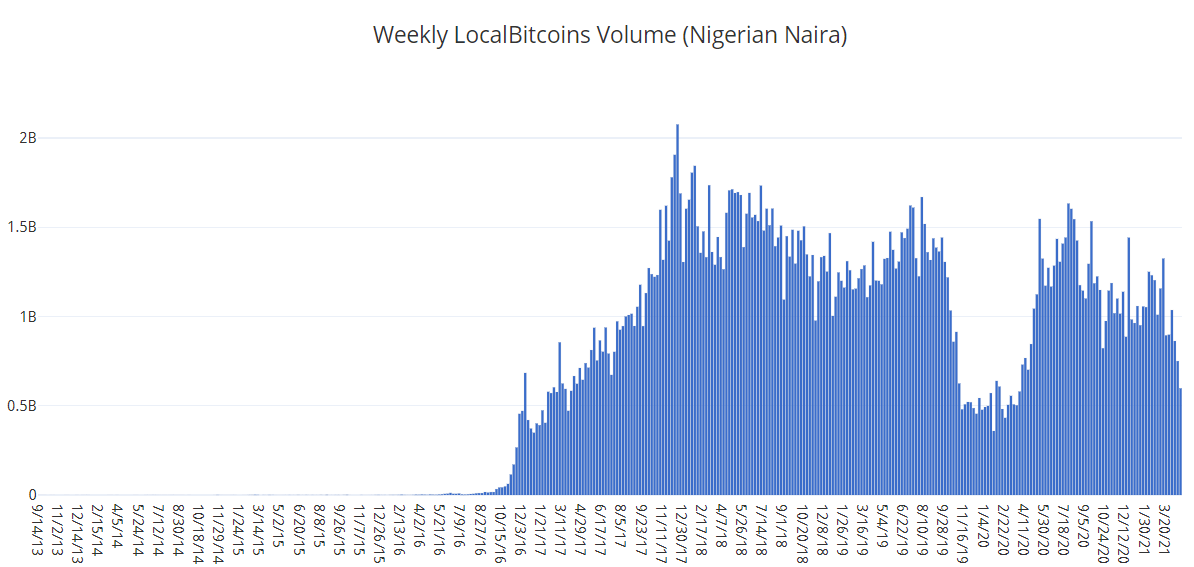

Nigeria is not only the most populous nation on the continent of Africa, it also has the continent’s largest economy. In addition, it is rapidly becoming the central hub of cryptocurrency activity in Africa. According to Coindance, a platform monitoring cryptocurrency trade worldwide, Nigerians traded up to about 1.13 billion naira (about USD 2.9M) in March 2021.

