Crypto winter is a phase in the cycle of the crypto market. It is a term used to describe the bearish period during which the prices and value of blockchain assets, which include cryptocurrencies, fungible and non-fungible tokens (NFTs) on the blockchain, drop significantly and stay at the bottom for months and even years before recovering.

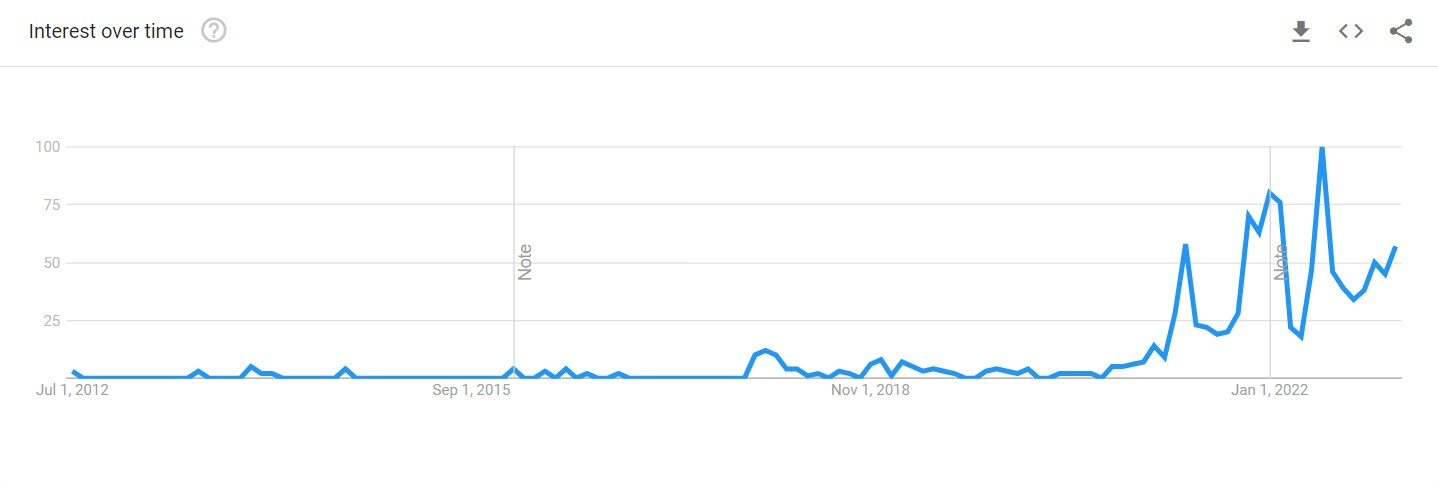

It is difficult to tell who first coined the term crypto winter. But looking at the data from Google Trends, its use, especially in the media, increased beginning in 2016.

Indicators of crypto winter

There are three primary indicators of crypto winter:

Drop in prices

The first is the prices of Bitcoin and other crypto assets dropping and staying at a bottom for a while. In general, the prices of all crypto assets mirror the price of Bitcoin. Blockchain assets are still highly positively correlated. When Bitcoin prices go up or down, all the other assets in the market tend to follow suit.

In the crypto winter period, the market prices can drop up to more than 50% from the established all-time high. For example, in December 2017, the price of Bitcoin hit a new all-time high of $17800. That was then followed by a slow and gradual drop until a bottom price of about $3200 was reached in December 2018. The market remained bearish for a few more months, and a major rally was not witnessed until late 2020.

The market became bullish again, and in late 2021 we witnessed the setting of new all-time highs. The price of Bitcoin hit close to $70,000. After that, the prices dropped, and by July 2022, the price was standing at about $20,000, and it was clear the market had entered yet another crypto winter.

Indeed, since the beginning of crypto in 2009, the market has experienced many similar crypto winters.

Widespread panic

The second indicator is that the drop in prices is often accompanied by widespread market panic. Of course, when the prices drop, those who have put their money in the crypto market may feel their positions threatened.

That is especially the case if they are not persuaded enough about the soundness of the market foundations or their ability to keep their resources in the market long term. Some investors may be tempted to sell at the slightest indication that the market is taking a nosedive. As a result, this further pushes down the price as there is more supply than demand in the market.

Meanwhile, those who have not bought already, unless they are experienced HODLers, are least likely to be persuaded to buy. Often they are made to believe that crypto is about to finally implode and will never recover. The panic that comes with crypto winter is often accompanied by assertions, especially in the mainstream media, that the end days of crypto and Bitcoin have arrived. And those who have never approved crypto feel proven right.

The Bitcoin Obituaries, a web page that tracks the reports of the death of Bitcoin in the mainstream media, tends to get the newest entries during crypto winters.

However, experienced crypto investors take the price drop as a sign that it is time to prepare to enter the markets. Crypto winters offer an opportunity, especially to HODLers, to purchase blockchain assets at the cheapest price possible.

Low funding for startups

The third indicator that the crypto market is in the winter phase is the drop in the amount of investment that blockchain and crypto startups are receiving.

