Today, over 13000 assets are listed on Coinmarketcap, the leading price-tracking website for blockchain assets. The list is growing longer over time as new blockchain projects launch.

It is important to point out that decentralized applications (DApps) and non-fungible Tokens (NFTs) are not included in the Coinmarketcap list, even though they are also digital assets on the blockchain. That means the list of blockchain assets is much longer.

With that being the case, every blockchain asset has a unique offer and value proposition to end-users. However, as you can imagine, it is difficult to know all the assets and what they actually offer.

What is easier to do, though, is to put the assets into broad categories based on how they are created and, more importantly, the function they are designed to perform.

The first major categorization of blockchain assets to emerge is that of Bitcoin and the rest. Bitcoin is an asset in a special category. That is, in particular, because it was the first-ever to launch, and all the others are technically its copycats.

It was only after Bitcoin’s success that the world came to know of blockchain. And thanks to Bitcoin, developers around the world saw the opportunity, potential, and power in the technology and created their own and digital assets on top of them.

All the other digital assets created on the blockchain after Bitcoin, except for non-fungible assets and decentralized applications, are known as altcoins. This is the shortened form of alternative coins. This categorization is, however, not important in terms of function.

In total, there are six broad categories of blockchain assets based on function:

- Cryptocurrencies as Digital Cash

- Stablecoins, Privacy

- Utility tokens

- Security tokens

- non-fungible, tokens (NFTs)

- Decentralized applications (DApps)

Cryptocurrencies

Cryptocurrencies are the most known of all the assets that exist on the blockchain. The name cryptocurrency comes from the fact that they are digital currencies secured by cryptography. Basically, they are designed to function as money.

Like the US dollar, Euro, or any other government-issued currency, cryptocurrencies are supposed to serve as stores of value, units of account, and media of exchange.

It is important to reiterate that being money is the primary function that a cryptocurrency is designed to perform. If a blockchain asset has another primary function besides being money, it is more likely not a cryptocurrency.

This can be confusing especially considering that the word cryptocurrency is often used loosely to have the same meaning as blockchain asset. It is often the case that utility tokens and stablecoins are described as cryptocurrencies.

Examples of blockchain assets that are designed to serve primarily as money include:

- Bitcoin

- Litecoin

- Monero

- ZCash

- Ripple

- Bitcoin Cash

- DASH

While you can’t expect every store you walk into to accept your bitcoins, Litecoins, or Monero for payment, the list of places that accept them grows longer each day.

