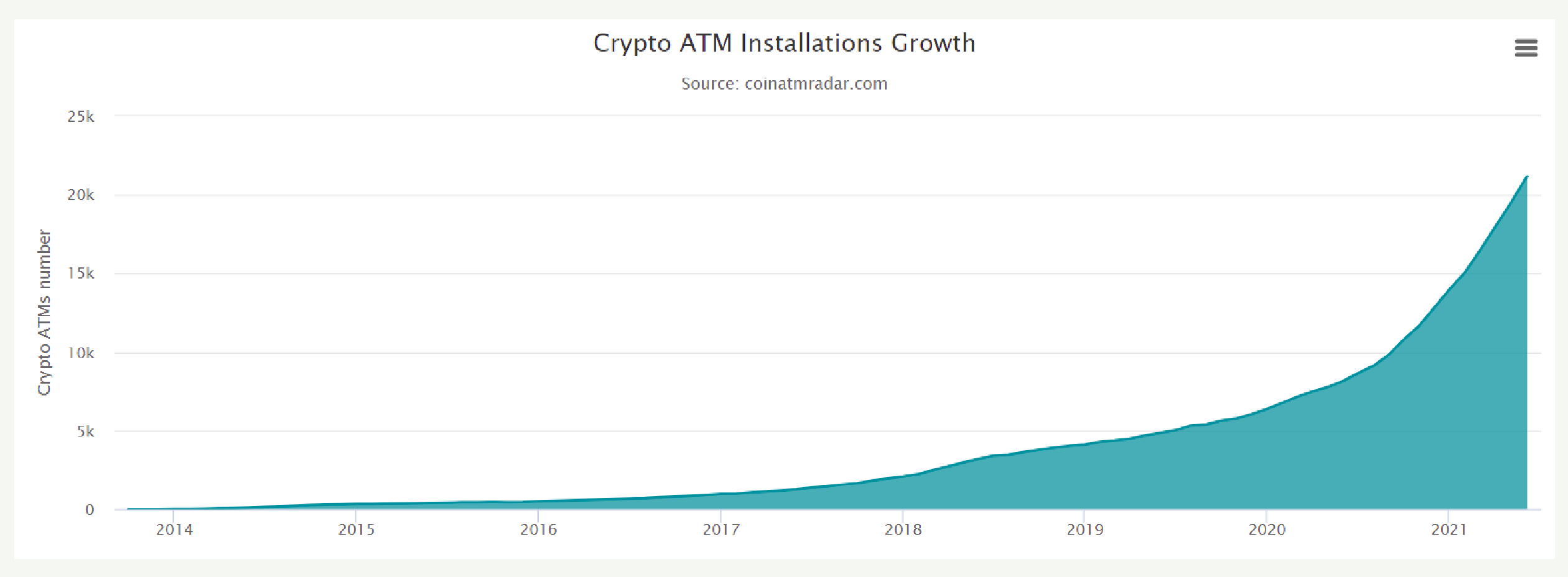

Bitcoin ATMs? Yes. Bitcoin ATMs first made their appearance on October 29, 2013 at Waves Coffee Shop in Vancouver, British Colombia, Canada. During those nascent days, it was a convenient way for individuals to buy/sell and transact bitcoin using cash. Worldwide, the number of Bitcoin ATMs has grown from 2076 to 21,666 in the last 3 years.

Bitcoin ATM Installations Growth

The chart show number of bitcoin machines installed over time.

The explosion in Bitcoin ATMs prompted me to ask the question?

Should I use a Bitcoin ATM?