For example, Reuters has reported that while crypto startups have received slightly more investment in 2022 than in 2021, the amount trended downwards towards the end of the year as the markets lost further value in the latest crypto winter.

What causes crypto winter

The primary cause of crypto winter is massive sales that follow the price hitting a new all-time high. That is because many investors and traders usually tie their wealth in crypto for a significant period and wait for the price to hit high enough prices for them to recover their investment and attain gains. There are also experienced short-term investors who are forced to sell off to avoid losing a significant part of their wealth.

In other words, the next crypto winter might begin as a market correction following a significant investment in the market.

The second major cause of crypto winter is negative events in the market, particularly huge hacks, scams, and mismanaged investment funds. In early 2022, there were several of these kinds of events, which shook faith in the crypto market. The most notable include the filing of Bankruptcy by Celcius Network and the crashing of the TerraUSD stablecoin. When these events happen, they scare especially new investors who can not easily differentiate between a platform being hacked or a company filing for bankruptcy and the robustness of the core blockchain technology.

How to protect yourself from crypto winter

The following are steps you can take to protect yourself from the effects of crypto winter:

Acquire knowledge

The first step to protecting yourself from crypto winter’s effects is acquiring knowledge. That means acquainting yourself with the fundamentals of the technology that supports the crypto market and being aware of the current trends and news that might positively or negatively affect the market. Anticipating where the market might go based on your informed understanding allows you to explore available options for your next steps.

In particular, market knowledge will help you make the right decisions when choosing assets to invest in and make you more resistant to emotions such as the fear of missing out (FOMO) and greed. The assets that lose the most value and often do not recover after a crypto winter are either not grounded in sound technology or are not designed with meaningful utility.

With deep knowledge of the market and the underlying technologies, you are able to do an accurate fundamental analysis. You, therefore, invest in assets that will recover with time, even when they lose a significant portion of their value during a major crypto winter.

Meanwhile, by following the news around crypto closely, you can take the right steps ahead of time. For example, you will be in a position to know how the market will react after a major event and therefore decide whether to buy or sell.

Consider the HODL Strategy

The second step you can take to protect yourself from crypto winter is to adopt the HODL strategy. This is buying assets with no intention of selling in years. That gives you the leeway to accommodate a crypto winter and accumulate value from the rally that follows it. That works even better when you choose the assets you invest in with a detailed understanding of the soundness of the technology and the viability of their utility value.

With the HODL strategy, you also invest the money you can afford to lose if the particular asset fails to recover after a crypto asset.

Diversify your portfolio

Make creating a diversified portfolio part of your crypto investment strategy. The assets in your investment bucket should be diverse enough to represent negatively correlated markets. Diversification should not be limited to the crypto market. Indeed, investing in crypto should be one of many others you consider. Your strategy and portfolio include stocks, real estate, bills, boards, metals, and commodities.

The net value of your portfolio should always be positive despite part of it losing value over a given period. That means while the market prices of your crypto investments are dropping during a winter, other assets should be canceling out those losses.

There is also crypto summer

Indeed, just as we have crypto winter, we also often experience crypto summer. This is the period when the market is bullish, and assets often achieve their newest all-time high prices during this period.

Most new all-time highs follow major crypto winters. Throughout the crypto market’s history since 2009, we have experienced as many crypto winters as crypto summers. The period between late 2017 and early 2018 was a crypto summer. There was also the period between late 2020 and early 2022.

Indicators of crypto summer

Of course, the first indicator is growing asset prices often leading to new all-time highs. In these times, there is often more demand for crypto assets than supply.

The second indicator is excitement among seasoned crypto investors but even more among new investors in the market. It is during this time that many people who have not bought crypto assets before get enough confidence to try their hand. Most of them tend to be driven by the widespread positive news about the market performance.

Then there is growing investment in crypto and blockchain-related startups and projects both by mainstream investment firms and public offerings or token sales. Developers and entrepreneurs are most motivated to, in particular, launch applications, solutions, and new assets when the market is generally bullish. It is easiest to persuade mainstream investors to put their money into crypto-related projects during this period.

What causes crypto summer

Just like crypto winters, crypto summers are often part of normal market corrections. It happens when there is too little investment in the market; therefore, those already into it have their value grow significantly.

Investors put in more money to gain from anticipated growth, which drives the demand up, and the prices follow. This is further driven by confidence that the market will continue to expand.

Another common cause of crypto summer is the halving of the Bitcoin reward. This is the reduction of half of the new coins that are released to miners and makes Bitcoin a deflationary asset. This phenomenon happens after every four years, and the net result is that the supply of Bitcoin is reduced and which pushes up the price. The other blockchain assets follow suit as they are positively correlated to Bitcoin.

How to survive crypto summer

Even though prices are growing during Crypto summers, there is a risk involved for investors, especially those who do not properly understand how the market works. In particular, they are likely to enter the market while the more experienced investors are exiting, and that locks them in, or they end up selling at a loss as the price keeps dropping from their point of entry.

