The widespread adoption of cryptocurrencies is still relatively slow, but market acceptance of these nascent currencies is growing, especially in terms of regulators creating frameworks within which they can operate. The jury is still out on the numbers, but it is estimated that there are easily over 5,000 cryptocurrencies in circulation. In early 2020, the combined market cap was $250 billion and jumped to over $337 billion by early August. It is safe to say that they are here to stay.

Volatility defines the Cryptocurrency narrative.

Despite the increasing acceptance of crypto-assets, volatility still dominates the narrative around them. The wild swings that Bitcoin posted in 2017 were jaw-dropping. Its price moved from $900 in January, to $20,000 by the end of the year.

In an effort to inject some price stability in the crypto market, stablecoins were introduced as a potential solution. Simply put, a stablecoin is linked to another asset, or basket of assets, that are more stable and subject to minimal price fluctuations. Stablecoins are often pegged to the value of fiat currencies (such as the US dollar, Euro, Sterling etc) or precious metals (silver, gold, platinum etc) to avoid high price swings.

The most popular stablecoin is Tether (USDT), whose value is pegged to US dollar, maintaining a 1 to 1 ratio in terms of value. For every USDT token issued, it keeps one US dollar in reserve. In theory, this should keep the USDT price stabilised at $1 USD, and not follow the broad cryptocurrency market fluctuations we see with Bitcoin and Ethereum that are not pegged to an underlying asset. Each unit of USDT can be redeemed for one of the US Dollars in the reserve.

A more efficient way to transfer money.

Stablecoins are increasingly being used as a medium of exchange. International remittances and cross-border payments work well with stablecoins because of their ease of global transfer, i.e. speed and lower costs. Stablecoins are also perfect for seamless payments of blockchain-based assets. They have an open architecture which means that they can easily be integrated into digital applications. Traditional banking infrastructure tends to be clunky and outdated, limiting the speed and efficiency of bank transfers.

Tether (USDT) is by far the largest stablecoin in terms of market cap and has seen a meteoric rise in value. It is currently the 3rd largest cryptocurrency with a market cap of $15.6 billion. Since Tether was released in 2014, many other stablecoins have come onto the market, and they have been met with strong interest. Some notables are USD Coin (USDC), Circle, the Gemini Dollar, Paxos Standard Token (PAX), and MakerDAO (DAI).

Join Club Swan and get… more!