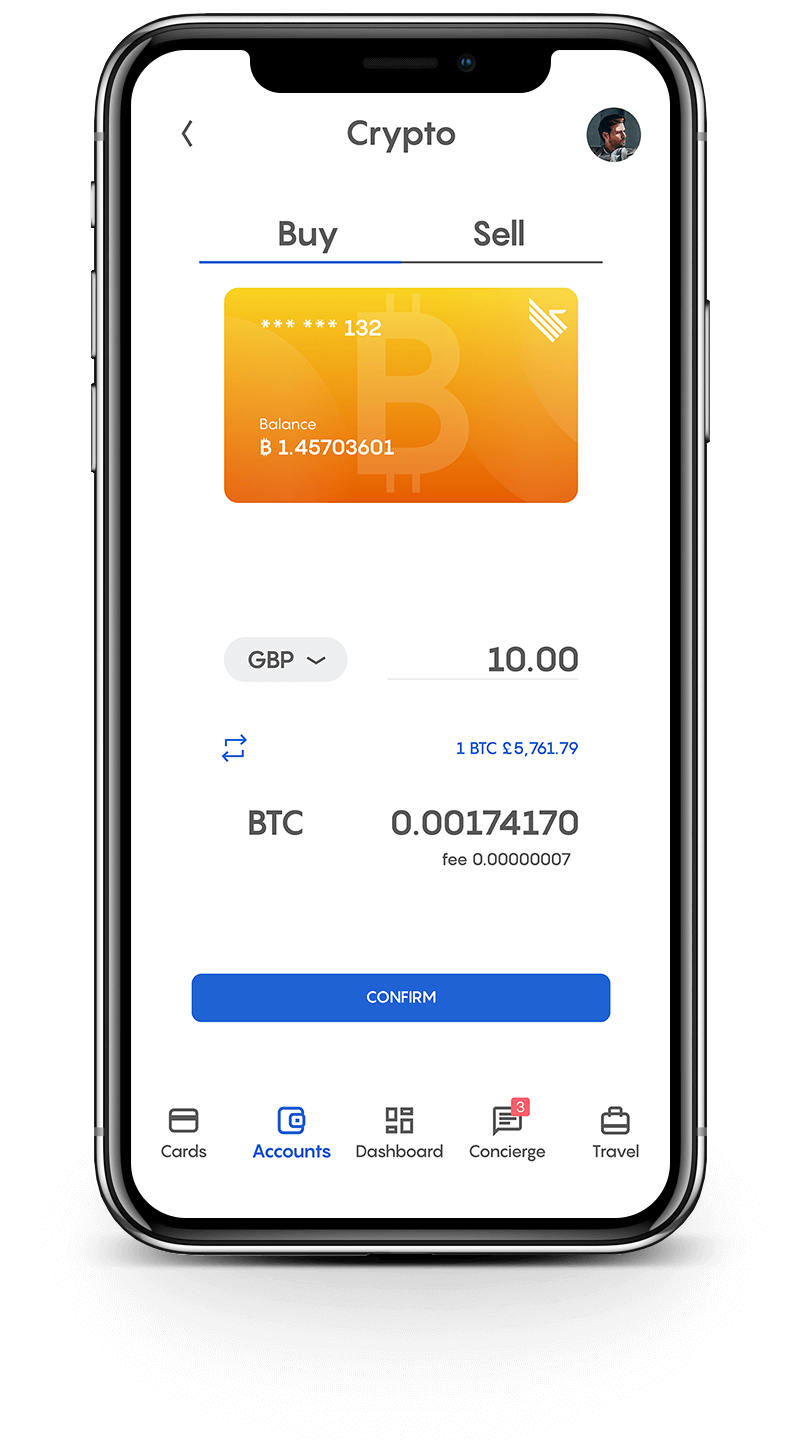

Meanwhile, you can use crypto cards like the one issued by ClubSwan. They facilitate the conversion of your crypto holdings into the currency merchants accept.

With the Clubswan card, you can shop in millions of stores both offline and online using cryptocurrencies, well kind of.

Stablecoins

Stablecoins can be described as a subcategory of cryptocurrencies. What separates them from the rest is the unique problem they are designed to solve.

The one challenge that seemed to have made many merchants hesitant to accept cryptocurrencies is the high volatility in their market prices. No merchant is happy to sell an item but then loses the profit margin to the changes in the currency price.

Merchants who accept crypto have to settle their costs using fiat currency. That means they have to sell the bitcoins, Litecoin, ZCash, or Monero they receive for dollars before paying suppliers, utility bills, and even employees.

If they settled their cost items using crypto, then price volatility would not be an issue.

Nevertheless, developers in the space have designed stablecoins. These are digital assets on the blockchain that are backed by other assets. As a result, their price is pegged on the price of the asset that backs them.

The majority of stablecoins in use today are backed by the US dollar. Their market value is basically that of the US dollar, and that means those accepting them don’t have to worry about rapid changes in prices.

The most used stablecoins today are:

- Tether (USDT)

- USD Coin (USDC)

- DAI

- True USD (TUSD)

- Paxos Standard (PAX)

- Binance USD (BUSD)

Join Club Swan and get… more!

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan’s flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

Utility tokens

These are assets on the blockchain similar to cryptocurrencies and stablecoins, except for how they are used or the purpose they serve. While cryptocurrencies are money, utility tokens serve a specific function, usually on a single platform.

Mostly, a utility token allows the holder to access a service on a particular application or blockchain. They are close to what casino chips are. While casino chips have value, they are designed to be accepted in particular venues.