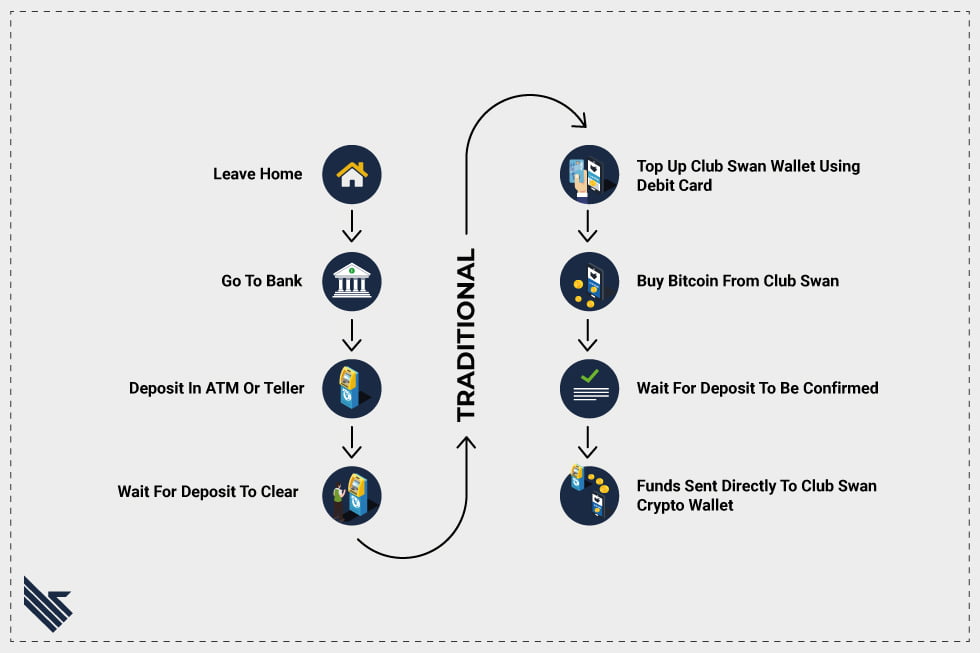

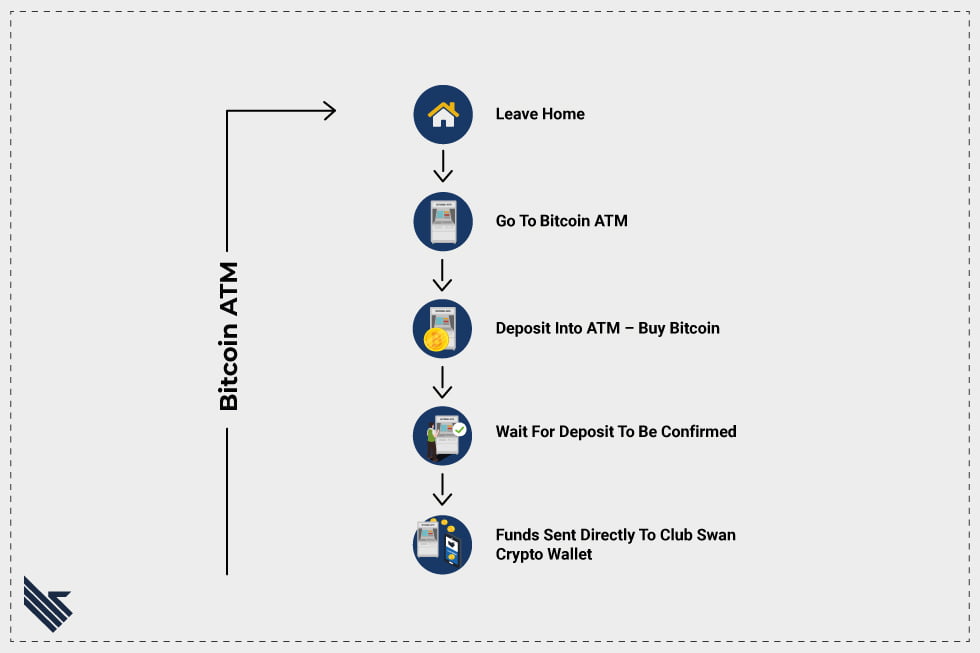

In the name of efficiency, I saw the Bitcoin ATM at a convenience store and immediately I thought, I could maybe save a step. Let’s compare processes.

If efficiency were the only goal, it looks like the Bitcoin ATM beats the traditional process, right?

Think again. In my case, speed has its price. One thing I failed to do was look at the market price of bitcoin and compare it the price of the ATM until I finished the transaction. It was five minutes later and then I noticed that I should have looked before I leaped.

