Whenever an increase in supply or inflation is discussed, there is often a mention of money printing presses. This inadvertently leaves a misleading impression that all money in circulation comes from a physical printing press.

Indeed, it used to be the case that all fiat money (bills and coins) in circulation came from a printing and minting press. However, how money enters, stays, and leaves circulation has changed significantly. In particular, much of the money in circulation today is held and spent as entries in computer servers managed by financial institutions.

Yuval Noah Harari, a professor of history and author of several best-selling books, including Sapiens: A Brief History of Humankind and Homo Deus: A Brief History of Tomorrow, has described money as ‘collective fiction’ and ‘faith-based object,’ whose value is nothing more than a shared narrative.

In a podcast interview, Professor Harari indicated that more than 90% of all money in the world is just computer entries. According to his research, of the $60 trillion of the total value of money worldwide, only $6 trillion is in physical cash or coins.

Nevertheless, even in the digital form, there is a ‘printing press’ system through which money gets in and out of circulation, especially as part of the central bank’s monetary policy implementation.

While physical bills and coins come into circulation through physical printing and issuance through the banking system, non-physical cash gets into circulation primarily through fiscal and monetary stimulus programs.

Stimulus programs

As the name suggests, stimulus programs are intended to stimulate the economy, especially during times of recession. This is generally achieved by putting more money in the hands of businesses and individuals so that they can consume more and create more demand for goods and services.

This, in turn, makes producers, manufacturers, and service providers expand their operations, which also includes demanding more raw materials from the market and hiring more people.

The actual program can be achieved using the following fiscal and monetary policy tools:

Government increasing spending

Building new roads, railway lines, and airports often increases capacity, improves efficiency, and creates new economic opportunities. However, sometimes the construction of the new infrastructure also serves the purpose of injecting new money into the economy to spur the growth of demand and supply in markets.

The government has many reasons to create new money and release it to the economy. That includes paying contractors to build new infrastructure, such as roads, bridges, railroads, and housing. The contractors, in turn, pay their own suppliers and subcontractors. This way, the money trickles down to small businesses and individuals.

The government might also increase the money supply by expanding its social programs such as health insurance, housing subsidies, food assistance, child care, and cash transfers.

Government buying assets

This is another option the government has when it needs to inject new money into the economy. During the 2008 financial crisis, the US government put significant money into failing financial institutions and manufacturers.

Through the Emergency Economic Stabilization Act of 2008, often called the ‘bank bailout of 2008,’ the US government bought stocks and other risky assets held by struggling companies. In particular, the treasury spent about $700 billion to buy assets of failing banks and insurance companies.

FOMC – Monetary policy interest

The government incentivizes businesses and individuals to borrow more by lowering interest rates, which is the cost of credit. This also supports the fractional reserve system, which allows commercial banks to lend out up to 90% of the money they hold as deposits.

In the US, this process is managed by the Federal Reserve through the Federal Open Market Committee (FOMC), which sits after every six weeks to determine, among other financial market issues, the interest rates (Federal Funds Rate) at which depository institutions such as banks and credit unions can lend reserve balances to other depository institutions overnight on an uncollateralized basis. The committee also ensures the institutions maintain reserve requirements.

Those who borrow the reserve held by depository institutions lend it to others or spend it on goods and services from businesses that then deposit it back to the institutions that had a moment earlier issued it as loans. The banks then proceed to issue new credit using the new deposits. This cycle can repeat itself many times and, in the process, add a significant amount of new money into circulation.

When the government wants to bring down inflation, one of the measures it can take is to decrease the Federal Funds Rate and, therefore, discourage businesses and individuals from taking loans, which in turn reduces their expenditure.

Tax cuts

The revenue service leaves more money in circulation by lowering the taxes businesses and individuals pay. On the other hand, when taxes are high, businesses and individuals have less money to spend.

Grants to businesses and families

Sometimes, the government may issue direct grants to businesses and individuals.

In 2020 during the Covid pandemic, the US government wrote checks to millions of families under the Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020. Each adult American citizen in a household making less than $75000 annually received $1,200 and an extra $500 for each child under their care. In addition, families with children received tax rebates.

This program was meant to cushion families from economic hardships caused by the pandemic.

However, since the government is basically writing checks on its own account, such programs often release a significant amount of new cash into circulation.

Social welfare programs such as housing, food stamps, and public health care can be considered stimulus programs of a similar kind.

Advantages of stimulus programs

During times of recession, there is little economic activity happening. That translates to low employment rates and low economic output.

By increasing the money in circulation through stimulus programs, businesses are incentivized to increase production and employ more people as there is more demand for goods and services.

Of course, through these programs, failing businesses are saved, and struggling families are protected from harsh economic situations. These are some of the benefits of stimulus programs.

In their book Trade Wars Are Class Wars, Matthew Klein and Michael Pettis describe how stimulus programs were used to match East and West Germany after reunification in 1990, and that prevented mass migration from the East to the West, as the latter was offering better economic opportunities to the citizen. The new government of unified Germany offered incentives to businesses to set up operations in the East and also put money into social programs targeting citizens in the region.

