Have you ever wondered why so many countries use the dollar as their currency name? Contrary to common belief, America was not the first country to adopt the dollar moniker, in fact, the currency name originated in small town called Sankt Joachimsthal in Bohemia (Now known as the Czech Republic). A local Count took advantage of the towns rich silver deposits and opened a mine to mint silver coins. These coins become widely used amongst traders all over Europe. They were referred to as Schlicken Thalers or Joachim’s Thalers (pronounced Tallers) and eventually the name evolved into the abbreviated word “dollar”.

The Symbol

There are many theories surrounding the founding of the iconic $ symbol, but there is no conclusive evidence as to which one is correct. The most interesting theory is one that involves the financing of the American Revolutionary War. Oliver Pollock, a wealthy investor, earned the gratitude of Spanish officials by arranging discounted flour shipments from Philadelphia. The American revolutionaries desperately needed money to pay for war against the British military, and while the French and Spanish governments offered financial assistance, Pollock personally donated several hundred thousand Spanish pesos to the cause, and organized a bond issue to raise funds. Pollock would often use an abbreviation for the Spanish peso known as “ps” in correspondence. When writing the “ps”, his letters would merge, and it formed the $ symbol we know today. In his exchanges with Robert Morris, the Superintendent of Finance for the United States during the war, Pollock began to denote dollars using the $ symbol, until it became the official symbol of currency in the United States in the 1790s.

The Adoption

When America gained independence, the government realised that they needed their own currency. Before the war, many different currencies were used, including the pound sterling and the Spanish dollar. In the seventeen and eighteen hundreds’ silver Spanish dollars, also known as “pieces of eight,” were used extensively in the Americas and even Asia. Spain’s political clout, its commercial sea routes, and the coin’s quality; entrenched its place as the preferred currency for over three centuries.

After independence, the U.S. Mint was quickly established, to produce America’s first dollar coins, and their value was to be guaranteed by the cost of the base material. The first U.S. silver dollars, often called “Flowing Hair” coins, were minted in 1794, followed by the Draped Bust and Seated Liberty dollars. However, there is more to this story; after independence, the continued evolution of money in the US became somewhat chaotic.

Running In tandem to the circulation of metal coins, was paper money called Continental currency. This was issued by the Continental Congress to help fund the war. Due to the huge cost of funding the war, and a lack of fiscal acumen, the government printed too many of these notes, which in turn, caused massive inflation. The value of a Continental declined rapidly, and in just 5 years it was worth just 2.5% of its face value. It is interesting to note that the term “not worth a Continental” emanates from this event. The Continental Congress was not the only government issuing currency during the war. The individual states, seeing themselves as free from the constraints of British legal restrictions, issued a plethora of notes. Although some early issues were redeemed, the majority of them suffered the same fate as the Continental.

If you want to explore the paper currencies of the time, you can see a comprehensive list on the University of Chicago Library website – https://www.lib.uchicago.edu.

An assortment of other payment options were also used in the seventeen and eighteen hundreds. In the Great Lakes area, they equated money to animal skins. For example, the skin of a muskrat was worth 25 cents, a beaver pelt was worth 50 cents and a large buck skin was worth a dollar. You guessed it – this is where the word “Buck” came from when referring to the dollar.

