Is Europe, in particular, the Nordic region, facing an energy crisis caused by increased Bitcoin mining?

On November 5, the director generals of the Swedish Financial Supervisory Authority and the Swedish Environmental Protection Agency issued an open letter to the European Union calling for a ban on energy-intensive cryptocurrency mining.

Their letter stated that crypto-mining, particularly Bitcoin and Ethereum, threatens Sweden’s progress in limiting global warming as outlined in the 2015 Paris Agreement.

Part of the letter reads, “Between April and August this year, electricity consumption for Bitcoin mining in Sweden increased by several hundred percent and now amounts to 1 TWh annually. That is equal to the electricity of 200,000 Swedish households.”

On November 17, Norwegian local government and regional development minister Bjørn Arild Gramdays disclosed in an interview that they were considering supporting the push by their neighbors Sweden.

“Although crypto mining and its underlying technology might represent some possible benefits, in the long run, it is difficult to justify the extensive use of renewable energy today,” he stated.

It is not clear whether the envisioned ban will extend to retail services such as exchanges, investment, and crypto debit cards.

Bitcoin mining is energy-intensive because it uses a consensus mechanism known as Proof of Work(PoW). One computer is picked to update the shared ledger every ten minutes among the thousands on the Bitcoin network.

The computers have to compete in computing a mathematical problem, which consumes a significant amount of energy to be picked.

According to Cambridge Center for Alternative Finance (CCAF), a research institute established in 2015 by the University of Cambridge, the Bitcoin network consumes anywhere between 90 and 130 terawatt-hours of electricity annually.

To give you a perspective, Norway generated about 154 terawatt-hours of electricity in 2020. That means the electricity consumption of the global Bitcoin network is close to that of Norway and indeed more than what some countries produce or consume.

The impact of the China ban

How much electricity Bitcoin consumes has been a concern for many around the world for a while now. However, it seems to have become an urgent issue for Europe, particularly after China banned Bitcoin mining within its borders in late September 2021.

Before the ban, over 50% of Bitcoin mining operations happened in mainland China, which was another concern. Many thought that, with the majority of the computing power of Bitcoin in China, that gave the Chinese the leverage to control the cryptocurrency.

Turns out China saw Bitcoin as a threat it had to stop.

China became the home of the major Bitcoin mining operations because it offered cheap electricity. In Sichuan and Yunnan provinces, two of the four provinces, where most operations were mainly located, were hydropower and renewable energy. Meanwhile, in Xinjiang and Inner Mongolia, the energy came from cheap coal.

With the ban, the mining had to move elsewhere. Some Chinese miners moved to countries that still permit it and, more importantly, those that offer cheap energy.

There have been reports that many Chinese Bitcoin miners relocated to neighboring Kazakhstan, which has some of the lowest electricity prices in the world. Many others moved to the US and, in particular, to Texas.

Meanwhile, with reduced competition from Chinese miners, crypto enthusiasts in several other countries around the world picked up mining.

Bitcoin miners in the Nordic region belong to the latter category. The alleged increase of Bitcoin mining in Sweden and Norway is not caused by the Chinese moving in, but locals finding it easier to mine with the competition from China out of the way.

However, there are reasons that Sweden and Norway could be attractive to Bitcoin mining. At the top of the list is that the region is one of the leading producers of cheap renewable energy.

It also has an extremely cold climate, which reduces the energy that mining rigs need, especially for cooling purposes.

