It’s almost clichéd to state that we live in disruptive times; disruption has in fact become the moniker of the 21st century. In a short 20 years we have watched, and largely benefited from entire industries being upended by technology. The last decade in particular has seen some of the most significant changes. The way we travel, eat, shop, invest, bank, communicate, transact, socialise, and even stay healthy, has moved from the physical to the virtual realm and has put knowledge and the ability to profit from it, in the hands of almost everyone who has a smart device.

Anyone who lived through the 2008 financial crisis will tell you they were dark days. The events that led up to one of the biggest financial blunders on record, spawned a flurry of regulation across Europe and the US (from Dodd-Frank Wall Street Reform and Consumer Protection Act, the Emergency Economic Stabilization Act to MiFID (The Markets in Financial Instruments Directive), a gigantic 5000-page document. However, within the context of our disruptive and disrupted financial ecosystem, no matter how hard we and try and ring fence the accidental consequences of innovation – regulation will always lag behind technology.

As the ink was drying on the papers prepared by regulators to tighten restrictions in financial markets, an elusive character or group, (depending on your preferred conspiracy theory) called Nakamoto Satoshi introduced Bitcoin to the world. The premise was simple; decentralise the payments industry to make transactions faster, safer and cheaper for the man in the street. However, it strayed from its ideological roots and grew into the biggest game changer in the world’s financial history. While cryptocurrencies have given law makers headaches, they are now faced with another monster under the bed that make cryptocurrencies a walk in the park to regulate – a hearty welcome to Wallstreetbets, populated by users of Reddit, a prominent social media platform. Perhaps their power is overstated here but they cannot be laughed off as a rogue element of social warriors intent on promoting anti-establishment discourse.

So why are we talking about them? In late January 2021, anonymous Reddit users on the sub-reddit group Wallstreetbets, collaborated to inflate the price of GameStop stocks. GameStop is a games retailer, whose stock was floundering due to the pandemic, the shift to online gaming and an expensive physical footprint in retail spaces. Hedge fund traders looking for a quick profit, short sold the stock which put further downward pressure on the price. Wallstreetbets managed to reverse their fortunes by encouraging members to buy the stock, pushing the counter to record highs. In early January 2021, the stock was trading at $19, but by the time the Reddit community was finished with their game of “Burn the Bears” it hit $330 two weeks later.