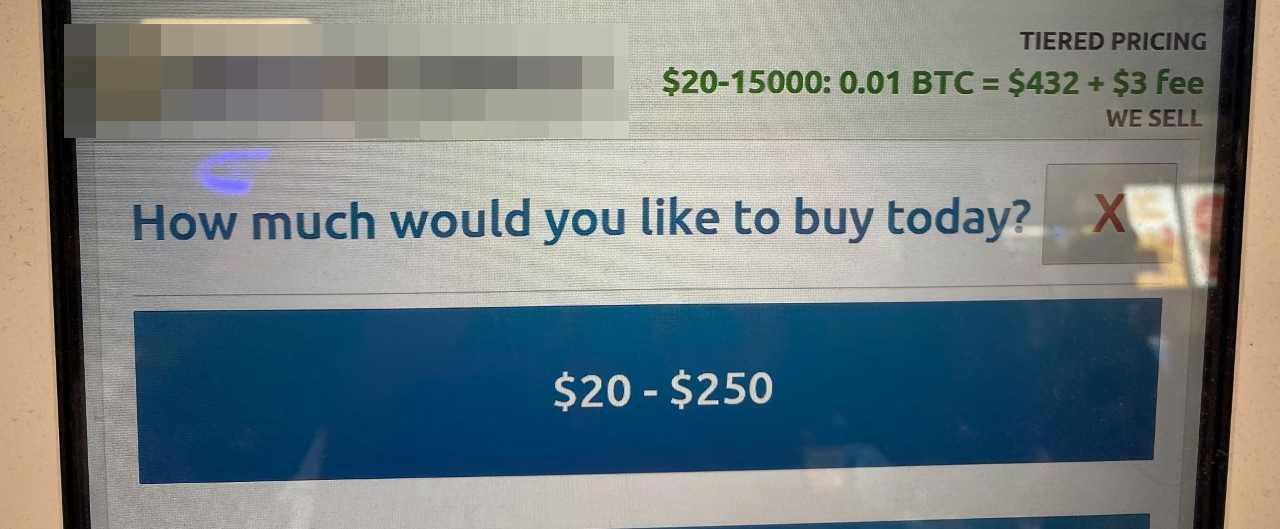

Price Shock!

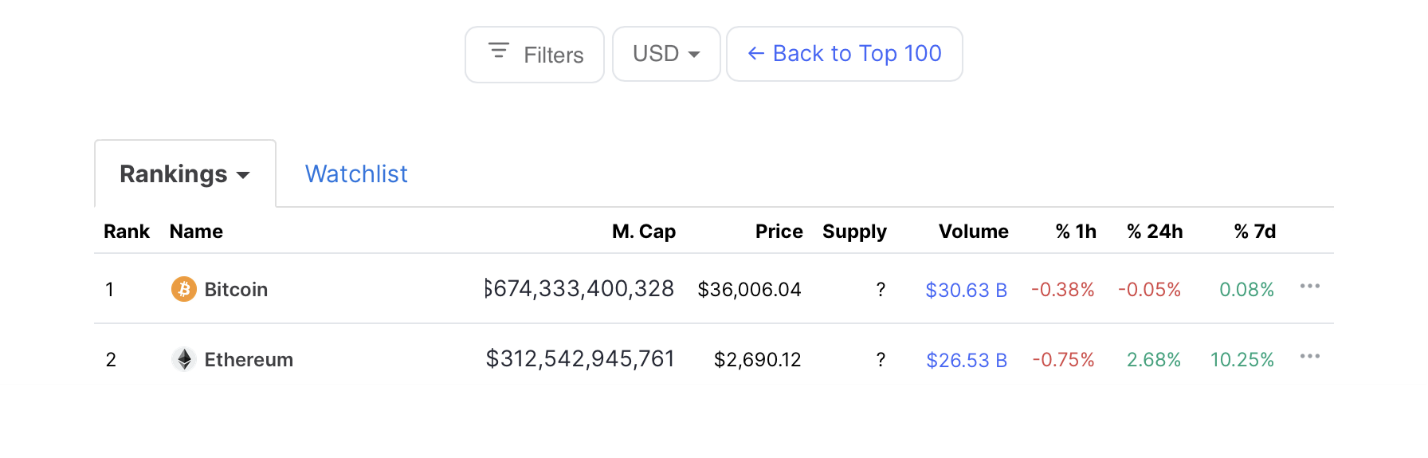

.01 BTC = 432 which means that 1 BTC = $43,200 + $3

Let’s look at the difference in buy rate.