Advertisement

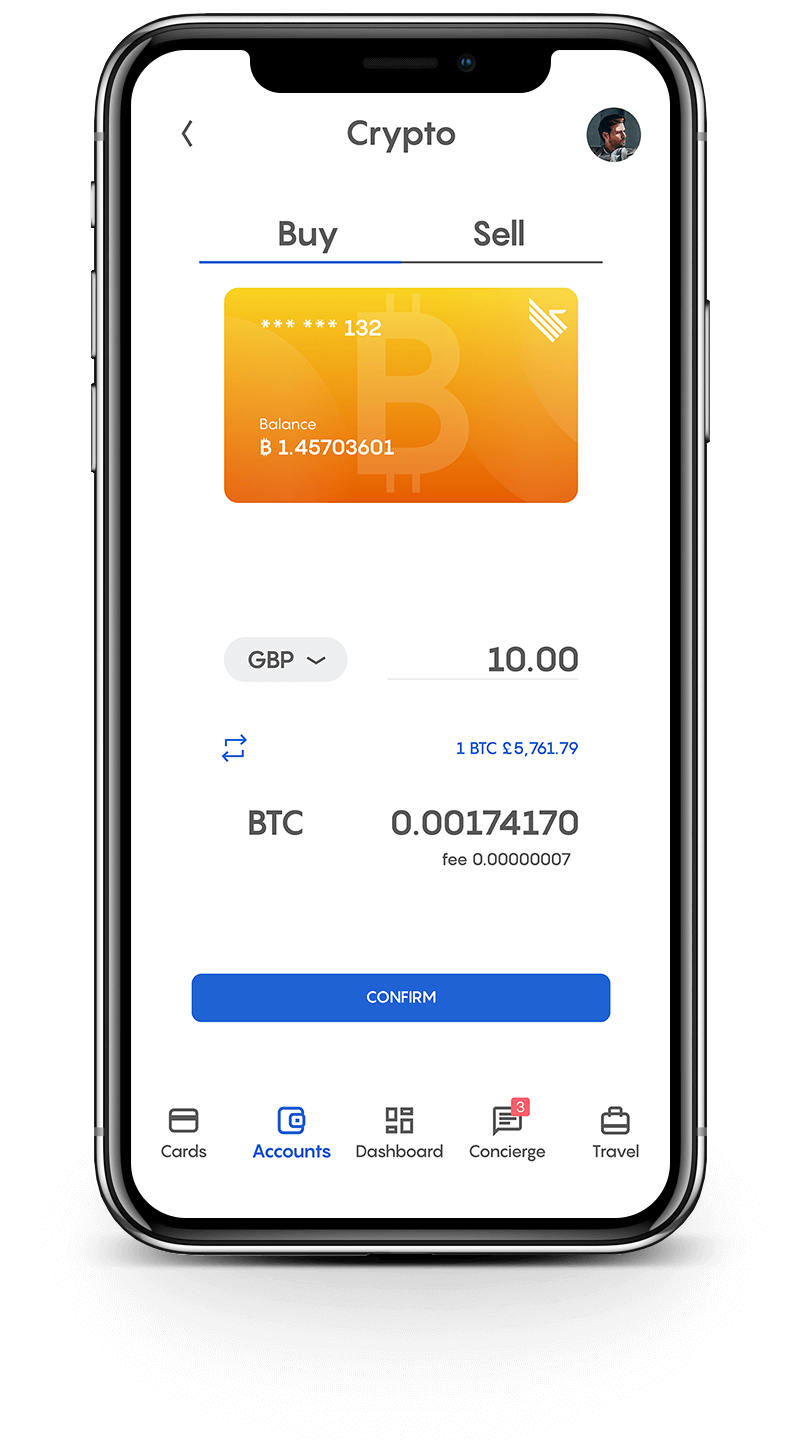

Join Club Swan and get... more!

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan's flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

Two sides of the concern

That bitcoin mining activity has gone up in Sweden and Norway seems to have rattled regulators. The letter by Sweden to the EU is an indication of that.

It is important to recognize that the concerns raised by Sweden, Norway, and others around the world are two-pronged.

The first part of the concern is that Bitcoin mining contributes a significant amount of greenhouse gases to the environment as miners use dirty sources of energy, particularly fossil fuel.

Indeed, some miners have found cheaper sources of energy in fossil fuels. Miners who operated in the Xinjiang and Inner Mongolia provinces of China using coal represent that group.

There have been assertions that Bitcoin miners have acquired and reactivated fossil fuel-powered energy generators that had long been retired.

The Greenidge Generating Station in Dresden, New York, is pointed out. This coal-powered generator ceased operations in 2011, however, it was relaunched in 2019 to power bitcoin mining.

The second part of the concern is that Bitcoin mining takes a significant amount of renewable energy that could be used on more deserving courses. Indeed, Sweden and Norway have classified Bitcoin mining as essentially a meaningless and wasteful operation.