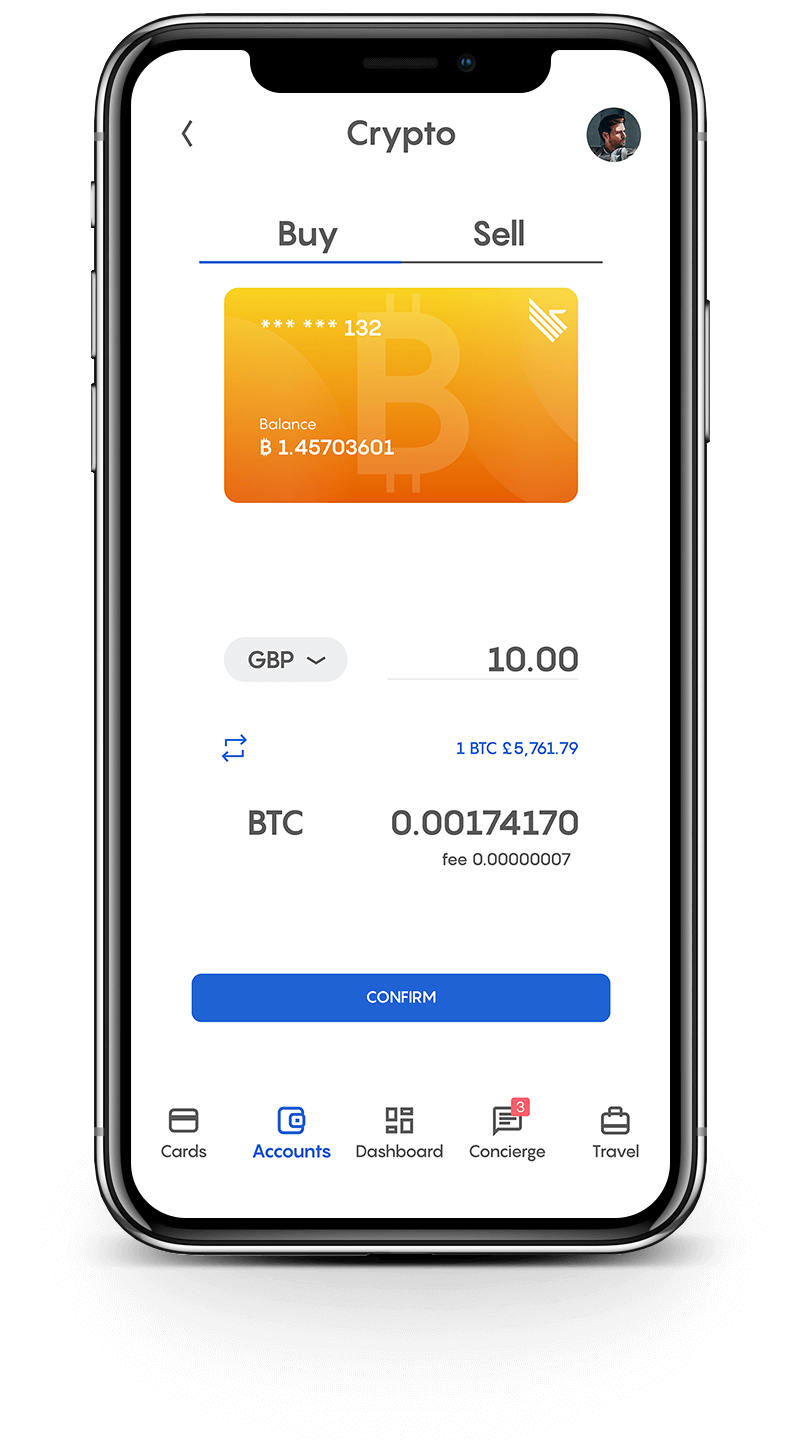

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan’s flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

A growing medium of exchange.

The way various stablecoins are collateralised differs, for example, unlike Tether which holds USD in reserve, DAI is not backed by a reserve of USD. It is collateralised by other crypto assets like ETH, in addition, the DAI reserve is not controlled by any one entity.

While cryptocurrencies don’t have traditional volume indicators like stocks, as a measure of trading frequency, it is interesting to look at velocity indicators. Velocity is a measurement of the number of times that an average unit of supply has been transferred in the past year, and it is indicative of the rate of turnover. If you look at the Bitcoin and Ether turnover rates, stablecoins are being exchanged relatively frequently. This may underscore the belief that stablecoins are being used more like a medium of exchange. Also, as blockchain adoption increases, so will the demand for native coins. Users will need to pay the commission to transfer tokens on the blockchain network and will need to use the native coins for that network as a commission.

Facebook’s Libra making regulators jittery

.

Facebook’s Libra is another form of stablecoin that is pegged to a group of ‘low-volatile assets’, including bank deposits and government securities in multiple currencies. To make one global currency that is not restricted by any one national centralised currency, Libra is built onto massive user bases through which it could achieve a substantial global footprint via Facebook, Instagram, WhatsApp and Oculus. Global stablecoins of this nature could significantly improve the financial system, by lowering transaction fees and increasing the speed of remittances and cross-border payments. The downside is that it could pose a systemic risk to existing financial infrastructures, especially in countries that have weak currencies. These minor currencies would be at risk of being marginalised in favour of stablecoins. This could undermine monetary policy, and since this is unchartered territory, it is difficult to predict the outcome of large-scale adoption of a global currency in a third world country. It’s not going to be an easy passage for Libra; will have to meet the regulations of every country it operates in. In the meantime, US Congress has requested that Facebook puts development on hold until they get a definitive picture of how it may affect existing financial systems.

Governments are embracing digital currencies.

While regulators and government grapple with the nuances of digital assets, they are not denying their value and place in the current financial ecosystem. The U.S. Federal Reserve is investigating the potential of a central bank digital currency (CBDC) as the foundation of a new, secure real-time payment and settlement system. They are acutely aware that currently, it can take a few days to get access to transferred funds. A real-time retail payments infrastructure within the central banking system not only makes sense, it is a necessity, as individuals adopt the sleeker systems already available to them.

The US Government is not alone in developing a national digital currency, other countries going down the same track are China, Estonia, Senegal, Singapore, Tunisia, Ecuador, Japan, Palestine, Russia and Sweden.

Regulation – still a sticking point

.

As with all digital currencies, the issue of security remains omnipresent. Cybersecurity is possibly one of the biggest obstacles digital currencies must face. Ransomware attacks, stolen crypto-assets and illegal trade, is a challenge that regulators and individuals must deal with daily. Regulatory bodies have been slow to create specific laws that set-out minimum standards for cybersecurity, especially when it pertains to intermediaries who offer custodial services for crypto-assets. Dealing with this issue will no doubt fast rack the adoption of cryptocurrencies.

The future of stablecoins appears to be set for growth, and they are laying the foundation for greater crypto adoption. Regulators, including the FCA in the UK, believe that many fiat-pegged stablecoins should be classed the same as eMoney and subject to the appropriate rules of scrutiny. Due to the different structures of stablecoins, it is still not clear which will fall under the influence of existing regulations and those that will not. Stablecoins and cryptocurrencies structures will continue to evolve as the stakeholders refine and iterate the protocols. Given that cryptocurrencies have grown from one lone Bitcoin in 2010 to over 5,000 in 2020, we should not have too long to wait before we see these nascent currencies settle into the broader spectrum of payment options.