Steven Hatzakis is the Global Director of Online Broker Research for Reink Media Group, leading research for the ForexBrokers.com and StockBrokers.com brands. He brings over 20+ years of experience in the fintech industry.

What difficulties do cryptocurrency holders come across when exchanging crypto to fiat?

Years ago, if someone wanted to off ramp crypto to fiat or vice versa, this could only be done on an exchange. As the industry was pretty young, the process was accompanied by many issues. There were no stable coins and no integration with bank accounts. In the following years, many solutions have emerged, but they all come with their own flaws as well. Crypto debit cards have withdrawal limits. Local regulators impose their rules as well. (e.g. if you exchange more than $10k in the US, you are obliged to file a declaration to the tax authorities.) When it comes to taxation, it’s difficult to account cryptocurrency trades because the lack of standardized reporting as not all exchanges provide the same level of details in their brokerage account statements. The U.S. government has classified cryptocurrencies as a property asset, for tax purposes, but in other countries the rules can vary.

Off-ramp solutions such as the one offered by Aurae can resolve many of these problems, but there are still too few offers in the market.

Another big problem of the crypto industry as a whole is its fragmentation. Many cryptocurrency investors keep different tokens in their portfolios, but they have to simply store them on exchanges with no chance to cash them out because of the low liquidity and inability to use these tokens elsewhere. Such tokens held in cold storage can be even more difficult to move if the wallet provider discontinues support years later, in the case of tokens that are supported by few wallets.

What could be the catalyst to move the industry forward?

Big players, for sure. Now that PayPal and other large institutions are entering the space, we may see things change for the better. In the current state of the market, there are still many unresolved problems.

For example, take the private keys. In order to restore your crypto wallet, you have to retain a combination of words that serves as a recovery phrase. And to do that, you have to back it up in the first place when you create this wallet. Not all users are educated enough to do that, and this results in money losses.

Centralized platforms such as PayPal can make the process easier by storing the keys and passwords and helping users restore them on demand. This would not only bring the adoption of crypto payments to a new level but also help investors protect their funds more efficiently. However, the ultimate solution is for users to eventually become self-sovereign over self-custody of their own crypto, but that is something that is not for everyone, which is why large institutions are needed too.

What is your experience in the crypto industry?

I’ve been working in the financial services industry for over 22 years. Cryptocurrencies drew my attention in 2013, that’s when I first wrote about bitcoin arbitrage and cryptocurrency market inefficiencies. . Back in those early years, cryptocurrencies were considered a novelty rather than an independent asset class.

As my interest in this new technology grew, I started to dive deeper into the research of blockchain technology and paying specific attention to their technical challenges and security assumptions. I continue to see that many new projects that emerge, for example on Ethereum and other blockchain platforms that try to resolve token economic challenges as they rely on the communities that build around them. (i.e. network effects)

What about your career as an advisor?

I’ve advised over a dozen crypto startups such as Etheralabs, Vedas Labs, Digits and others. The biggest challenge new projects face is that the potential lack of adoption their founders have sufficient technical knowledge to fully understand how the technology works and how it can be implemented. For example, a blockchain that is designed without factoring in the adversarial nature of crypto will be setting itself up for failure (i.e the problem of a dishonest majority seeking quick profits by quickly selling the tokens after the distribution.) I’ve advised startups on what measures they can put in place that would be akin to a penalty to disincentivize this behavior. With the number of scams available on the internet about cryptocurrency, it’s important for projects to follow best practices to differentiate themselves and the interest of token holders alongside the interests of any sponsoring entity and its shareholders.

What would be your best advice to cryptocurrency traders?

If you really intend to make money in crypto over the long term, it may be best to avoid day trading a large portion of your portfolio, if any. If you truly want to test your luck on daily market movements, one option is to use just a small portion of your whole portfolio for this purpose. I believe one optimal approach is to keep 50% in a cold wallet, up to 30% to a hot wallet and leave no more than 20% for day trades on an exchange. In this way, a trader could retain custody over at least 70% of their crypto assets, while being able to trade up to 20% of their portfolio on an exchange. The downside is that the burden of responsibility falls on the user to manage their cold and hot wallets, where one wrong mistake can lead to an irreversible loss of your assets. Another strategy is to systemically buy a small amount and hold by investing passively at a set frequency, such as once per week, regardless of what the market price is, as timing the market is not something that is easy to do in the cryptocurrency markets.

Earlier, you’ve mentioned Aurae’s card. What’s your opinion about the product?

The services provided by Aurae Lifestyle have really simplified many aspects of cryptocurrency payments for me. The prefunded card that they provide is the best card among the similar options represented in the market. The high limits that they offer to their VIP clients are incomparable with other options while the tailored services make managing big amounts of crypto proceeds much easier. All-in-all, acquiring such a card along with the concierge services is an excellent way to reward yourself.

In addition to Aurae Lifestyle, there is a more moderately priced service for cryptocurrency enthusiasts called Club Swan. While the limits are somewhat lower and the concierge services are streamlined, I’ve been told Club Swan members can off-ramp and liquidate crypto proceeds with the same ease as Aurae Lifestyle members.

Advertisement

Join Club Swan and get... more!