Advertisement

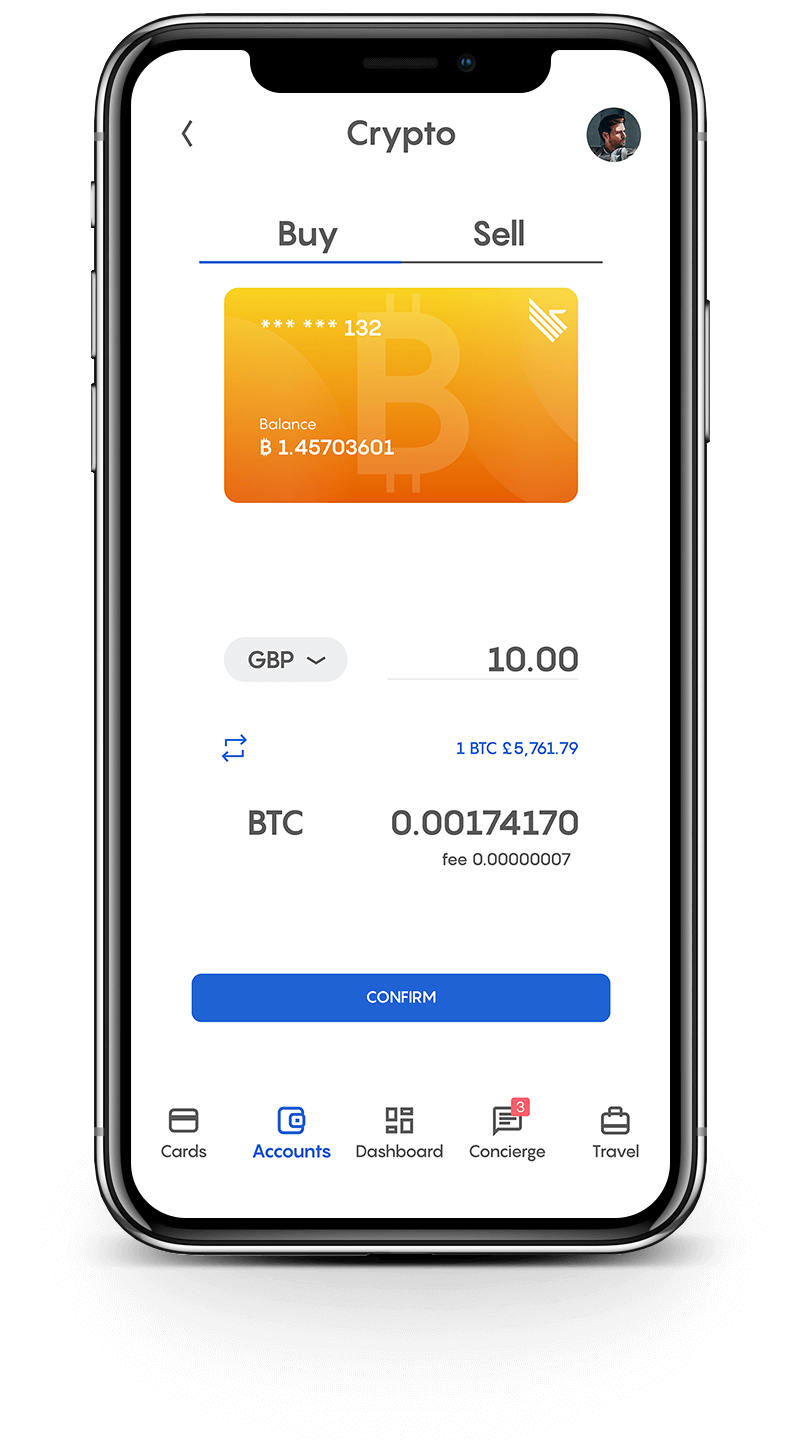

Join Club Swan and get... more!

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan's flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

GameStop became the unwitting beneficiary of a social movement. The motive behind this, according to reddit users, was “not to make quick money through market exploitation” but it was rather a gesture to ‘get back at’ what they perceived to be a rigged market. This action has been labelled market manipulation by some and market forces by others. Either way, it has made the entire financial community more than a little wide-eyed. The actions of the “Wallstreetbetters” has surfaced age old debates about market volatility, the subjectivity of stock valuation and the potential for collectivist activism to wreak havoc within the ranks. It seems that the question was unequivocally answered in events that will undoubtedly go down as one of the notables in the financial history annals – and it’s not over yet.

No-one could have predicted that a social media community could wreak such havoc in the equities markets – but it did, and this is the impact of the collective. The regulators are up in arms and trying to figure out how to stop this from happening again, but in the meantime the army of Wallstreetbetters is growing, with 2 Million additional members being added to their ranks since the movement began.

GameStop was not the only stock that was targeted, AMC, Koss, Express and Silver were also on their radar. Silver took off after the Reddit crew thought they could upset the market and punish mainstream financial institutions. The ploy worked for a while, silver did indeed rally but professional analysts and traders reacted quickly to get control. The key difference between GameStop and Silver was that there were very few short positions in silver futures. In fact, traders were betting on prices rising.

When GameStop and other Reddit-targeted stocks started to rally, Wall Street clearing firms ordered brokers to add millions of dollars more in capital to guarantee those trades. Robinhood, the trading platform that the Reddit traders used, didn’t have the additional capital and had to reel in the traders. Robinhood suffered fallout, after being accused of turning their backs on the little man. However, it wasn’t just Robinhood that was the party pooper, the NYSE stopped trading on GameStop 30 times over 2 days to cool the markets.

Cryptocurrencies were not sitting on the side-lines when the GameStop saga unfolded, DOGEcoin stole some of the limelight. The coin by Billy Markus of Portland Oregon was designed to poke fun at the early altcoins, that had no value other than to make a quick buck (Unobtanium, TrumpCoin and PutinCoin, to name a few). Once SatoshiStreetBets, the Crypto version of Wallstreetbets set its sights on DOGEcoin the coin’s market cap increased (600%) to the tune of USD 8 Billion in 24 hours.

There is a lot of speculation about where this is all going. Extreme market volatility means that there are as many winners as there are losers. The value of a stock is anchored by its underlying asset and if the share price strays too far beyond the asset value, the market will eventually correct. This is not to say that there are not flaws in the system. There have been calls for tighter regulation, especially as smaller, less experienced investors now have access to trading platforms. Many market leaders want to abolish Short Selling altogether.

There is an interesting dichotomy in this story. Had the big players in the hedge fund fraternity colluded to manipulate the markets, they would have suffered the wrath of the regulators. The Wallstreetbets crew, however, have not been accused of any misdeeds because their numbers are relatively small. Yes, they are small now, but one can’t help wondering – for how long? The phenomenon of financial disruption is still in it’s infancy; cryptocurrencies, once vilified by financial watchdogs and institutions, are now in the portfolios of even the most conservative companies. As technology evolves, access to platforms gets easier and the discontent of the establishment grows stronger, there may be some serious systemic threats looming. This may play into the hand of the crypto warriors and the blockchain industry as a whole. The next five years will make for interesting times and one could hazard a guess that the establishment are in for one heck of a bumpy ride.