The 300% surge in the price of bitcoin has spectacularly rewarded investors who rode the wave of the nail-biting 10-month rally that started in March last year. This time round, the pundits were spot on – early in the year, many predicted a breakthrough the $20,000 barrier and a few more predicted the $30,000 dollar breach. Currently nudging the £39k marker (at time of writing) Bitcoin is showing strong momentum with $40,000 looking entirely feasible. The “naysayers” are now most certainly re-thinking their positions, as Bitcoin is now the world’s sixth-largest currency, with trading velocity at six times the U.S. dollar. The combined market cap of all cryptocurrencies is now above $103Tn according to CoinMarketCap, so it looks like crypto is here to stay. The billion-dollar question on the lips of many now, is “what is driving the market and where to from here”?

Interestingly it is not the small crypto warriors that are driving the market, but rather some heavy hitter institutional buyers. Several significant actions by large corporations have increased investor confidence in this volatile asset. PayPal’s decision to embrace Bitcoin and other cryptocurrencies, was considered a game changing move by analysts. PayPal’s massive client base of over 300 million, will now have the option to fund their accounts with crypto, paving the way for mass adoption.

Analysts also reported that activity on the iBit exchange, (run by Paxos which partners with PayPal) revealed that PayPal and Cash App, recently bought almost 100 percent of freshly issued bitcoins. In addition, Square, a payments company founded by billionaires Jack Dorsey and Jim McKelvey, just invested $50 million in bitcoin to diversify its balance sheet. Visa and PayPal are believed to be working with over 25 digital currency companies on Bitcoin-related projects, further legitimising the coin. JPMorgan, Guggenheim, FundStra’ and Mass Mutual have also given crypto a thumbs up. Guggenheims CIO Scott Minerd, in an interview with Bloomberg, stated that given bitcoin’s scarcity and anti-inflation properties, it should be valued at a staggering $400,000.

True to form, Bitcoin’s meteoric rise took other cryptocurrencies along for the ride. Ether was not left in the shadows as it shot past the $1,000-mark early January to hit its highest level since Feb 2018, jumping 61.47% in the last 7 days. It is currently trading at $1197.54. Litecoin rose by 31.5% in the last 7 days and is currently trading at £165.81.