It is also possible in the bullish market for them to be victims of pump-and-dump schemes. This is where more experienced traders conspire to create an impression that the value of an otherwise nondescript asset is growing rapidly, and investors will miss out on an opportunity if they do not buy but then end up abandoning it once they make a profit from it. This often leaves inexperienced investors holding worthless assets.

Learn about the market dynamics

It is, therefore, as important to know how to protect yourself during crypto summers as in crypto winters.

You should know the basics of investing in the crypto market, such as the best time to get in. Buying when the market is at the top of bullishness might lead to losses as the value might not go any further up.

Know how to identify pump and dump schemes. The best way to avoid this is to only invest in assets with sound financial and technological foundations.

Don’t plan your buy-offs to coincide with the high prices unless you are a day trader. Of course, if you are HODLing you should be ready to miss the high-price opportunities and have the resilience to wait for another summer, which is often hard to predict when it comes next.

Both crypto winter and crypto summer form the nature of the crypto market; therefore, they should not surprise you when they occur. You just need to take the necessary steps to anticipate and prepare for them.

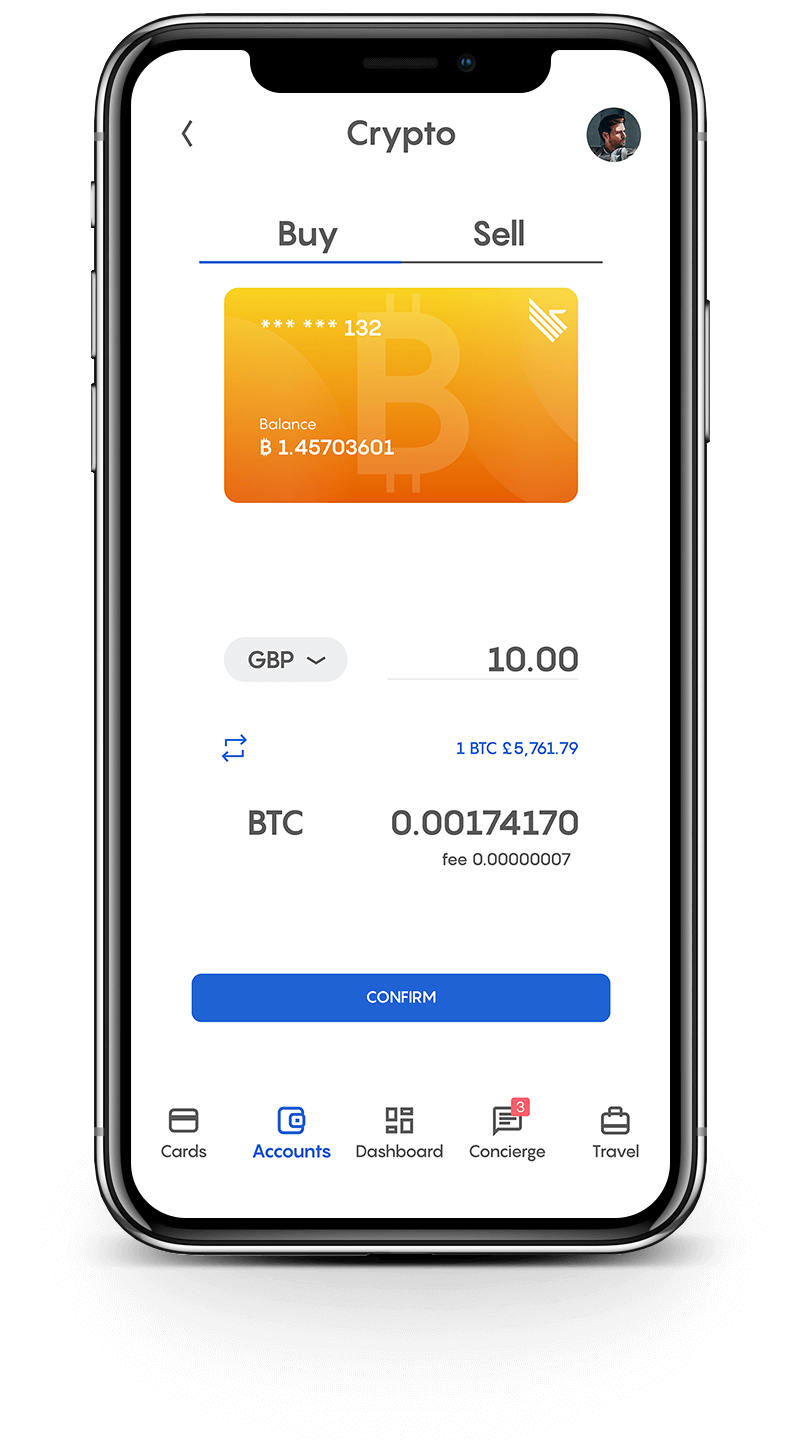

Advertisement

Join Club Swan and get... more!

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan's flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.