Disadvantages of stimulus programs

Unfortunately, often the result of stimulus programs is inflation. This is money losing its purchasing power as too much of it is in circulation. With high inflation, people lose their money even though the actual figures in their bank accounts stay the same. The purchasing power of the money they hold reduces.

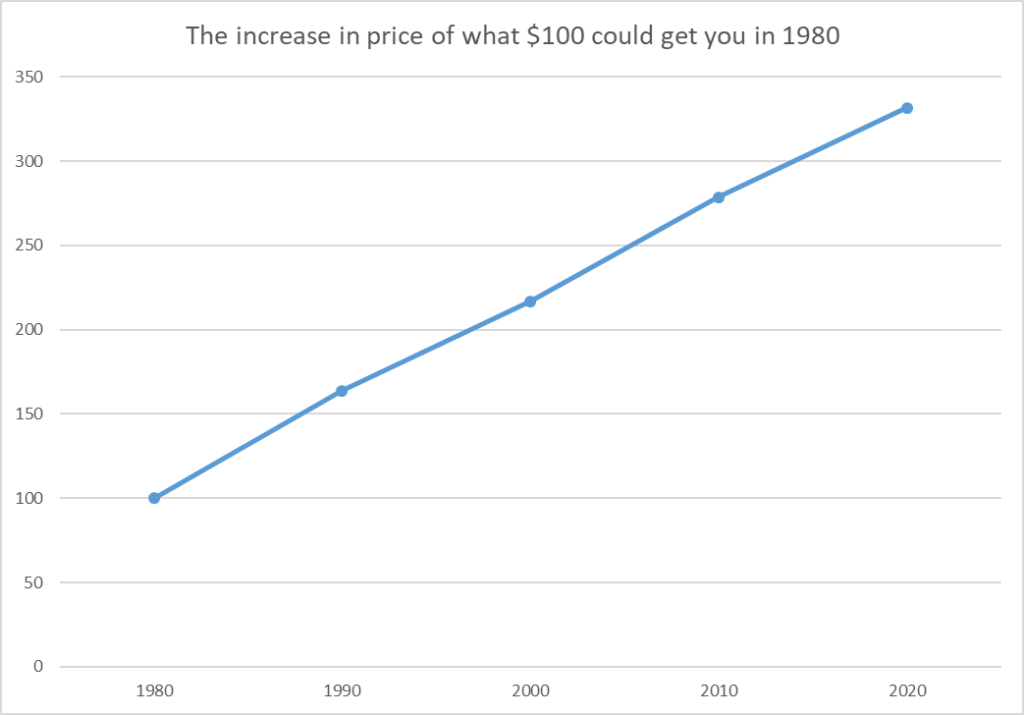

While inflation can be reversed through actions such as the increase of interest rates, in the long term, it grows incrementally. According to data from the US Bureau of Labour Statistics, $100 in 1980 had the same purchasing power as $390.91 in 2023.

Some have also observed that some stimulus programs can lead to the growth of market bubbles that end up bursting with devastating effects.

For example, some believe that the origin of the 2008 financial crisis was the Federal Reserve lowering the federal funds rate from 6.5% in May 2000 to 1% in June 2003. This, over time, resulted in mortgages saturating the housing market, and that led to the prices falling even as the interest rates increased. In the end, the homes lost value even as it became more expensive to service the mortgages.

The Bitcoin Way

What Bitcoin does very well is redefining how new currency comes into circulation and how the money supply is managed.

With fiat currencies, the amount of money in circulation is extremely malleable. Meanwhile, Satoshi Nakamoto decided that the supply of money should be constant. Only the demand and supply of goods and services should be variables in the marketplace.

Also, Bitcoin introduces a more transparent way of creating and injecting money into circulation.

Indeed, Bitcoin has completely changed the concept of money generation. Instead of relying on the central bank bureaucrats’ day-to-day decisions on how much money should be in circulation, Satoshi Nakamoto put that responsibility on a trustless protocol.

The number of units in circulation was determined beforehand, and everyone knows what that is. The cryptocurrency was built with a cap of 21 million coins. It is also the case that the no one has the power to change that.

That means with adoption and economic expansion, the currency’s value grows. Indeed, besides adoption, the value of Bitcoin is also very likely to grow because some of the coins are lost from circulation for good, and there is no mechanism for replacing them.

Indeed, according to data from the blockchain research company Chainalysis, close to 4 million bitcoins have been lost for good due to people forgetting their private keys and some dying without sharing them.

Bitcoin having a supply cap and some of the coins getting lost makes it a desirable store of value. Over the long term, the purchasing power of Bitcoin is more likely to grow rather than diminish. Indeed, this is where the concept of HODLing as a long-term strategy comes from.

In a nutshell, Bitcoin is designed to have an inherent tendency to do the opposite of what fiat currencies do, especially in the long term. The fiat currency loses value over the long term as those in charge can’t help but continue to increase its supply. On the other hand, bitcoin has a fixed cap and loses some of its coins with time, therefore, almost guaranteeing an increase in purchasing power in the long term.

Always check with local country websites for the most up to date visa, health, tax and travel requirements before entering a country. This article is general information and does not constitute legal advice, check with a legal professional for visas, working visas, applicable tax and crypto laws specific to you.