The launch of Bitcoin in January 2009 was a very low-key event. Hardly anyone, least of all a central bank, took notice. Nevertheless, this event seemingly marked the beginning of the end for a financial system that has been around for over 500 years.

When central banks finally learned about Bitcoin and decided to say something about it, they mostly scoffed it off as some tool mostly used by criminals to launder money on the dark web.

The most vocal critics in the wider banking industry, such as JP Morgan Chase CEO Jamie Dimon, called it a worthless currency that would be stopped.

“Virtual currency, where it’s called a bitcoin vs. a U.S. dollar, that’s going to be stopped,” Dimon stated in 2015. “No government will ever support a virtual currency that goes around borders and doesn’t have the same controls. It’s not going to happen.”

However, with time, the central banks and the banking sector have generally seemed to change their position on cryptocurrencies. One major shift in how they view cryptocurrencies is acknowledging that blockchain, the technology on which they exist, is not only disruptive but could also improve how financial services are delivered in a major beneficial way.

Ben Bernanke, the former Chairman of the Federal Reserve, was among the first voices in the global banking industry to state that while they saw Bitcoin as a threat that needed to be stopped, they recognized blockchain as a valuable technology.

“The Fed, the Bank of England, and Japan are very supportive of these technologies because they’ll improve payment systems,” he said about blockchain in 2017 at a Fintech conference in Toronto, Canada.

In the meantime, the value of Bitcoin, and that of the other cryptocurrencies, has continued to go up. Also, the list of cryptocurrencies has continued to grow longer.

The blockchain itself is delivering more applications in addition to digital currencies. That includes decentralized finance applications (DeFi), which offer more financial services such as credit, insurance, and currency exchange.

A decade after the launch of Bitcoin and blockchain, the central banks and major commercial banks around the world have had to look at them for new opportunities. The Central Bank Digital Currencies (CBDCs) is an attempt to leverage some of those opportunities.

