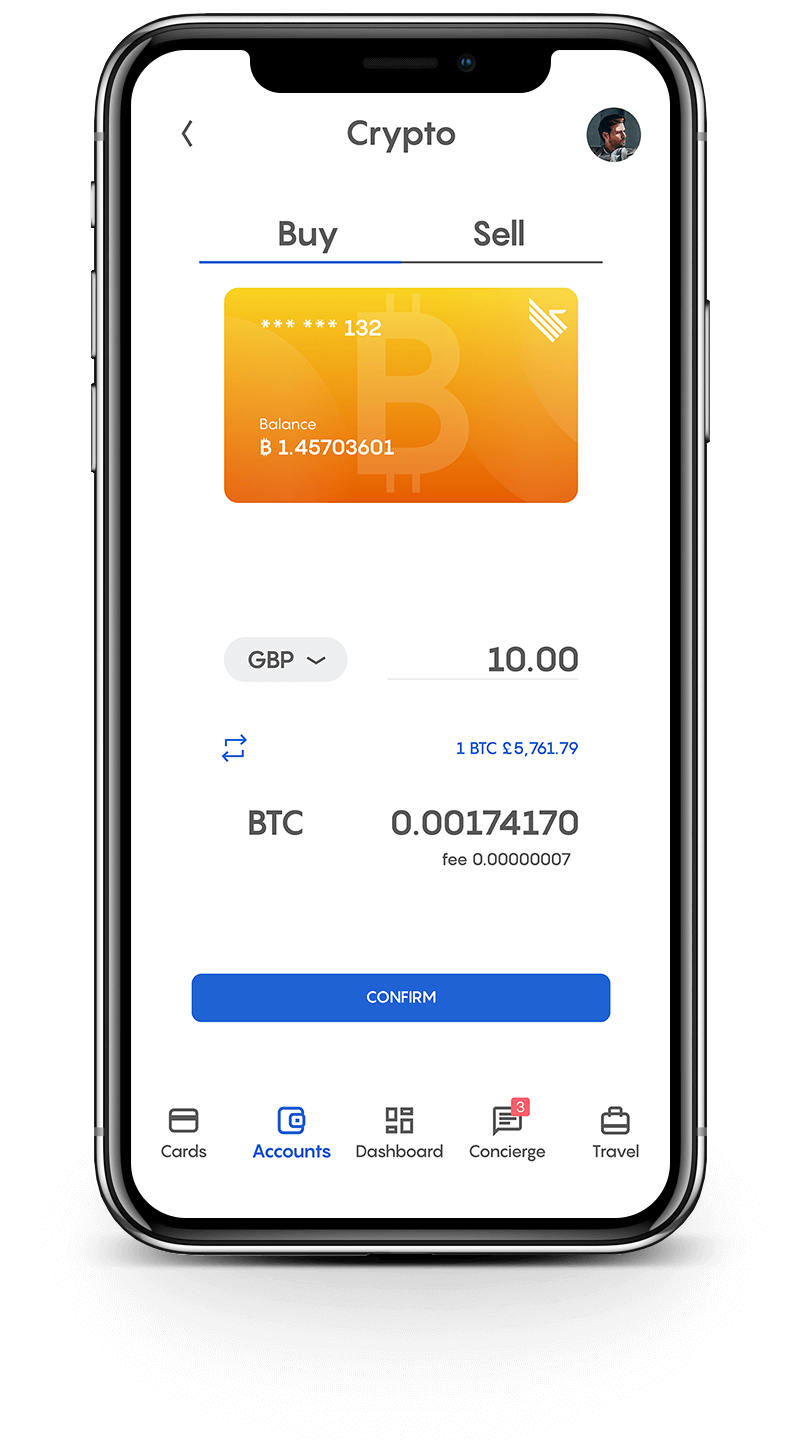

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan's flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

The cryptocurrency rescue

We have entered the era that Friedrich August Hayek describes in his book. A society where private currencies compete to attract users through sound policies and functionality. Also, an age when different currencies have different functions. For example, Litecoin could be great for shopping and general commerce, while Bitcoin could be great as a store of value.

With Bitcoin and other cryptocurrencies for the first time in close to 200 years, the concept of private money is being tested again. Going by what we see already, this time around, it could work.

At the technical level, cryptocurrencies have proven themselves as a technology that is ready to take over. The only part that it needs to fix is the widespread public acceptance. Of course, simply because it is a perfect form of money does not mean it will be accepted in the marketplace.

Do cryptocurrencies stand a chance?

Overcoming major obstacle

While economists and monetary scientists like Friedrich August Hayek have advocated for the liberation of the currency markets, government hold through regulation and propaganda have always stood in the way.

It was always believed that the only way to end the monopoly was by influencing change in laws, in particular, what is known as the legal tender laws.

Many did not foresee an anonymous developer and cryptographer designing and releasing community money in the form of code that could not be stopped because it functioned as a decentralized system.

So, cryptocurrencies have already overcome the first and perhaps the most challenging obstacle—launching and getting tested without having to beg the regulators for the opportunity.

The second obstacle is having the public see how better they are as a form of money compared to fiat. That is going to happen primarily because they are deflationary. As fiat loses value over the next decade, as they have always done, the crypto will continue to grow in value. That is going to make the public take note and appreciate their long-term worth.

It is a matter of time before even governments, especially those that have for a long been forced to accept economic instructions from international organizations like the IMF, embrace cryptos as a viable alternative to the current system.

In June 2021, El Salvador President Nayib Bukele announced plans to make Bitcoin legal tender. That is not going to be easy to achieve. Global financial institutions like the World Bank and IMF and countries like the US are going to put pressure on the legislators and regulators in the South American nation to stop the process.

Already a team of experts from JPMorgan Chase & Co. has declared that El Salvador’s declaration of Bitcoin as legal tender could create challenges for both the country and the cryptocurrency. More such reports will follow as part of the effort to make El Salvador return to the fold.

Nevertheless, whether El Salvador eventually adopts Bitcoin as a legal tender, its intention is a sign of the things to come in the next decade or so.

Meanwhile, other factors are working for cryptocurrencies. This includes the advancement of information technology, artificial intelligence (AI), and the internet of things (IoT), all of which demand money made for the internet. They all need programmable money that can be used with smart contracts that make transactions between machines possible.

In a nutshell, considering everything, cryptocurrencies stand a good chance of being the primary money society uses in the next few decades.