If you want examples of how politics, environmental issues and governance affects currency markets, you need to look no further than 2020. Few currencies have escaped the impact of the Covid- 19 pandemic and the effects of one of the most tumultuous US presidential elections in history. While the rand has always been sensitive to world events, its own economic landscape has played a massive role in the currency’s long-term erosion.

Politics and outlook

In the last two decades, South Africa has been reeling from large scale corruption and fiscal mismanagement. When the new guard headed up by Cyril Ramaphosa, took the reins in February 2018, it was hoped that the proverbial new broom would sweep clean the cronyism that has defined the government post Nelson Mandela. Sadly, little has changed and while there are numerous investigations, the wheels of justice turn slowly.

A “no fly zone” for investors

In March, Moody’s rating agency downgraded South Africa to a sub investment destination. This precipitated their removal from the World Government Bond Index (WGBI), making their debt a “no fly zone” for funds that track the index. However, the removal from the index did not result in severe outflows, as much of the sell-off had already occurred earlier in the year, with investors having sold 57 billion rands worth of bonds. Their saving grace was the uptake of SA bonds by emerging market investors, who still see their yields as favourable compared to other emerging market regions. The South African rand is a good example of how a currency can be buoyed by speculators and investors even if the fundamentals are week.

Ratings agencies united in their views

The consensus of the ratings agencies is a generally negative outlook for South Africa. As their debt burden increases and their investment status falls, the cost of servicing their debt is going to hurt. Their status as a high-risk investment destination means that they will be paying a premium for foreign loans. This, coupled with the weak currency, does not augur well for the economy. Their GDP contracted by an unprecedented annualized 51% in the second quarter of 2020. Mining, construction and manufacturing were the worst hit. To put this into perspective, during the global financial crisis of 2008 their economy contracted by 6.1%.

South Africa is not suffering alone

The dual gremlins of Covid-19 and Britain’s exit from the European Union has caused the pound to slump to record lows against both the Euro and the USD, as they hash out a deal for international trade. Britain’s decision to leave the EU on 23rd June 2016, resulted in an 8.1% drop in value against the Euro by 1st July. This was due to the political uncertainty resulting in loss of investor confidence. Between July 15, 2015 and July 15, 2016, Sterling dropped a massive 17% against the euro – from a high of 1.44 to a low of to 1.19. Today, it is trading around the 1.11 mark. As the Brexit saga continues, we could see further volatility in what was once considered a stable currency. The US has not escaped either, the USD is proving to be an almighty challenge for the trading pundits, it is simply too volatile to make any solid short-term predictions.

The current exchange rate of the Rand (as at 10-11-2020) is ZAR 15.5343 to 1 USD. While at first glance, the currency appears weak, and indeed it is, given that it was once on a par with the dollar in 1982, the fundamentals of this currency should see it trading at a much lower rate. The high yields that South African interest rates deliver, keeps investors interested. The ZAR on the 3rd Jan 2011, was 6.59648 to the USD, and has declined consistently, this equates to a 150% fall in value over 10 years. In recent days, the rand has strengthened against major currencies, but it is important to note that when major currencies slump, the minors benefit by default. So South Africans should not be lulled into a false sense of security as a result of specific events, e.g. the Trump / Biden election has caused the US dollar to weaken in the last week. The underlying economic and political uncertainty in South Africa will continue to erode the value of the rand and we may see the dollar strengthen again within the coming months.