Advertisement

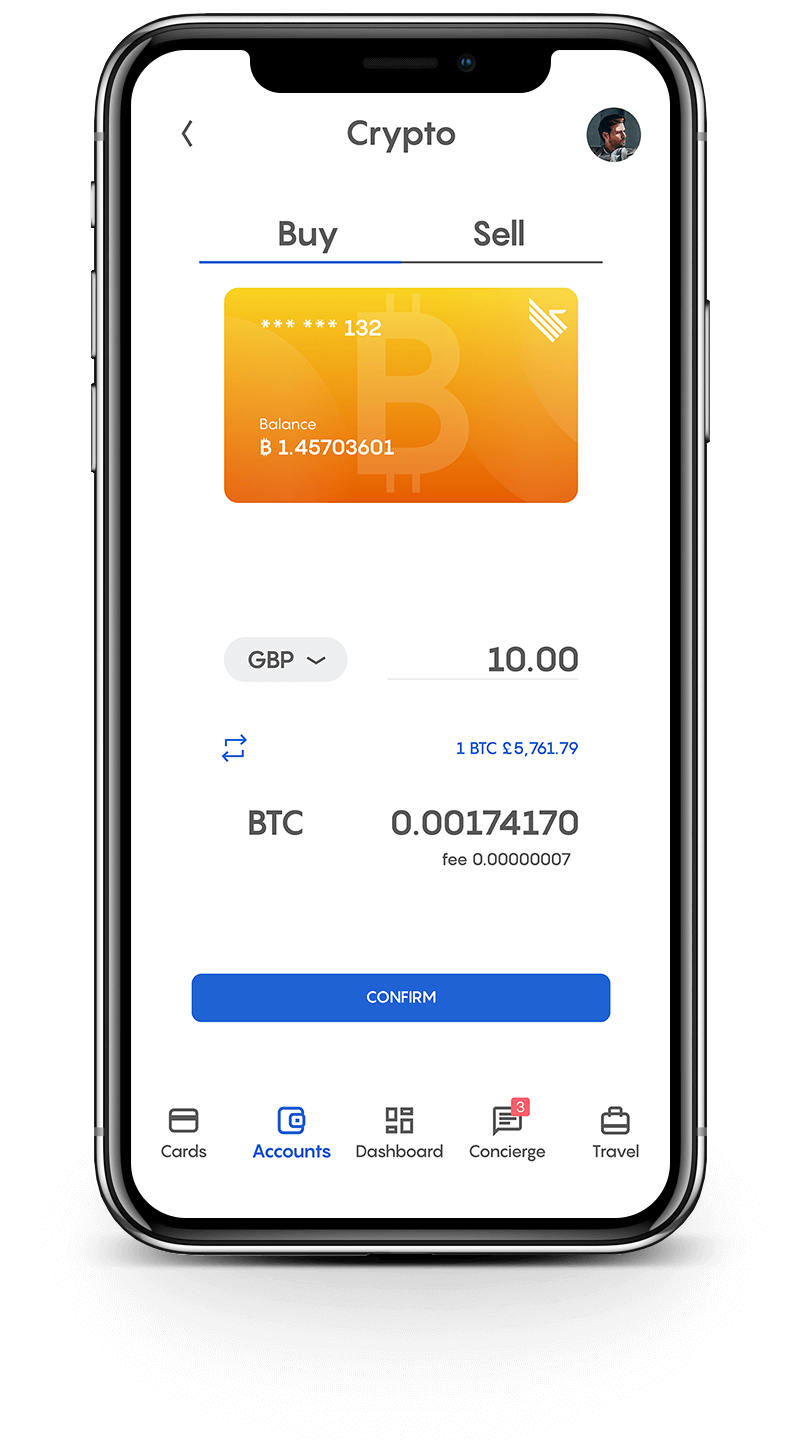

Join Club Swan and get... more!

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan's flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

It is also true some of the push to develop CBCDs comes from the need to offer financial solutions that can effectively compete with what crypto provides. If successful in that regard, central banks will continue having the necessary power to enforce anti-money laundering laws (AML) as well as taxation.

If they succeed, CBCDs could also change the financial landscape in a major way. For example, they could make automated teller machines (ATM) obsolete. These machines have been the primary channel for financial service delivery for over six decades.

Indeed, the central bank-issued digital currencies could make most commercial banks and financial institutions irrelevant, especially if the central banks directly deal with the public.

Bahamas became the first country to issue CBDC in October 2020. The Sand Dollar, as it is called, is meant “to promote more inclusive access to regulated payments and other financial services for unbanked and underbanked communities and socio-economic groups within the country.”

Meanwhile, China, Sweden, Hong Kong, and Thailand are carrying out CBDC pilot projects. According to a report by PwC, over 60 central banks around the world are researching the possibility of launching CBCDs. The list includes the US, UK, and EU.

However, most crypto enthusiasts do not see CBDCs as ideal forms of digital currencies, and that is because they are highly centralized. An ideal situation for them is for the central banks to embrace Bitcoin or other decentralized currencies.

A few countries may end up doing exactly that. In September 2021, El Salvador became the first country to make Bitcoin a legal tender. The country’s central bank not only permits the coin to be used to settle transactions and pay taxes, but it also actively facilitates the digital currency’s use by providing wallets and even mining it.

Nevertheless, this is not the path the majority of the central banks are likely to take. Most are taking active steps to limit the use of Bitcoin and other cryptocurrencies.

For example, in September, the People’s Bank of China (just a few days after El Salvador made Bitcoin legal tender, announced that “virtual currency-related business activities are illegal financial activities.”

So, whether anyone thinks CBDCs are great or not, most likely they are going to be a significant part of the emerging financial system.

What exactly is a Central Bank Digital Currency (CBDC)?

A CBDC is a virtual currency issued and managed by a central bank such as the US Federal Reserve, the People’s Bank of China, or Bank of England. They are similar to cryptocurrencies in some ways, such as how the end-users access and use them. For example, most of them are token-based systems like cryptocurrencies.

They are also different from cryptocurrencies in a fundamental way. While cryptocurrencies are powered by public blockchains, central bank digital currencies are powered by private blockchains.

Public blockchains, also known as permissionless blockchains, operate on peer-to-peer networks that anyone can anonymously join without going through a gatekeeper.

On the other hand, private blockchains, also known as permissioned blockchains or Decentralized Ledger Technology (DLT), operate on a peer-to-peer network controlled by a central bank.

What DLT is exactly is a network of computers that agree on the status of a shared ledger through consensus. However, unlike the blockchain on which cryptocurrencies exist, you can’t just join the DLT blockchain. You need to be let in by an admin, the central bank. Mostly, however, all the nodes on the network that powers a CBDC are owned and run by the central bank itself.

However, it is important to point out that not all central banks are likely to launch their CBDCs on any form of peer-to-peer network. Some might consider launching theirs on traditional centralized servers.

Central banks and E-money

The rise of cryptocurrencies has brought into the mainstream the critical question of whether it is necessary that a currency has to be issued by the government (through the central bank). For a long time, many have taken it for granted that it is the preserve of the government through central banks to issue currency.