Advertisement

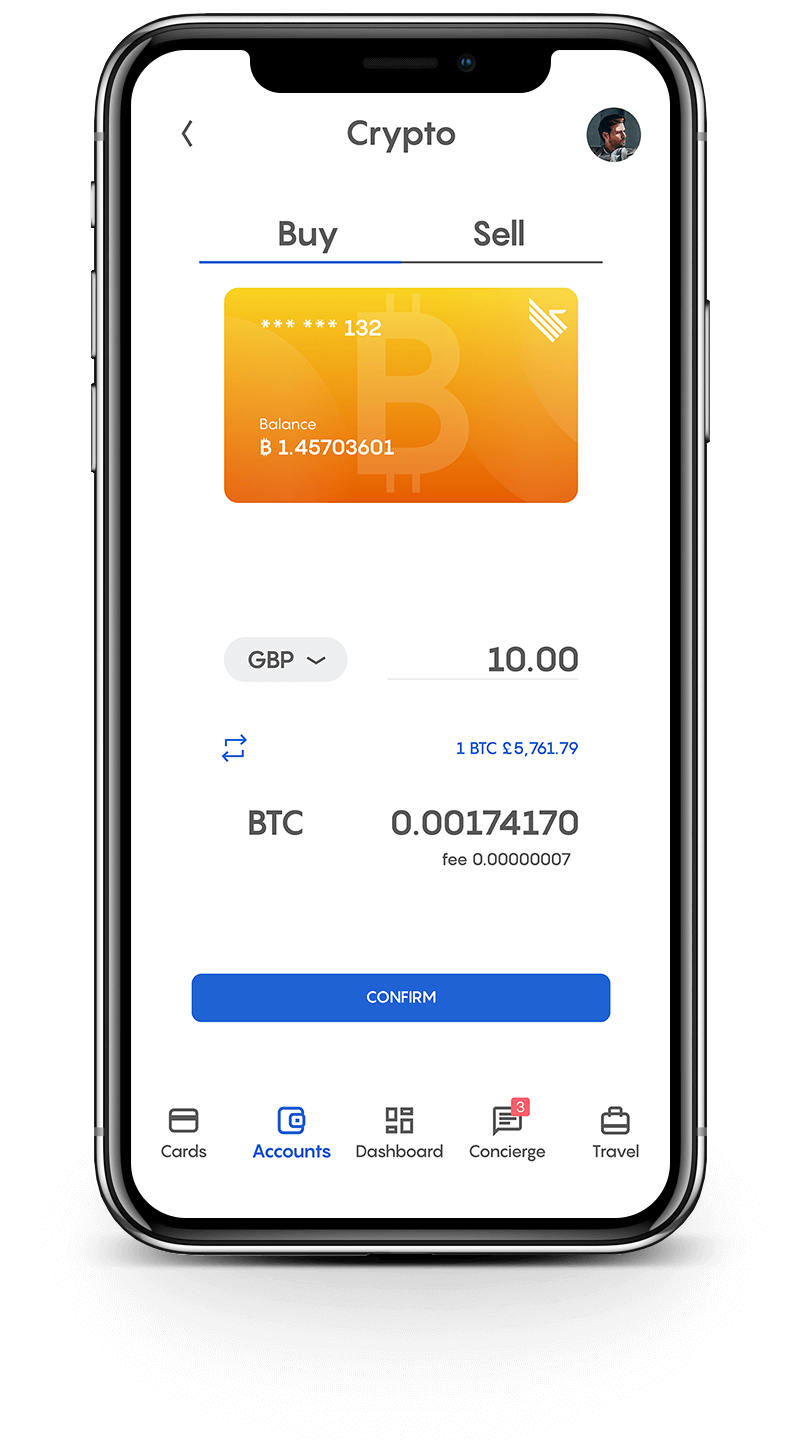

Join Club Swan and get... more!

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan's flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

Even XRP had some time in the sun, growing 35.72% to $0.308423 in the last 24-hour period. This growth is despite the Securities and Exchange Commission (SEC) announcing on December 22nd that it filed an action against Ripple Labs Inc. and two of its executives. They allege that they raised over $1.3 billion through an unregistered, digital asset securities by offering XRP. While Ripple Lab’s issues with the SEC continue, it will remain a cause for concern for Ripple’s XRP investors as it may be while before we see it back at December 2020 High levels of $0.6381.

There is no doubt that the pandemic has been a significant player in the crypto rally. The US dollar is under pressure, as its buying power is eroding. In a bid to help the victims of the virus, the US Congress will be paying out close to $1 trillion (with more to come) in a stimulus package. This needs to be paid for, and it will mean that around 50% of the world’s total supply of US dollars will have been printed in 2020. This does not augur well for inflation. In addition, widespread jobs losses and business closures will take their toll on the economy. The other massive issue for the US, is the absolute carnage that Donald Trump’s exit from the Whitehouse has caused. The storming of the Capitol Building was perhaps the final blow to an already polarised nation. There is a lot of work to be done to unify the country and restore the structures that underpin a strong economy.

While the fundamentals for cryptocurrencies look to be strengthening, the wild card that could bring the crypto rally to an abrupt halt in the short-term is Tether (USDT). In December 2019, the New York attorney general filed a memorandum of law alleging that Tether was an unregistered security.

They also alleged that they used reserve funds to cover an $850 million loss by Bitfinex, their sister company. They defended this claim by asserting that the money was deposited with a Panamanian-company called Crypto Capital and was then seized and safeguarded in several jurisdictions, including the UK and the United States. They lost an appeal to turn over documents to the courts, and the deadline to deliver the documents is now looming. Experts predict that legal action against Tether could cause a tumble of the entire market. That being said, the pundits are still bullish, and all eyes are firmly set on the $40,000 milestone.