Some coins are clearly utility tokens. For example, the Storj coin is used only on the Storj network to settle computer storage transactions between sellers and buyers.

Meanwhile, there is a class of coins that could be considered cryptocurrencies but are actually utility coins. An example of such a coin is ETH, the native coin of the Ethereum blockchain.

While you can use ETH like you would Bitcoin, it has a more fundamental use case on the Ethereum blockchain, making it more of a utility token. It is used as gas for those running other applications on the blockchain.

The Ethereum blockchain, unlike that of Bitcoin, does more than just process payments. In fact, the main function of the Ethereum blockchain is acting as a virtual machine on which developers and enterprises can build and run different kinds of applications and smart contracts.

To use the Ethereum blockchain to run an application or a smart contract, you need to have ETH, with which you pay the necessary transaction fees (or gas). Blockchains similar to Ethereum with utility tokens like ETH include Cardano (ADA), Binance Chain (BNB), Polkadot (DOT), and TRON (TRX).

Decentralized applications on these blockchains can have their own utility tokens. For example, Uniswap is a decentralized exchange on the Ethereum blockchain with a utility token known as UNI. While ETH is used to pay for fees on Uniswap transactions, UNI allows users to participate in the governance of the Uniswap application.

Security tokens

In 2013, developers behind a blockchain project known as Mastercoin organized the first token crowd sale. They promised to issue the native tokens of their new blockchain to those who supported them financially.

When Vitalik Buterin and his team started working on the Ethereum blockchain, they pre-mined about 60 million ETH, sold them to investors, and raised over 31,000 bitcoins worth US$18 million.

Ethereum went on to become the platform that facilitates startups creating tokens to sell for capital. This model came to be known as Initial Coin Offering (ICO).

With pressure from regulators like the US Security Exchange Commission (SEC), selling tokens to raise capital has been made to follow existing requirements. That has turned some of the tokens issued into security.

When tokens are created on the blockchain and sold as investment instruments, the process is known as security token offering (STO).

You can think of a security token as the digital version of the share certificate. Okay, this where compliance & legal can add their inputs and get “editorial credits” for continuing education units. (deep down, they wanted to be journalists, but could not stomach being poor for 10 years after university).

Non-Fungible Tokens

Cryptocurrencies and utility tokens are fungible. That means one unit can replace another without any challenges.

On the other hand, we have tokens created on the blockchain that are non-fungible. That means each token is unique from the rest.

An NFT can be anything from a photo, meme, video game skin to an asset portfolio.

For example, a tokenized share in a company could be a non Fungible Token because you can’t replace one with the other. The details such as holder, value, and are different for each token.

Platforms for creating and managing NFTs include:

Decentralized applications

Besides being a platform on which cryptocurrencies and tokens can be created and managed, blockchains can also serve as backends for applications like those downloaded from Apple Store, Google Play Store, or Chrome AppStore.

Blockchains offer better security, privacy, and overall user experience as compared to server backends.

Applications that run on top of the blockchain are known as decentralized applications (DApp). Any DApp that offers financial services is known as decentralized finance (DeFi) application.

Examples of DeFi include:

- Decentralized exchanges like Uniswap and Pancakeswap

- Decentralized lending platforms like Compound Finance and DyDx

- Decentralized insurance platforms like Nexus Mutual.

Most cryptocurrencies exist on their own blockchains. For example, Bitcoin, Litecoin, Monero, etc.

Some utility tokens exist on their own blockchains. Examples in this category include ETH, ADA, and Binance Coin. Other utility tokens, security tokens, stablecoins, NFTs, and decentralized applications are created on existing blockchains.

For example, Ethereum blockchain and Binance Chain support the majority of other types of digital assets. Ethereum, in particular, has thousands of different digital assets built on top of it.

Today, the assets the blockchain has given us are cryptocurrencies, stablecoins, utility tokens, non Fungible Tokens, and DApps. It is still early in evolution, and we are most likely going to see new solutions come into the market.