The other important question cryptocurrencies have brought to the mainstream is whether digital currency is viable and can adequately take the place of bills and notes without infringing on users’ privacy. Before the launch of Bitcoin, most digital currency schemes discussed were account-based, which meant users had to sacrifice the privacy of spending to use them.

However, the conversation about central banks issuing e-money is not a new one. According to a white paper published by the Bank of Canada, it goes as far back as the early 1980s.

“While the discussion about e-money has received significant attention recently, the idea of universal central bank accounts dates back to the ‘deposited currency’ scheme proposed by Tobin (1985). The electronic token idea was discussed during the first wave of the Internet in the 1990s,” part of the paper reads, “Then policymakers were preoccupied with the risk to the ability of central banks to implement monetary policy, concerns about money laundering, and the reduction of seigniorage. Back then, the idea of central banks issuing e-money was just a remote possibility.”

The paper explains that blockchain and distributed ledger technologies have mitigated most of the concerns raised in the 1990s, particularly regarding the risk of fraud.

What society might gain from CBDCs

When compared to the existing financial systems, CBDC could offer a lot. In particular, the system could make sending money a little faster. It could also make payments even across international borders significantly cheaper,

especially with the possibility of reducing the number of middle persons payments have to go through.

It could also make financial services more accessible, especially through mobile phones. These could increase inclusivity, especially in regions with high unbanked populations, such as sub-Saharan Africa and South East Asia.

Mobile payment services like Mpesa have already shown us what happens when financial services are made accessible through technologies like the mobile phone. The service has allowed even the poorest to participate in the economy. Before the service was launched in 2007, only about 30% of the Kenyan adult population could access financial services. Thanks to mobile money service that has gone up to about 80%.

Indeed, CBDCs could benefit the vulnerable members of society in other ways too. They could make it easy for governments to issue social benefits, including controlling where the money is spent using smart contracts.

CBDC could also increase competition and spur innovation in the financial industry, which has seemed to have become highly conglomerated in the last hundred years.

The downside of CBDCs

Even with all the good CBDCs could do, there are serious concerns about some of the things that can be achieved through them.

One of those is the increased control that central banks, and by extension, the government, will have over money. A CBDC gives the government even more power over how private citizens choose to spend their money.

Through a CBDC, a government can easily freeze your account (wallet) or reverse payments you make without recourse. Indeed, it is possible to render someone unable to function in society by clicking a button.

Today, physical cash can allow someone to trade and interact financially with others even when authorities freeze their bank accounts. If every transaction has to happen through a CBDC, then being blocked from accessing that service means not functioning completely as a free and sovereign member of society.

To aid the ability of central banks to control how people spend money is the amount of data they can collect. Through monitoring payments, the central bank can accumulate a lot of data.

Besides using this data to control how people spend their money, there is also the risk of it getting into the hands of those who might use it to harm others. A hacker can get into the system and, besides stealing funds and stopping users from accessing services, they can also collect information they can use to blackmail others, such as payment to adult sites.

Also, much of the discussion around CBDCs has not focused on how the technology will fix the problem of inflation. Today, most fiat currencies are poor stores of value because their purchasing power keeps going down due to the increased supply of currency units.

Cryptocurrencies fix this problem through capped inflation. Bitcoin, for example, has a cap of 21 million coins. It is not clear yet whether any of the CBDCs could copy that aspect of cryptocurrencies.

Technical and policy issues

It is still early days for CBDCs. At this point, only the Bahamas has launched one. Most central banks are still studying how they can implement theirs. With that stated, there are several questions regarding the technical and policy implementation of CBDCs.

One of those is whether individual citizens will have direct interaction with the CBCD system or it will be a system accessed only through existing retail financial institutions. Indeed, the CBDC has the potential to significantly change the core role of the central bank from that of general oversight and lender to commercial banks to be some sort of a retail financial institution.

Before the digital revolution, the central bank could have had to spend a lot on infrastructure to offer retail services to the public. Today, the cost is negligible, especially when the internet, mobile technology, and blockchain or DLT are combined.

There is also the question of whether one can use the same application, account or wallet to send money across international borders. Of course, it is highly likely the CBCDs will form a global network. However, how that is to be implemented is not clear at this point.

Another outstanding question is whether CBCDs will become the only way to settle payments or whether these systems will exist alongside physical cash issued by the same central banks as well as digital currencies issued independently by commercial banks.

Then there is the question of what happens in countries that already have widespread use of digital currency issued by corporate entities. A case in point is Mpesa in Kenya and Alipay in China. What happens to those systems? Will the company shut down its systems and acquire the central bank digital tokens?

We can’t tell how many of these questions will be resolved. We will have to wait to see what happens when a significant number of CBDCs are launched.