Now, let’s establish how bad the situation is in Europe and, in particular, the damage that Bitcoin mining is causing in the Nordic region.

According to Cambridge, the Bitcoin network consumes about kilowatts. That is an amount almost equal to what a small country like Norway consumes. That is a lot, and indeed it should be a concern to anyone who cares about the environment and meeting the global renewable energy needs.

But in order to understand whether Bitcoin mining is a threat to the efforts of the efforts of the Scandinavian countries to meet their energy.

As far as Bitcoin using dirty sources of energy, mining bitcoin is like any other business. It seeks to cut costs where it is possible. As it is today, green sources of energy are turning out to be the cheapest.

Indeed, a pattern has emerged during the migration of mining from China. Except Kazikistan, most of the other locations seems to be those with significant amount of green energy sources.

To get a clear picture, we have to look at available data. In particular, we have to look at how the Bitcoin hash rate has redistributed itself after the China ban. We also have to look at the amount of energy that the countries in the region generate and what percentage is going into Bitcoin mining.

Redistribution of the Bitcoin hash rate

With the China ban on crypto mining, the operations have moved to only a few other countries. Mostly those with cheap sources of electricity and a low need for cooling.

Based on data from Cambridge Center for Alternative Finance, nothing much changed for the majority of the countries. For example, before the China ban, about 0.21% of the hash rate was based in the UK. After the ban, the operations in the UK have increased marginally to 0.25%.

The countries that have taken up much of the hash rate that used to be based in China are the US, Canada, Iran, Russia, and Kazakhstan.

Before the China ban, the US had about 11% of the hash rate. That has increased to about 36%. Kazakhstan has moved from 5.35% to 18%. Russia has moved from 7.16% to 11.23%. Meanwhile, Canada has moved from 0.83% to 9.55%.

On the other hand, the entire European Union has about 2% of the confirmed share of the Bitcoin mining hash rate. Ireland indicates a percentage of about 4%, but there has not been any evidence to justify the figure, and it could be inflation due to redirected IP addresses.

Sweden has about 1.16% of the global hash rate, an increase from 0.21%. It leads in Europe. Norway is a special case, though. It is one of the few countries that have seen their hash rate share decline.

In December 2020, Norway had a Bitcoin mining hash rate share of 1.09%. Though it now has the second-highest percentage in the EU, its share has come down to about 0.58%.

How much electricity

Let’s find out the exact amount of electricity going into Bitcoin mining in Sweden and Norway, particularly the percentages compared to their generated amounts.

The amount of electricity the Bitcoin network consumes is based on the hash rate distribution.

With the Bitcoin network consuming about 130 terawatt-hours of electricity annually, based on data from Cambridge Center for Alternative Finance, Sweden contributes 1.508 terawatt-hours annually, which translates to 0.99% (of 154 terawatt-hours) of the power generated in the country.

Meanwhile, according to World Data, Norway produces close to 150 terawatts hours annually. It contributes to the Bitcoin network about 0.754 terawatts hours, which translates to 0.5% of the electricity generated in the country.

From these numbers, it is clear the amount of energy in the two countries going into Bitcoin mining is still insignificant. That is not to say that Bitcoin mining in the region cannot be of concern especially considering policy measures to be adopted.

Indeed, it could be that the regulators are seeing the need to be proactive and forestall the likelihood of more bitcoin mining hash rate moving into the European Union and negatively impacting energy plans in place.

It is also important to point out that Sweden’s suggestion that cryptocurrencies adopt more energy-efficient consensus mechanisms can only be supported. Indeed, there is a movement within the crypto space to embrace less energy-intensive protocols.

We can see this because most protocols being launched now are not energy-intensive. Most of them use Proof of Stake (PoS) instead of Proof of Work (PoW).

Even older blockchains are considering transitioning or implementing improvements to make them more efficient. For example, Ethereum is in the process of transitioning from Proof of Work to Proof of Stake.

Meanwhile, Bitcoin’s second-layer scaling solutions, such as the Lightning network, could make it less energy costly, especially at an individual transaction level.