Bitcoin ATM Quoted Price= $43,200 (+3)

Coinmarketcap Quoted Price = $36,008.04

Network fees are not included, but already, there is almost a 20% spread between the ATM buy rate and the current buy rate. So, skipping steps definitely comes with a heavy price and a $3 fee.

As far as process is concerned, the Bitcoin ATMs in the USA do conduct KYC. Users have to present a valid photo ID, a valid mobile number and an email address. These items are scanned into the ATM and confirmed prior to the transaction. This took about 5 minutes, which is not bad.

After depositing funds and waiting for 3 confirmations, I can attest the transaction was rather smooth, but the shock of seeing the difference in price was eye opening. On the flip side, the price of Bitcoin could have increased to offset the change in price, so depending upon ones situation, this may good or bad. In my search in the USA, I could only find ATMs near me where you could buy bitcoin, so you be the judge to determine if a Bitcoin ATM is right for you. As mentioned earlier, do not make the same mistake I did. You really need to understand the market price of ATMs and shop around for the best buy rate. While I checked online at coinatmradar.com, my criteria of choice was not price, but rather proximity and convenience. As you can see, it cost me.

Advertisement

Join Club Swan and get... more!

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan's flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

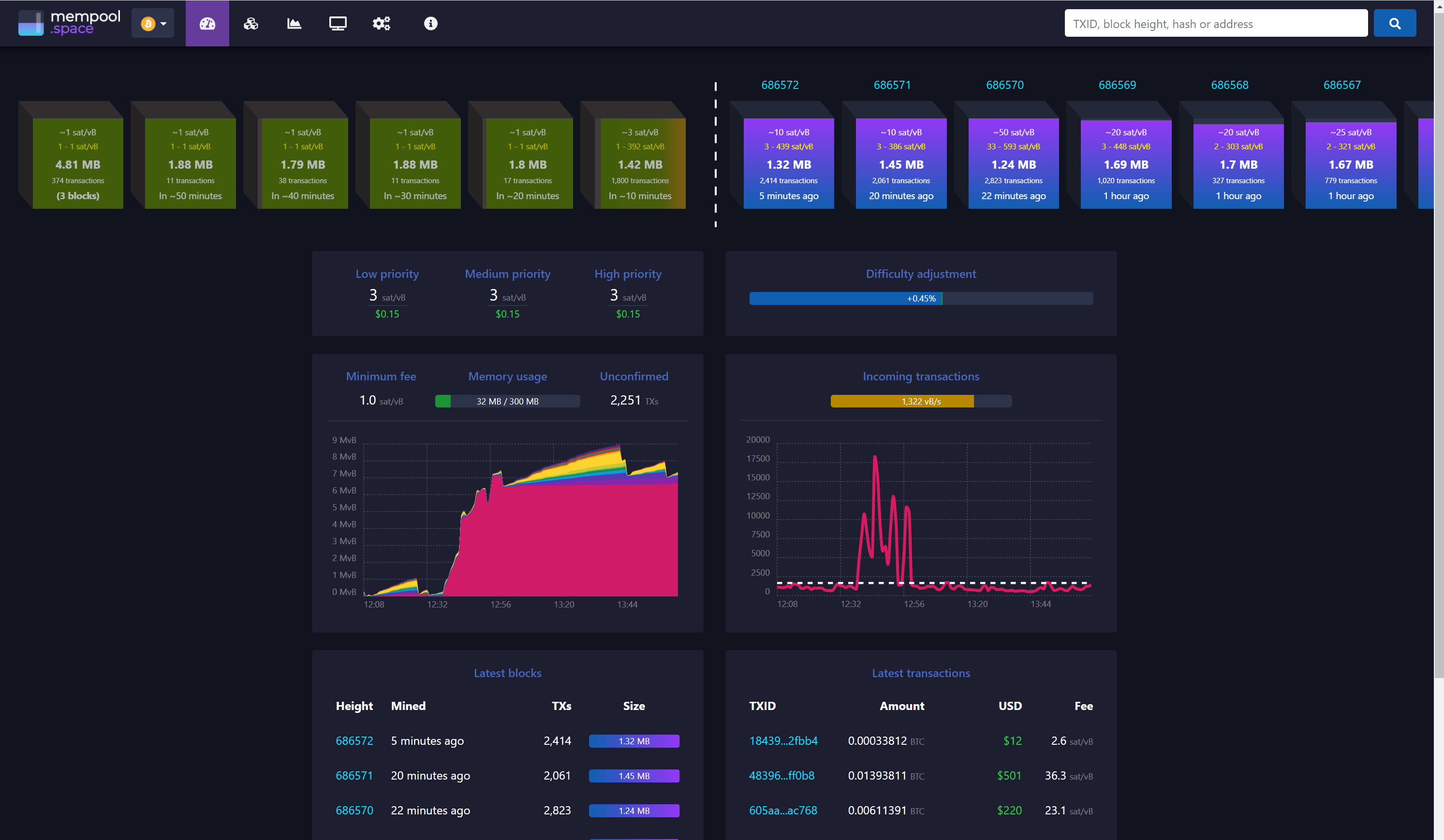

Network Congestion

If you were to use a Bitcoin ATM, another item to check is network congestion. If congestion is high, not only will funds take longer to reach your bitcoin wallet, but you may face additional fees in the process. One of the ways to monitor network congestion is to log on to mempool.space. Mempool.space will show transactions up to the hour and if congestion is light, it will result in less transaction fees. If there is congestion, simply wait until it subsides.

