Ten years have passed since Bitcoin made it onto the radar of investors, tech geeks, and nervous regulators. While it fights its way into the money mainstream, thousands of other alternative currencies have joined the march. There are now over 5,500 cryptocurrencies with a combined market capitalisation of $271.58 billion. It’s an impressive number given that Bitcoin was valued at $0.0008 when first released.

Market capitalisation of crypto VS fiat

When you compare the total market value of cryptocurrencies to traditional money, cryptocurrencies have a long way to go. Current estimates value traditional or “fiat” currencies at over $81 trillion. There is much speculation around the possibility of crypto replacing fiat currency, and five years ago many experts proclaimed it would never happen. Today however, they may be softening their positions.

The future is here

Last year, Thomas Frey, a futurist from the Da Vinci Institute, claimed that by 2030 cryptocurrencies would replace 25% of fiat assets. Heavy hitters like Jim Reid, Global Head of Fundamental Credit, Strategy and Thematic Research at Deutsche Bank, wrote in a report that “While critics bemoan cryptocurrencies as constrained by regulatory hurdles, we believe the incentives of governments and card providers are such, that digital currencies are inevitable.” He authored the section of the report entitled “The end of fiat money?” He went on to say “The forces that have held the current fiat system together now look fragile and they could unravel in the 2020s. If so, that will start to lead to a backlash against fiat money and demand for alternative currencies, such as gold or crypto could soar”.

Interestingly, the pandemic and the raft of geopolitical events that we are currently experiencing, are mirroring Reid’s predictions – both gold and crypto are bullish. To put this debate into perspective, the value of cryptocurrency is estimated in fiat, and fiat is becoming fully digitised as we move into a cashless world, there is no doubt that their ecosystems are quickly merging. Hybrid payment platforms such as Club Swan are gaining traction, as individuals look to integrate their traditional and digital currencies.

Join Club Swan and get… more!