Advertisement

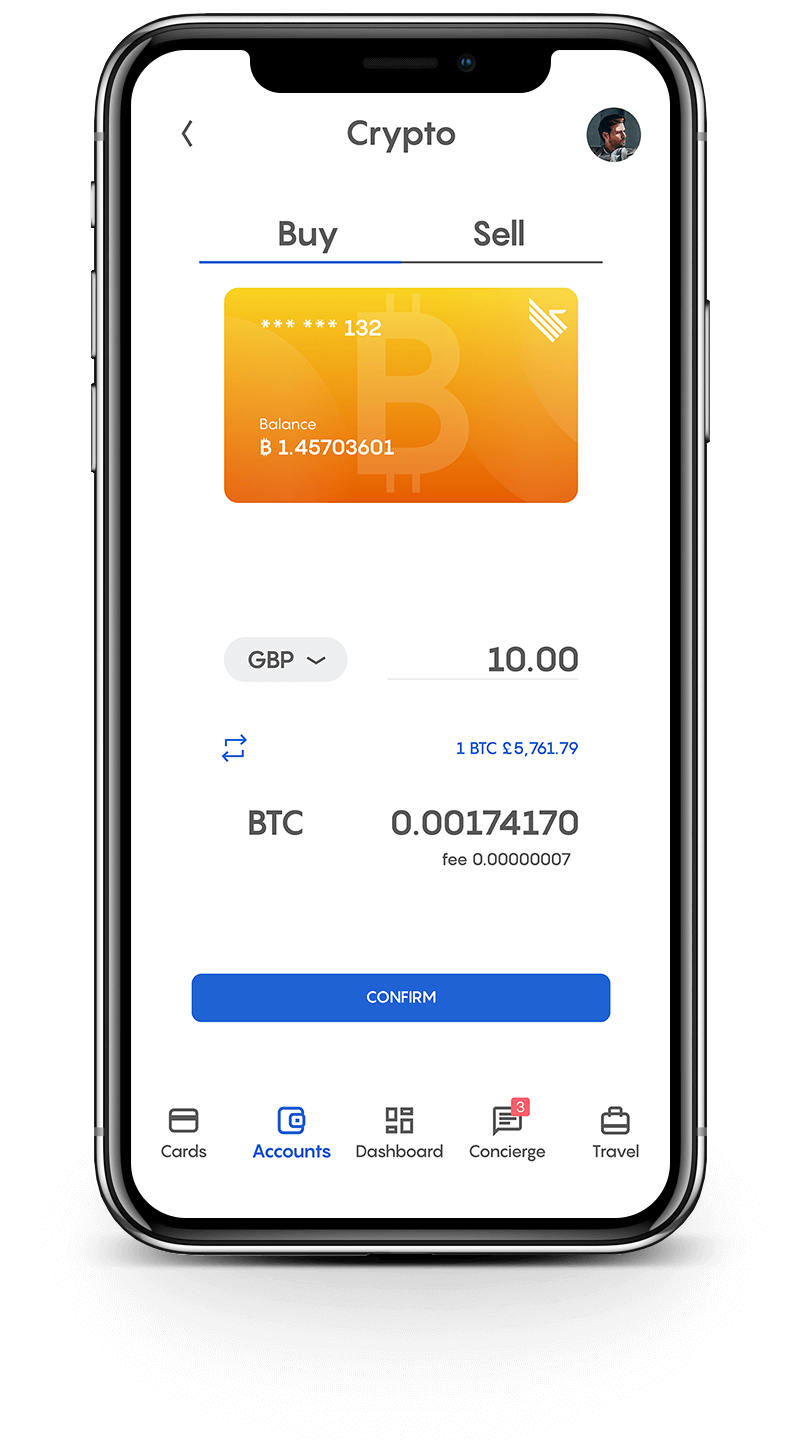

Join Club Swan and get... more!

Buy and sell your crypto at the best rates and spend them or transfer them to another wallet. You can seamlessly spend your crypto with the Club Swan card anywhere in the world. Everything from one account, on one platform.

- Buy, sell or store 9 different crypto currencies, including: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS.

- Low fees from 0.5%*.

- One simple rate for buy and sell. No hidden margin built into our prices.

- Seamlessly spend your crypto with the Club Swan card.

- Turn your crypto into traditional currencies.

- Quick and simple wallet to wallet transfers.

- Free transfers between Club Swan members.*

- 24/7 Customer support.

Club Swan's flexible account gives you access to multiple traditional currencies, live real time exchange rates, bank transfers and an elegant metal card allowing you to spend in more than 150 currencies around the globe.