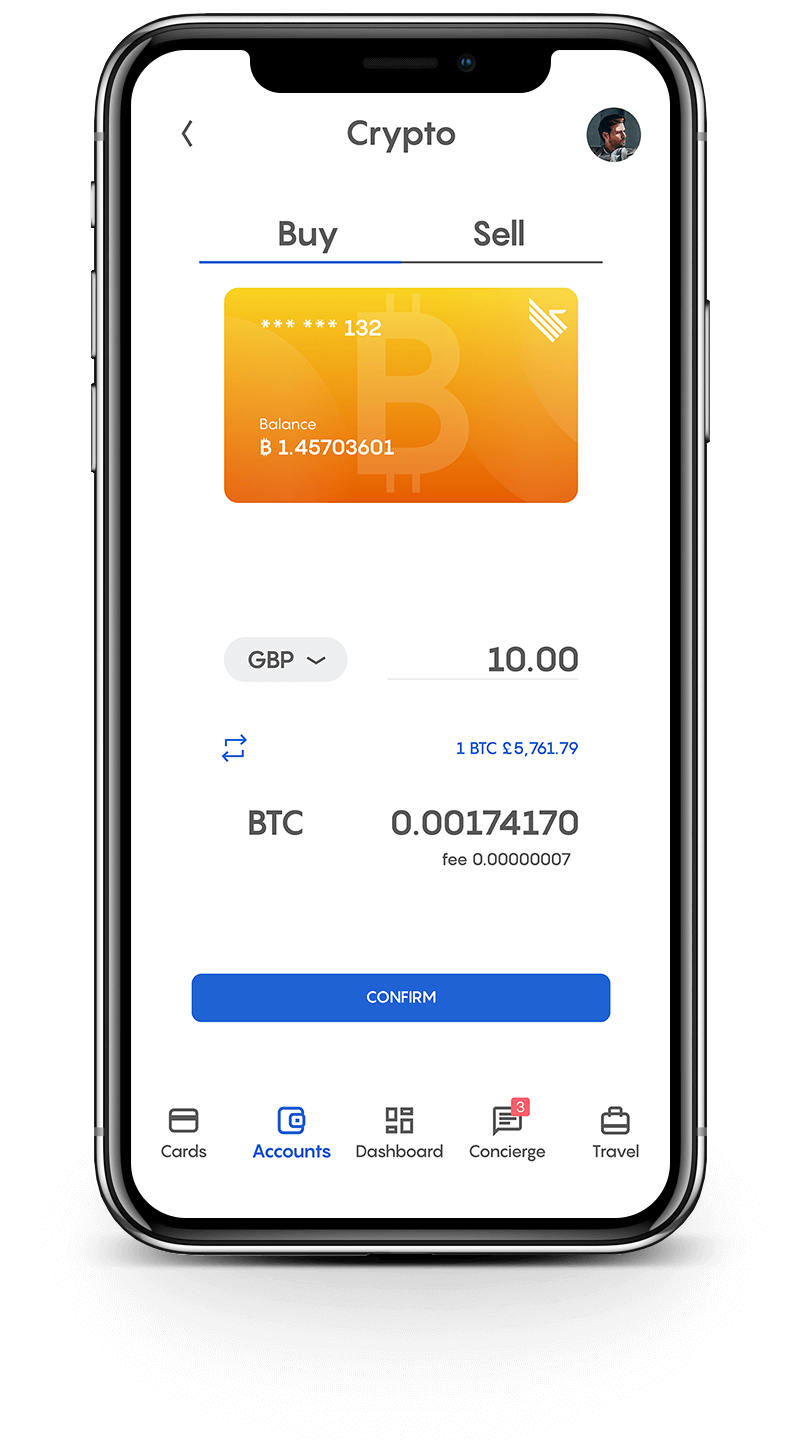

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan's flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

One of the biggest challenges that the crypto industry faces now is that people seek fast profits and do not care about the technologies. What should happen to change this fact?

The point is that there are many projects that don’t provide any new technology and thus their value is based purely on expectations of the crowd. Take Dogecoin as one of the most recent examples as its price boosted after a single tweet made by Elon Musk. In order for the situation to change, people should start to see the value that the technology provides.

Big companies such as Binance and Coinbase are capable of changing the course and show users the real value of digital assets as the combined capitalization of these two players can compete with Bitcoin alone, although both are also correlated to the price of bitcoin. Binance appears to be doing the right thing by regularly burning BNB to decrease its supply and increase the demand as a deflationary mechanism to counter the large amount of new BNB entering the market. This helps Binance pay a synthetic dividend to BNB holders who get the benefit of having their position concentrated by holding the asset. Many other utility tokens don’t have a deflationary mechanism.

What’s the most interesting technology that you have recently come across?

Oh, there’s quite a lot and I’m very bullish about the crypto market in general. There are many new technologies that are constantly coming out. For example, I’m particularly excited about zero-knowledge proofs (ZKPs). ZKPs have been around for decades have evolved in the last years with various blockchain use cases. This technology is targeted at security and privacy while ican also help users stay compliant with the local regulators at the same time. Users can potentially prove their identity without revealing it at the same time. For example, one can go to a local shop to buy a bottle of beer and prove their age without having to disclose any personal information to the seller, such as date of birth. ZKPs are already being used as a layer 2 solution to batch transactions on the Ethereum network to reduce gas fees.

What’s your opinion on the long-term future of the crypto industry?

Cryptocurrencies are surely here to stay, they have already shown themselves a new type of digital money and the world has acknowledged their existence for over a decade.

The problem of market fragmentation will be resolved thanks to the big corporations that will be able to put all aspects of the market together. The volatility will not disappear, though. Bitcoin will be just as volatile because of its limited supply and changing demand.

Also, what’s going to significantly change is the security consciousness of end-users. People will learn to treat their crypto funds seriously and take care of their private keys themselves instead of outsourcing their digital money to centralized platforms like Google. The internet will become a more secure and open place and cryptocurrencies will play a big role in its transformation.

The article is strictly the opinion of Mr. Hatzakis and not of his employer and not the opinion of Clubswan. The information contained is for informational purposes only and NOT INVESTMENT ADVICE. Cryptocurrency value is highly volatile, you could lose substantially all or all of your money, and you are encouraged to seek professional guidance regarding any purchase or sale of cryptocurrency.