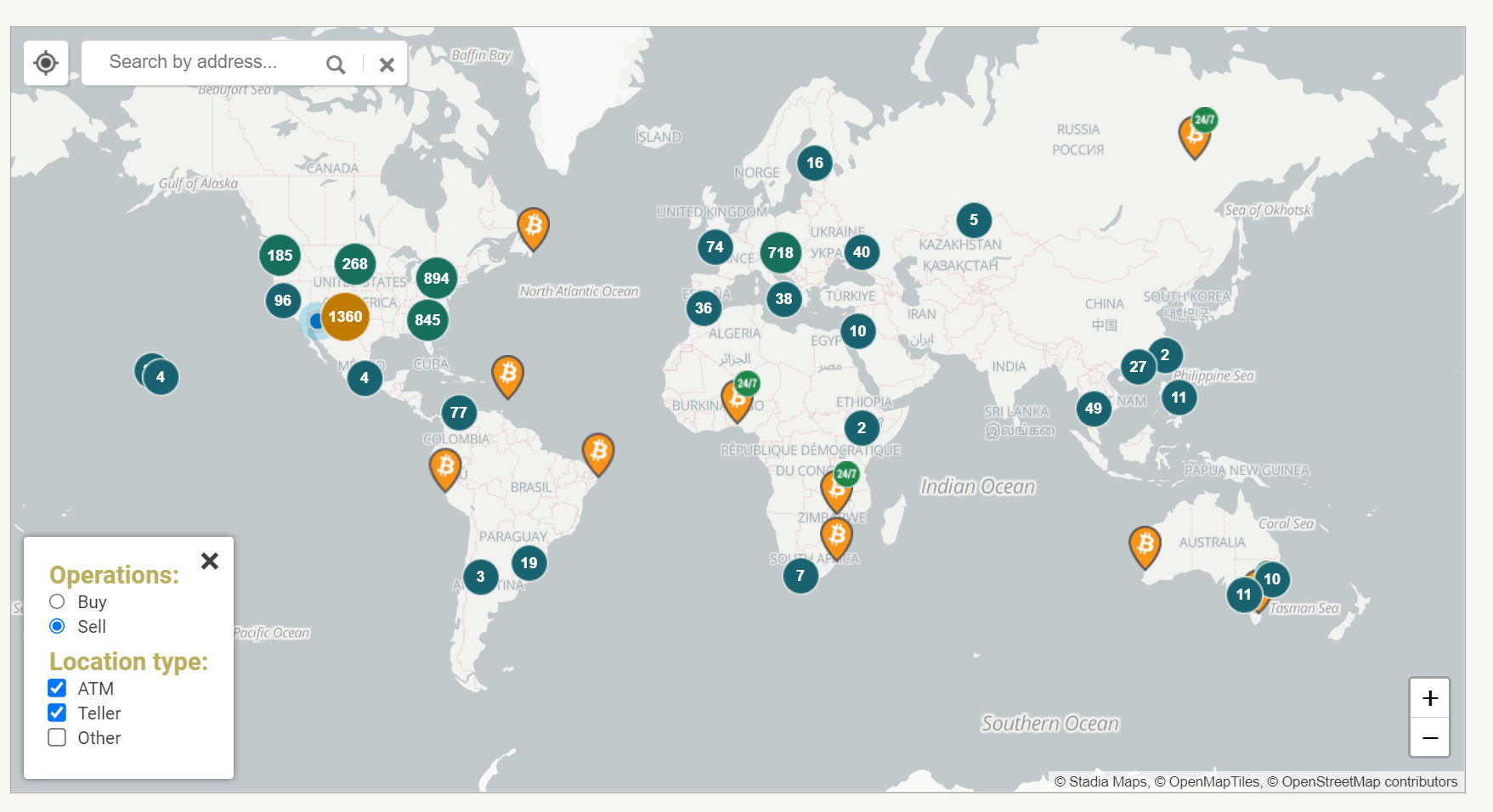

Selling Bitcoin – Bitcoin ATMs that allow withdrawals

Outside of my area, here is a map of Bitcoin ATMs that allow withdrawals:

Map of Bitcoin ATMs globally courtesy of coinatmsradar.com

Like the buy side, it is important that you examine the current market rate and shop around to find the best rate. In contrast to the USA, I had the opportunity use a Bitcoin ATM overseas for a withdrawal. The immediate benefit was the withdrawal limits were more favorable than using a traditional ATM and since I had a flight to catch early the next morning, I thought this would be the best option.

Drawbacks

One of the drawbacks of using a Bitcoin ATM overseas is power outages and brownouts. In my case, right after I sent my bitcoin to the blockchain, the power went out. Yes! The power went out. This time, I can take solace in the fact that the sell rates were favorable, but I thought this transaction was all but lost. Lucky for me, the Bitcoin ATM had a customer service number and a hotline. What was unexpected is the service provider of the ATM knew of the power outage and immediately informed me that the transaction was being processed and the funds would be ready for withdrawal once power was restored. I received a text 45 minutes later that power was restored to that building and I was able to complete the transaction.

Should You Use a Bitcoin ATM Internationally?

There are two practical use cases for using a Bitcoin ATM internationally

- Limits Identity Theft

Bitcoin ATMs do conduct KYC and users are required to provide a valid ID and the photo of the ID is compared to the photo of the user. In addition, depending upon the jurisdiction, enhanced KYC may be required. However, if you are like me, I have heightened sensibilities around exposing any bank information, credit, or debit card numbers abroad as I have heard horror stories of how information can be collected and used without your knowledge. The Bitcoin ATM does provide a level of privacy not found with traditional transactions. - Higher Transaction Limits

Looking to take home a one-of-a-kind souvenir from a locally renowned artist? The optimal way to pay would be using your credit or debit card. Unfortunately, if that merchant only accepts cash, you are out of luck. In my case and for my protection, there are withdrawal limits internationally and I was out shopping on a Sunday (banks are closed) so the only acceptable way to obtain cash to purchase the item was to use a Bitcoin ATM.

Club Swan members and future members, please share your experiences using Bitcoin ATMs on our Facebook page.