- Live traditional currency exchange rates.

- Bank transfer exchange rates typically 4-8% better than high street banks.

- USD, GBP, EUR, CNY, and JPY accounts*.

- Transfer funds in and out of your account with SEPA/SWIFT/Faster Payment/Fed Wire Payments.

- Spend 150+ traditional currencies around the globe with Club Swan card.

- International ATM withdrawals.

- Daily ATM withdrawal limit $1,500.

- High account limits.

- Free transfers between Club Swan members*.

- FCA regulated for your peace of mind**.

- 24/7 Customer support.

Save precious time and money. Use your Club Swan virtual assistant for your travel needs. We also offer personal shopping, VIP event access and unique experiences.

- Save up to 40% on flights and holidays.

- Exclusive negotiated rates on First and Business class airfares.

- Private transfers.

- Luxury car rentals.

- Personal shopping assistant.

- Luxury product procurement.

- Concert tickets.

- Activity experiences.

- Event access.

- VIP dining & restaurant bookings.

- Private event & party coordination.

- 24/7 live chat concierge support.

The move to hard and safe- haven currencies

South Africa has been dealing with a plethora of threats to its economy; high inflation, a weak currency high interest rates, weakening infrastructure and systemic corruption. These factors combined mean that citizens may find themselves getting poorer every year. The question that begs to be asked is how South Africans can protect the buying power of their currency, especially when experts say it is currently overvalued. The short answer is to move some money into hard currencies. While this was not a possibility in the past, the Fintech industry has created elegant solutions for people wanting to hold multiple currencies. Chris Scanlon, CEO of Club Swan, a payment platform that offers both traditional and cryptocurrency accounts says “technology has grown in leaps and bounds in the payments space. The industry is no longer constrained by physical borders and red tape. Now individuals can hold several currencies in one platform. This provides individuals with a place to park their funds and protect them from volatility, with instant access world-wide when they need them”

Bitcoin – not your usual suspect

Cryptocurrencies have also weighed into the financial fracas caused by the pandemic. Long touted as a possible safe-haven currency, it appears that the crypto warriors may be onto something. Scanlon say’s “while Bitcoin remains off its record high of $20,000 in late 2017, it seems to have moved into the space of a safe-haven asset, with some supporters describing it as “digital gold”. Bitcoins limited supply (21 million coins) and lack of ties to traditional financial institutions, has helped to create the support for its parallels with gold”. In the early months of the pandemic, the currency’s performance was rather lack luster, however since early March 2020, the price has rocketed from $5225.56 to $ 15,280 on November 10, a massive 192% increase. It is still too early to claim that cryptocurrencies will take the crown from gold as a long-term safe-haven. Their wide margins of volatility and relatively short track records create concern, however as regulators and governments warm to digital currencies, their full integration into financial markets is likely in the future. This begs the question, should you buy bitcoin with rand?

Where to from here?

There is no doubt that South Africans are intensely patriotic, and many are willing to ride out the current turmoil. The country has enormous potential and perhaps the latest round of the government’s attempts to weed out corrupt actors will put them on a stronger footing. South Africans are not naïve, they are acutely aware that they must preserve the buying power of their money. This perhaps explains why they are one of the highest adopters of cryptocurrencies in the world. In a global survey by Hootsuite and Wearesocial, they were ranked as the top country for ownership of cryptocurrency. The survey reported that 10.7 percent of internet users in the country own cryptocurrency, while the global average was 5.5 percent.

Scanlon say’s “any investor worth his or her salt, will extol the merits diversification in a financial portfolio. If you live in a country that has a highly volatile currency, it makes sense to shift money into more stable currencies. Many of our members hold a mix of traditional and cryptocurrencies on the platform and often use them for global payments and to fund the concierge services we provide. We have seen enormous interest in our platform since the pandemic, and we believe that services like Club Swan are set to grow exponentially as the future adoption of digital currencies becomes fully mainstream”.