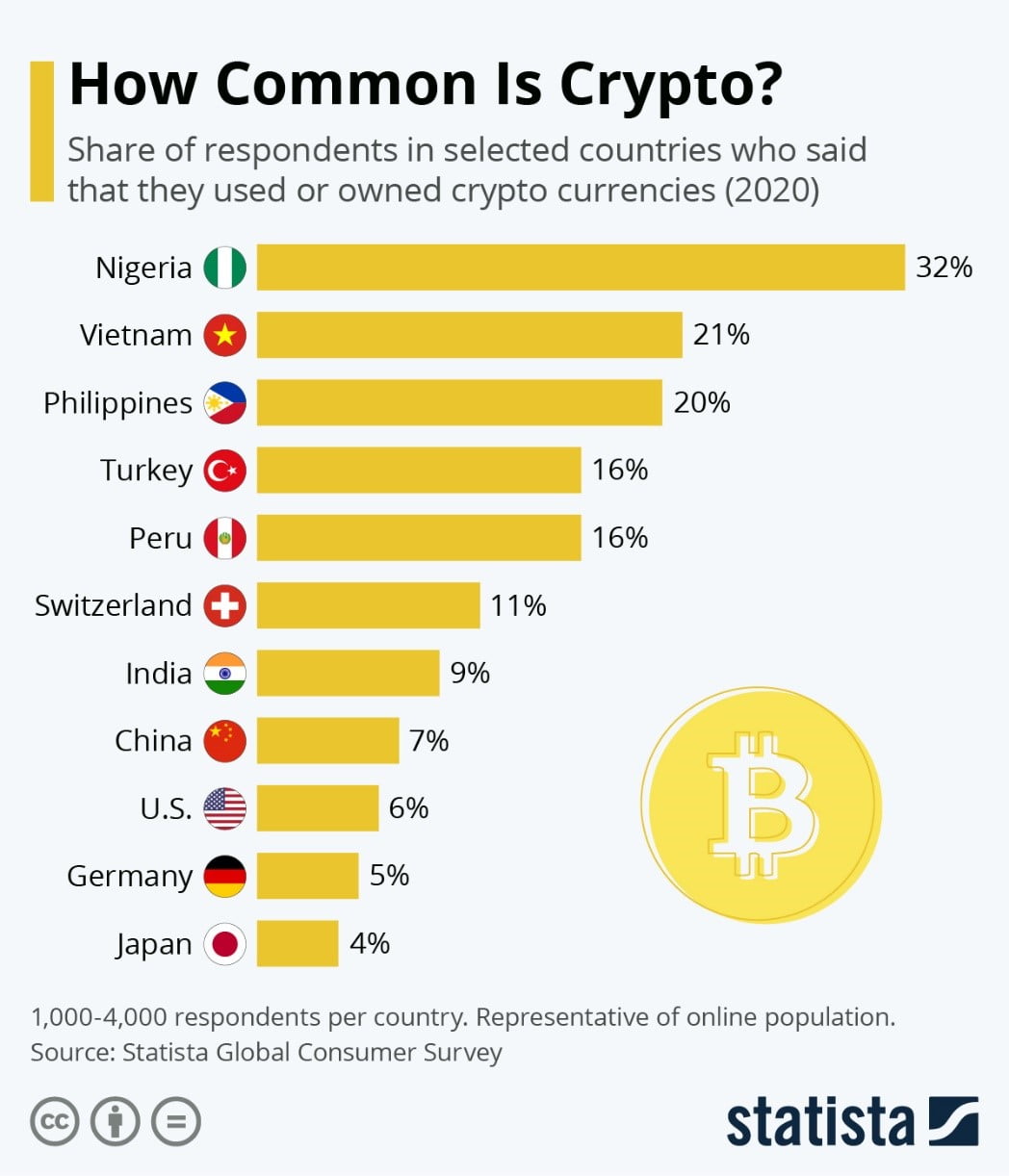

Cryptocurrency Adoption in Nigeria

When U.S. payment giant Stripe acquired the Nigerian fintech startup Paystack for $200 million, it was more than another acquisition story. It gave credence to the value that African tech startups have created for businesses, investors, and the ordinary African. Fintech companies have continued to save the day for ordinary Nigerians. Through innovative services and design thinking, they have solved problems that affect many people. For instance, schoolable.co helps parents to save towards their children’s school fees and get loans. They also ensure payments are tracked and reconciled. Bundle Africa helps with funds transfer, Flutterwave helps with payment processing and remittances, and Telokanda helps university students share weather data, amongst others.

Cryptocurrency Adoption Chart

Source: https://www.statista.com/chart/18345/crypto-currency-adoption/

In February, Binance Africa sponsored over 1,000 African developers to learn the basics of building on the Binance Smart Chain. Truly, Decentralized finance (Defi) has revolutionized the way applications are developed on blockchain.

Bitcoin in the Real Estate Landscape

Bitcoin has been making headlines for the past couple of weeks as it becomes more accepted by mainstream media, and accepted by some realtors for the first time. The CEO of Bamboo Real Estate and Construction, Osayemon Ighodaloh said that “the need to innovate and provide options made him adopt smarter means of payment.” According to John Adelakun, a real estate analyst, “Digital currency helps to reduce barriers to ownership of property. As more people get familiar with it, they will start to realize that it has a lot of potentials to bring prosperity and freedom to many different aspects of our lives.”

At this time, Nigerian realtors are talking about accepting Bitcoin, but there has not been real traction as yet. The cheapest houses in Lagos cost up to 8 million naira, which is way out of budget for people below the upper class. With blockchain, housing units can be split into multiple fractions and people can own fractions of the property.

Available Channels for Purchasing Bitcoin:

- Through the crypto exchanges

- Peer-to-peer crypto trading

- Joining membership clubs designed for crypto enthusiasts

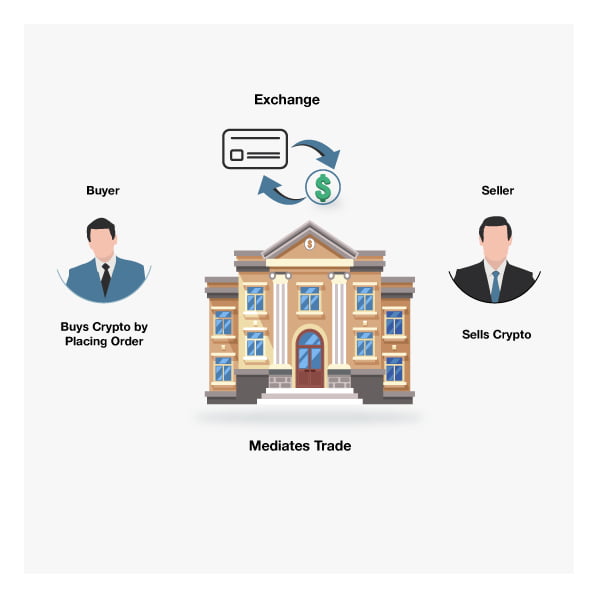

1. Through the crypto exchanges

Cryptocurrency transactions usually involve an exchange platform as an intermediary. Notable exchanges used include Luno, Bittrex, Binance, Banxa and Coinbase.