Advertisement

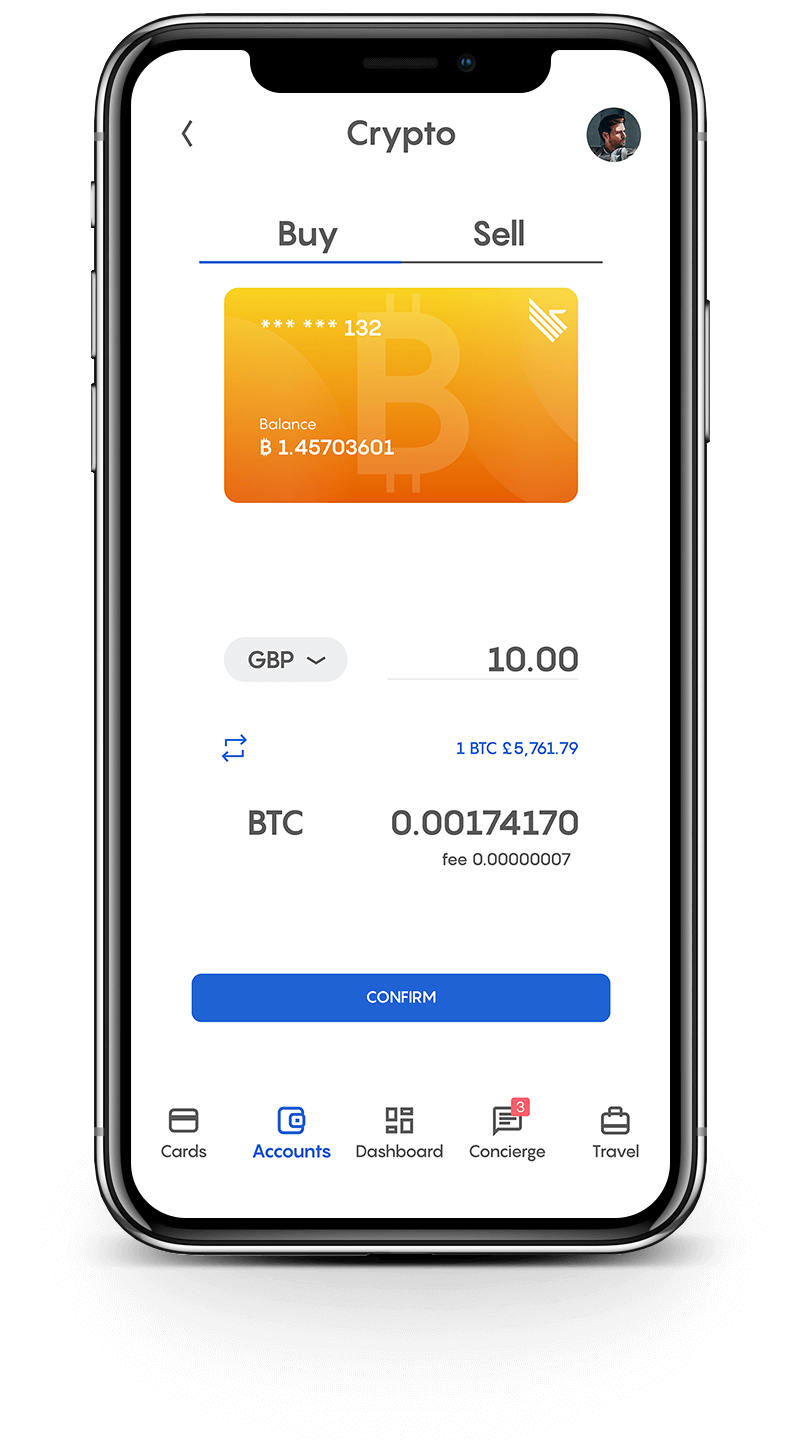

Join Club Swan and get... more!

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan's flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

Have you ever wondered why so many countries use the dollar as their currency name? Contrary to common belief, America was not the first country to adopt the dollar moniker, in fact, the currency name originated in small town called Sankt Joachimsthal in Bohemia (Now known as the Czech Republic). A local Count took advantage of the towns rich silver deposits and opened a mine to mint silver coins. These coins become widely used amongst traders all over Europe. They were referred to as Schlicken Thalers or Joachim’s Thalers (pronounced Tallers) and eventually the name evolved into the abbreviated word “dollar”.

The Symbol

There are many theories surrounding the founding of the iconic $ symbol, but there is no conclusive evidence as to which one is correct. The most interesting theory is one that involves the financing of the American Revolutionary War. Oliver Pollock, a wealthy investor, earned the gratitude of Spanish officials by arranging discounted flour shipments from Philadelphia. The American revolutionaries desperately needed money to pay for war against the British military, and while the French and Spanish governments offered financial assistance, Pollock personally donated several hundred thousand Spanish pesos to the cause, and organized a bond issue to raise funds. Pollock would often use an abbreviation for the Spanish peso known as “ps” in correspondence. When writing the “ps”, his letters would merge, and it formed the $ symbol we know today. In his exchanges with Robert Morris, the Superintendent of Finance for the United States during the war, Pollock began to denote dollars using the $ symbol, until it became the official symbol of currency in the United States in the 1790s.

The Adoption

The $10 Demand Note

As previously stated, during the war, private banks in the US issued their own paper currencies. To bring an end to the mayhem multiple currencies caused, the government created the $10 Demand Note which was the first official paper currency. However, there was one more step they needed to take to bring stability to the currency system – they had to defeat the counterfeiters. The paper currency was easily copied, and it was estimated that more than 30% of bills were fake by 1865. Another interesting fact was that in the same year, the Secret Service, which is still in existence today, was originally founded to break up counterfeit organisations. Many of the currencies of the time carried stern warnings such as, “To Counterfeit is Death”.

The Dollar Now

Fast forward to 1970, and the US dollar, along with other world currencies, is free floating which means that countries can freely decide how their currencies will work internationally. Countries can also peg their currency to another currency, or simply let it float and respond to market forces. Many countries peg, or fix, their currency to the U.S. dollar to safeguard and stabilise the value of their currency. This practice is especially important for international trade, as wide fluctuations in currency values can undermine a countries ability to trade across borders.

The dollar has been adopted by many other countries, even though they do not share a common financial history or peg their currency to the USD. These countries include Australia, New Zealand, Jamaica, the Cayman Islands, Fiji, Namibia, and the Solomon Islands. It is interesting to note that 61 countries and territories use the dollar as their currency moniker.

While the US dollar has recently come under pressure from geopolitical events and the Covid-19 pandemic, it remains one the strongest currencies in the world, and should continue to successfully weather storms that cross its path.