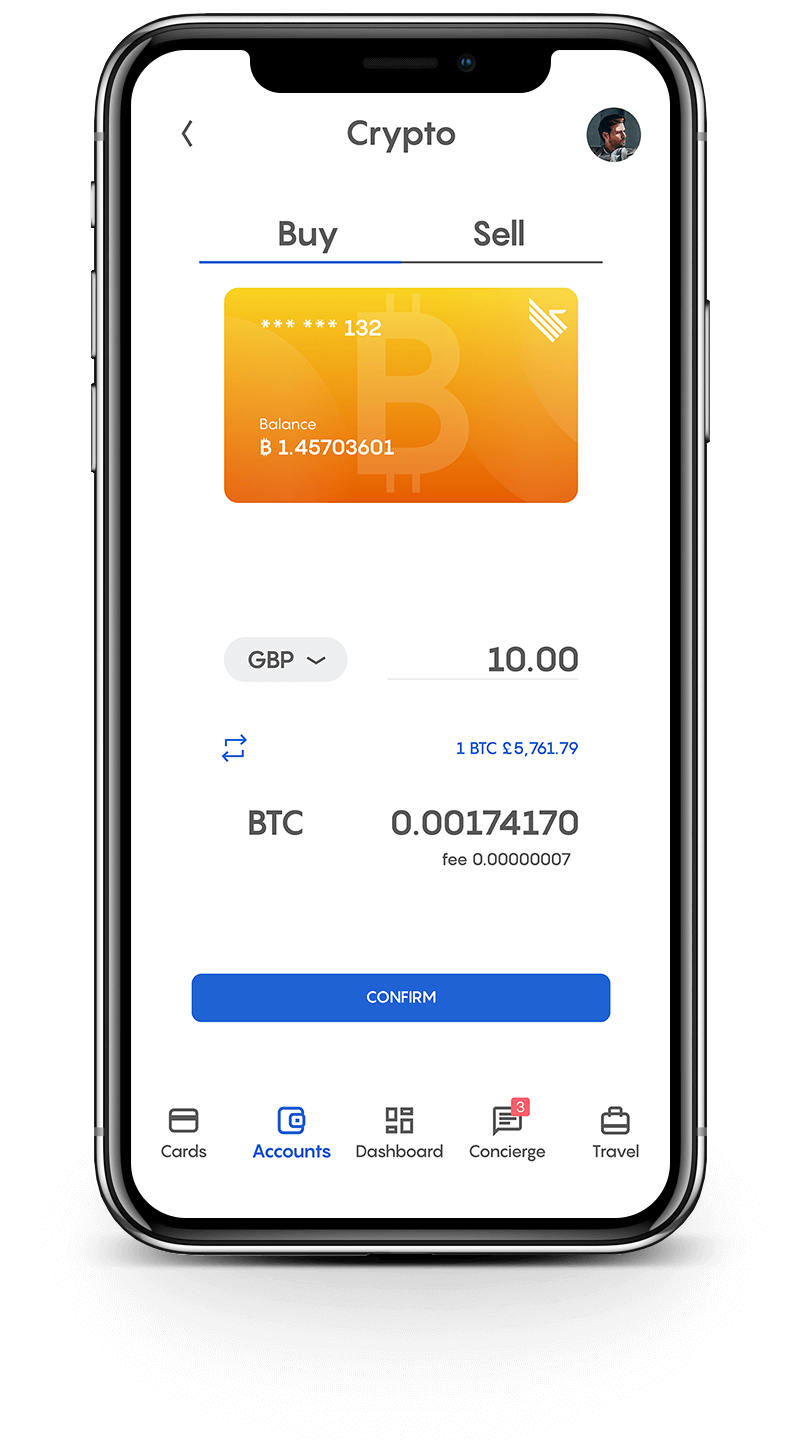

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan’s flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

Cryptos are gaining acceptance

Once massive sceptics, governments and financial institutions are now accepting that alternative currencies are here to stay. Governments are recognising that the transparency, low-cost and ease of movement that cryptocurrencies offer, could solve many of the world’s financial challenges, especially in the unbanked markets. The US Federal Reserve is talking about creating a crypto dollar linked to the value of its fiat currency. In the UK, the Financial Conduct Authority is researching the elements of a cryptocurrency regulatory framework. China, once on the warpath with crypto, will soon be launching their own digital currency called the Digital Currency Electronic Payment (DCEP).

Early crypto enthusiasts believed that crypto would result in the total demise of traditional currencies. Their argument was that after 50 years of tight financial regulation by governments and central banks, individuals would be militant about reclaiming control of their money. However, this has not happened, individuals are taking a more measured approach.

Do cryptocurrencies have an advantage over fiat currencies?

The short answer is yes, they have the potential to save businesses and financial services firms a significant amount of time and money by cutting out the middlemen. Another major criticism of the fiat system is the way in which the value of a country’s currency can change outside of domestic borders. The Nigerian Naira is a prime example of this – its value drops 30% as soon as it is taken out of Nigeria. Digital currencies – for the most part – are not issued by any nation or state and are therefore not subject to the same geographical fluctuations.

Then, there is the immutable record-keeping of the blockchain. Blockchain is a valuable defence against fraud, as records cannot be altered once processed. It also allows for full decentralization, this means that the flow of money is not regulated by any government or financial authority, and therefore unencumbered by the policies and agendas of central banks. Instead, cryptocurrencies self-regulate through their peer-to-peer networks.

Is there a downside to replacing fiat with crypto?

There is always a “but” and in this case, it’s a big one. The current speculative nature of crypto does not make for a peaceful sleep. Imagine if you only had access to crypto and had the equivalent of $3000 in your bank account when you went to sleep. Then overnight speculators ran riot and your $3000 was now worth $2000. This would not be good for individual or economic stability, and until there are watertight checks and balances in place, this will remain a significant hurdle for full adoption.

Money laundering and decentralization will continue to be the focus of regulators. Anti-money laundering (AML) initiatives will continue to be an imperative for banks and financial institutions. They spend vast amounts of money to ensure regulatory compliance. If digital currencies replace fiat, the anonymity allowed by technology like blockchain would make AML extremely difficult, costly, and time-consuming. While regtech is a fast-growing industry, it has not yet caught up with the myriad of requirements needed to provide a robust AML structure. Many banks and other financial organizations would be reluctant to adopt cryptos for this reason. A similar issue arises from the decentralized nature of crypto. Governments and financial authorities are extremely unlikely to fully sanction any currency over which they exert no influence or control.

More points to ponder

Whilst blockchain ensures that crypto transactions are securely recorded, there can be issues with coins themselves. Cryptos are vulnerable to hacking, power supply issues (although the new generation of cryptos have more efficient mining systems), software problems, and not least, the foibles of humans. We have all heard of the investor who lost millions of dollars’ worth of Bitcoin when he threw away a laptop containing 7,500 Bitcoin. Not to mention the pain 100,000 investors felt when Gerry Cotton, CEO of a major Canadian exchange died, taking with him the cryptographic keys to access $137 million of cryptocurrencies. The company owes its customers $190 million but can’t access the funds to pay them back.

Digital currencies have a long way to go before the fiat system starts to disband, digital currencies may have to adopt some of the characteristics of fiat money if they want to achieve mainstream acceptance. This means that the cryptocurrencies of the future will almost certainly exist on the terms of central banks, financial institutions, and governmental bodies. However, the last five years have delivered a plethora of surprises for humanity, so no bets will be placed.

The information contained in this blog post is for educational or informational use only, and is not intended as financial or investment advice. Seek a duly licensed professional for financial or investment advice.