2. Peer-to-peer crypto trading

With peer-to-peer trading, two people transact business directly without involving the bank.

3. Joining membership clubs designed for crypto enthusiasts

There are clubs for crypto enthusiasts. Examples are Crypto Builder Millionaire’s Club and Blockchain Nigeria User group. Crypto Builder Millionaire’s Club provides mentorship for newbies wishing to benefit from cryptocurrency but find it difficult to navigate. There are perks for joining such as having first-hand information about developments in the crypto space, crypto giveaways and gifts, etc. Club Swan is also a membership club designed for cyptocurrency enthusiasts. Services include travel discounts, rewards, and virtual assistants. As of May 1, 2021, Club Swan is accepting qualified members from Nigeria.

Advertisement

Join Club Swan and get... more!

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan's flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

Other Channels

Crypto P2P: Within the blockchain network, sellers put up their offer and interested buyers bid for it. This method introduces a delay in the transaction time because the buyer must be matched with a seller. As a result of this, it is not unusual that transactions remain hanging for 24-72 hours.

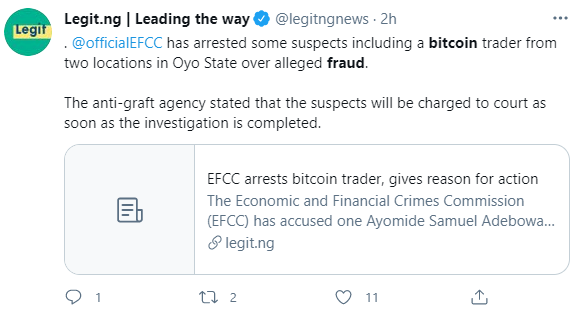

Naira P2P: Before the advent and popularity of crypto exchanges, individuals primarily bought cryptocurrencies by finding sellers and transferring the Naira equivalent to their bank accounts. Some new entrants into the cryptocurrency space fell victim of fraudsters who promised to help them mine and trade bitcoin and manage their earnings. The unsuspecting individuals fell for the tricks and lies. A suspect was arrested in Oyo State.

Use of other currencies: Because the main hurdle was trading crypto with the Naira, crypto exchanges devised a means where users can trade with other currencies. The available alternatives are dollar coins and stable coins. NGNT is a digital currency that represents the Naira. 1NGNT equals 1 Naira.

Challenges Cryptocurrency users in Nigeria face

Speed of transaction

A fast crypto transaction can be as important as the speed of a Bitcoin or Ethereum block. Transactions often take hours to complete. Ideally, Bitcoin transactions can take anywhere between five minutes and one hour. However, most transactions are instant. According to Abolaji Odunjo, he prefers using Bitcoin because it “helped protect his business from currency devaluation and most transactions are instant.” This can take anywhere from five minutes to an hour, depending on the Bitcoin network.

High and Inconsistent Charges

To really compare the best options for fiat on-ramps, you have to look at the fees before and after conversion. Let’s say there are two fiat gateways that a user can use to buy Bitcoin for $1000: The first says it only has 2% but adopts a conversion rate of $21,000/Bitcoin. The second charges 3% as fees but uses a conversion rate of $20,000/Bitcoin.

| Fiat Amount to Convert | Fee | Conversion Rate | Bitcoin Received |

| $1,000 | 2% | $21,000/Bitcoin | 0.0467(3.7% More Expensive) |

| $1,000 | 3% | $20,000/Bitcoin | 0.0485 |

While the first seems cheaper when only judging based on fees, the user would only receive 0.0467 Bitcoin, compared to the 0.0485 Bitcoin that the user would receive when using the second on-ramp. The first gateway is about 3.7% more expensive than the second while quoting a lower fee!

As a general rule, be wary of gateways that provide low fees but provide very poor conversion rates.

Like it or not, the world of fiat (normal everyday government-backed currency like Naira, USD, AUD, or Euro) is still the king, and is likely to be for the foreseeable future. So, what if you only have fiat currencies, and want to participate in the crypto world? You will need to convert this money. Therefore, there is still a challenge that needs to be addressed in the issue of charges.