Nothing beats the surprise of finding forgotten cash in a coat you haven’t worn for a while. Whether it’s ten or fifty dollars, you somehow feel a little richer. Finding forgotten banknotes in your pockets may however be lost forever, as we inch towards a cashless world. The Covid-19 pandemic has given the trend of going cashless a firm shove, as businesses and people shy away from touching physical money.

Many businesses have made the switch to digital money in a bid to reduce virus transmission, and for the large part, it has been met with total acceptance. The migration from cash-to-card-to-mobile, is progressing steadily world-wide, and even cards are now being viewed as old tech, as mobile payments gain more ground.

While cash is still widely used, statistics show that cash usage is decreasing year on year. While Sweden initially led the charge for a cashless society, they have fallen behind Finland, Norway and South Korea. Within the Swedish retail payment market, the outstanding value of cash in circulation has dropped to 1% of Swedish GDP, but they are still not cashless.

Some may argue that South Korea is already potentially cashless. With an almost 100% smartphone adoption rate, payments using mobile phones or cards are at an all-time high. Over 1600 banks and thousands of businesses have already stopped accepting cash. China is also a contender as a fully cashless society, one of the most popular payment methods is by phone QR code scanning. Estimates are that this payment method will account for 11.6% of the country’s GDP by 2022. Experts predict that these countries will be cashless by 2023 and will become the nations to watch as others follow suit.

Advertisement

Join Club Swan and get... more!

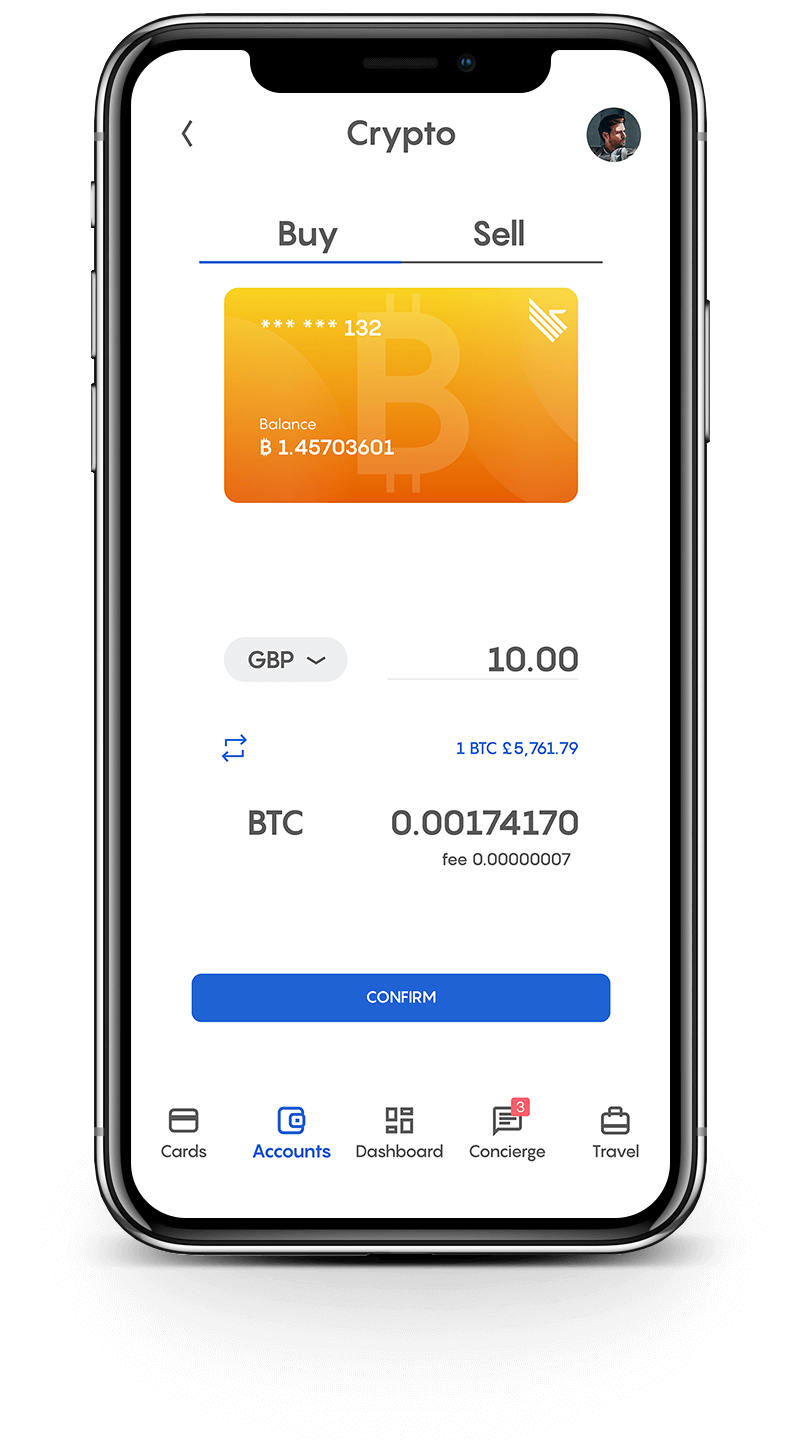

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan's flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

According to UK Finance, the growing enthusiasm for cashless payment methods may have helped prepare UK customers for the changes they now face due to the coronavirus lockdown. In the UK, fewer than one in four payments were made with cash and more than half were made by card. The balance of payments were made up of direct debits and bank transfers. The US is also following the cashless trend; according to a 2019 report from Statistica, in 2019 the USA logged $176.3b in digital transactions and these numbers are expected to increase to $201.8 by 2023.

There are however downsides to a fully cashless society, individuals would be 100% reliant on the private sector for access to money and payment methods. Therefore, the full implementation of digital currency must happen without disrupting commercial banks and proponents must factor in the effect on people who do not have access to, or the ability to use technology.

Advocates of cash maintain that going cashless may negatively affect how people spend their money, as it can result in people being less aware of how much they’re spending. Additionally, it could make people more vulnerable to hackers and scams.

Regardless of which side of the fence we are on, cash is no longer holding the crown, and it will be interesting to see the progress of cryptocurrencies in this environment. Many suspect the only exposure children of the future will have to banknotes, will be looking at them on the pages of their grandparent’s scrapbooks.

The information contained in this blog post is for educational or informational use only, and is not intended as financial or investment advice. Seek a duly licensed professional for financial or investment advice.